BEQUANT launches new BEQUANT Dollar Index (BQDI)

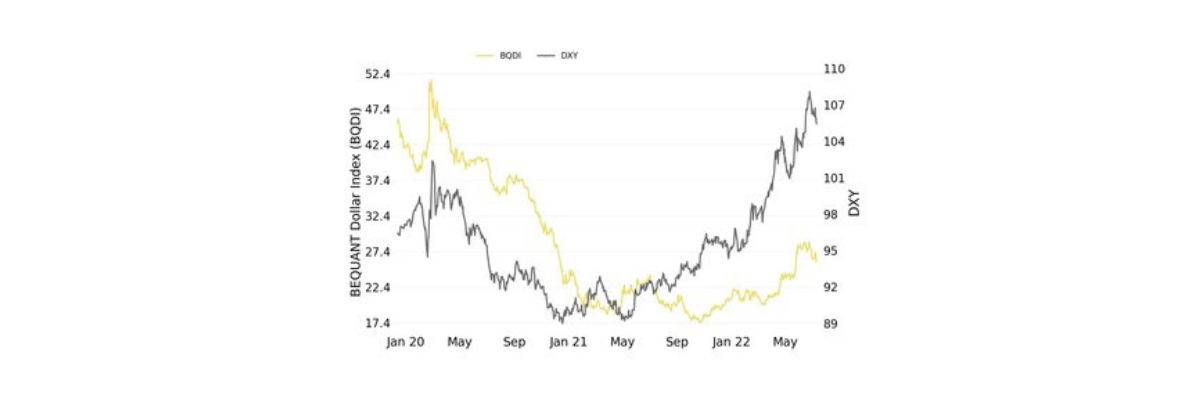

3rd August 2022 - BEQUANT, the digital asset prime brokerage and exchange, have announced the launch of BEQUANT Dollar Index (BQDI). The new Index measures the dollar's strength against the basket of top eight cryptocurrencies including Bitcoin, Ethereum and Cardano by market cap. Each coin has a weighting based on its market capitalization and volumes traded. The basket of coins is updated every month to reflect market movements.

The index aims to help investors to understand the spillover effects of the U.S. monetary policy on crypto. By comparing the BEQUANT Dollar Index to U.S. 10Y Treasury or the traditional DXY, users can understand if the macroeconomic environment is directly linked to the broader crypto market.

If the correlation is strong, investors can expect new releases of economic data to add volatility to the market like in the traditional finance space. It also can help investors assess coins that are independent of the market volatility.

Martha Reyes, Head of Research at BEQUANT

Martha Reyes, the Head of Research at BEQUANT, commented: "The new BEQUANT Dollar Index is another tool to help our clients make more informed investment decisions. Our research team has worked hard to quantify and capture the latest economic story into the broader crypto market. This is another way for investors to analyze the interconnectedness of the two and navigate through fundamental analysis in crypto more clearly."

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.