FXSpotStream Deploying New Micro-Second Low-Latency Architecture

October 06, 2021 – Bank-owned FX and Precious Metals utility FXSpotStream (FSS) is deploying a new low-latency architecture globally to deliver substantial improvements to the Service’s market data processing times. The project is already underway in the company's New York site and will involve a full overhaul of the existing infrastructure in place for FSS’ liquidity providers and clients.

Once in production starting Q4 with a phased roll out in New York, followed by London and Tokyo in Q1 of next year, market data processing times under all market conditions are targeted to not exceed a maximum of 250 microseconds. Additionally, the new architecture will provide scalability to allow the Service to maintain the same performance levels as FSS continues to grow.

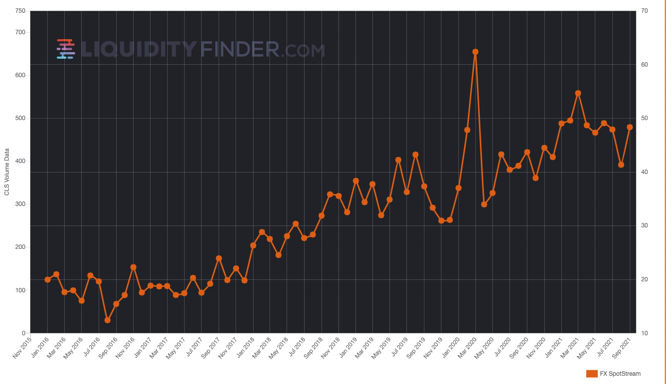

FXSpotStream Co-Founder and CEO, Alan Schwarz commented, “We have grown tremendously since our launch in 2011 becoming the 3rd largest FX Service by volume with an ADV this year at USD48.5billion. At the same time, we have placed great importance on the speed and quality of our market data distribution. Our aim is to provide our clients plus liquidity providers the best-in-class infrastructure and prioritise the performance and reliability of the Service in the same way as our deep product offering. Ensuring that our clients receive pricing and can send orders in a timely manner is of critical importance.

We have set a baseline targeting that clients’ market data latency in all market conditions, including during peak periods, will not exceed 250 microseconds. As a result, we will see times that are much faster than this target, but we are setting a maximum time to provide a level of consistency in performance during periods of high market volatility.

As we look forward to the next decade, we remain very bullish about our business. We recently launched over our API support for all of our banks’ Algos and supported Allocations functionality. In just 2 months since we went live with our Algo offering we have already supported $3.2billion of client Algo orders. Work to add a GUI to support Algos and Allocations is underway and is expected to be live by late Q1 2022.”

FXSpotStream is a bank owned consortium founded in 2011 and operates as a market utility, providing a multibank FX streaming, RFS and matching services supporting trading in FX Spot, Forwards, Swaps, NDF/NDS and Precious Metals Spot and Swaps. Banks connected to FXSpotStream serve as Liquidity Providers to clients. Clients can access a GUI or single API from co-location sites in New York, London and Tokyo and can communicate with all Liquidity Providing banks connected to FXSpotStream. FXSpotStream also offers over its API access to all of the Algos of the FXSpotStream liquidity providers and supported pre and post trade Allocations.

FXSpotStream has revolutionised the FX trading landscape by eliminating on its core streaming offering the cost of execution for price takers and allowing price makers the ability to pay a flat fee for providing prices to their clients. We are the only venue on the market today with this unique commercial model. FXSpotStream’s 15 LPs include Bank of America, Barclays, BNP Paribas, Citi, Commerzbank, Credit Suisse, Goldman Sachs, HSBC, J.P.Morgan, Morgan Stanley, MUFG, Societe Generale, Standard Chartered, State Street and UBS.

To see further information about FXSpotStream, see the monthly ADV, and how to access the service, please click the link below:

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.