A Dollar in Decline FX Markets Shift as Global Capital Looks Elsewhere

ACY Securities - Luca Santos

ACY Securities - Luca Santos

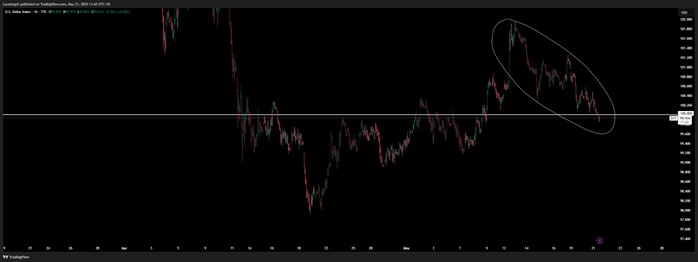

Despite a muted macro calendar, the FX market continues to paint a narrative of cautious divergence. The dollar's recent weakness while not a new theme is becoming harder to ignore as it fails to mount any meaningful rebound from recent lows. Behind this lies a cocktail of global capital rotation, risk recalibration, and market fatigue with the U.S. exceptionalism trade.

DXY H1 Chart

USD: Stuck in the Middle of Everything

Dollar softness has become the market’s background music not disruptive, but persistent. While U.S. long-end yields have pulled back slightly, there’s been no fundamental shift to justify a deeper dollar rout. What’s changed, arguably, is positioning and patience. Investors increasingly seem to be preparing for a world in which the U.S. fiscal imbalance weighs more on the greenback than on yields. The market is still digesting the implication of a government that talks about deficit control but keeps spending, and the idea that the dollar rather than bonds could be the release valve.

This explains the bid under non-USD risk assets. When traditional hedges lose appeal, investors reach for new ones. And that’s what we’re seeing: a subtle pivot toward non-dollar denominated inflation hedges European equities, select commodities, and cross-currency exposure.

EUR: Holding Ground in a Noisy World

The euro has quietly reclaimed ground, bouncing back from last Friday’s dip with a consistency that feels more like quiet accumulation than speculative push. There’s little in the macro to drive this Europe’s fundamentals remain tepid, but capital seems to be looking for somewhere to go. With the U.S. fiscal situation unresolved and the ceasefire hopes in Ukraine still fragile (Polymarket odds for a July ceasefire remain stuck at 20%), Europe benefits from simply not being the source of the problem.

That said, EURUSD’s inability to convincingly reclaim the 1.13 handle remains a red flag. Until we get a clean break higher, the euro remains a tactical long not a structural one.

EURUSD H1 Chart

GBP: Peak Positivity Has Passed

The pound’s modest rally feels increasingly tired. Optimism around the UK-EU "reset" has fizzled under the weight of economic reality. Trade deals with the U.S. and EU are in place but underwhelming, and markets are bracing for a potentially soft CPI print and dour PMIs. Gilt yields are high, tax hikes are biting, and the growth narrative is losing steam. For now, EURGBP long remains a sensible relative value play, as sterling struggles to justify any standalone strength.

JPY: A Market That Wants to Like the Yen

The yen’s price action has been one of the most puzzling stories of the week. Despite a poor 20-year auction longest tail since 1987 and consistently hawkish market chatter, the yen continues to attract bids, particularly around the Tokyo fix. The upcoming Kato Bessent meeting could bring some clarity, but for now, the yen appears to be the beneficiary of growing scepticism around the dollar.

Still, the contradiction is hard to ignore Japan’s long-term debt dynamics are worsening, yet JPY is strengthening on higher yield impulses. This may work for now, but the macro math doesn’t add up long term. We're still tactically short CHFJPY but increasingly watching for a spot to renter JPY longs on broader G7 disappointment.

CHF: A Story of Conflict

The Swiss franc remains stuck in limbo. USDCHF has pulled away from recent highs, but the broader narrative is unchanged. On one side, CHF still attracts safe-haven demand amid “sell America” flows. On the other, its low yield and SNB’s clear openness to NIRP makes it a cheap funder against higher yielders like AUD and EUR. Until one of those narratives breaks, expect more sideways chop in CHF.

AUD & NZD: Divergent Paths After RBA Cut

The RBA's 25bps cut was expected, but Governor Bullock’s post-meeting comments misinterpreted or not were taken as a dovish tilt. Despite this, AUD has outperformed, suggesting markets had priced in a worse outcome. However, the conviction behind AUD longs has wavered somewhat. With inflation surprising to the upside, the RBA is now caught between two narratives, and that uncertainty is dampening enthusiasm.

By contrast, NZD may emerge stronger in the near term, especially as the dollar continues to offer little resistance. We maintain a medium-term bullish bias on AUD but are scaling exposure accordingly.

CAD: Eyes on CPI, but Risks Skewed One Way

All attention today is on the Canadian CPI print. The YoY inflation rate is expected to fall, but core measures may remain sticky. The market is already pricing in significant easing for the June BoC meeting, which sets up a classic asymmetric risk: any upside surprise in inflation data could force a repricing and drive CAD strength. That’s not our base case but the risk exists. We remain short CAD for now, betting the BoC will move early before tariff effects start bleeding into the data.

The FX market feels like it’s in a holding pattern but one that’s slowly tilting away from the dollar. With rate hikes largely behind us, positioning and macro sentiment are becoming the dominant drivers. The dollar’s inability to catch a sustained bid, despite relative U.S. economic strength, speaks volumes. And while no one wants to declare the start of a new regime, capital flows suggest investors are quietly preparing for one.

As always, I stay data dependent but not dollar dependent.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.