ACY Securities Provides Capitalise.ai Auto-Trading Tool For Clients

March 29, 2022 - ASIC regulated online trading provider ACY Securities has rolled out Capitalise.ai as a new offering for their clients aimed at adding value and improving their trading experience. This new offering provides traders a one of a kind experience by fully automating trading strategies without the need for any technical skills, using no-code plain language text inputs.

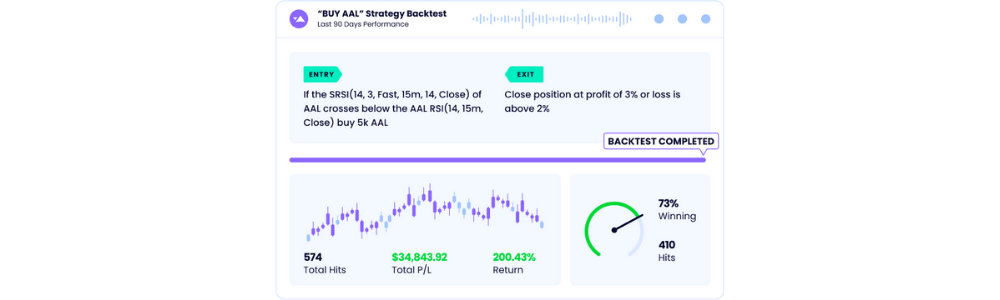

Capitalise.ai’s proprietary technology is based on artificial intelligence (AI), machine learning (ML) and natural language processing (NLP) to turn simple language text rules entered by traders into custom algorithmic trading strategies that can be instantly executed.

ACY securities clients can now access Capitalise.ai’s full suite of capabilities for free including backtesting, loop strategies, smart notifications and much more. Users will also be able to access Capitalise.ai’s mobile app for Android and iOS, so that they can stay in control of their trades 24/7, 365 days a year, and free themselves from trading from a computer.

Commenting on the announcement, Alla Darwish - Head of Global Brokerage commented, “We’re always looking for ways to add value for our clients. The introduction of Captialise.ai to our clients further bolsters our commitment to provide our clients with valuable tools and insights so they can improve their trading knowledge and become better traders”.

This update comes off the back of a recent announcement where ACY increased the number of instruments from 1600 to over 1800, combined with the choice of MetaTrader 4 or MetaTrader 5 platforms.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.