Advanced Displacement & Imbalance – The Smart Money Concepts Trick Most Traders Miss

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita“That Looked Perfect… Until It Didn’t”

Ever had this happen?

You spot the clean displacement. Wide-bodied candles. Structure break. You draw your FVG. You wait for price to come back in.

And then - boom. Price runs through it like it doesn’t even exist.

Here’s the kicker: that wasn’t bad luck. That was a Liquidity Trap Displacement, and you just took the bait.

Today, I’m breaking down how to filter the real from the fake so you can stack your trades with the same moves the smart money is making, not against them.

What Most Traders Get Wrong About Displacement

Everybody can draw a big candle and call it displacement. The difference is:

- Beginners think all displacement = continuation.

- Pros know displacement is a message - sometimes honest, sometimes a lie.

Your job isn’t to find more setups. Your job is to learn to read intent.

The Two Flavors of Displacement

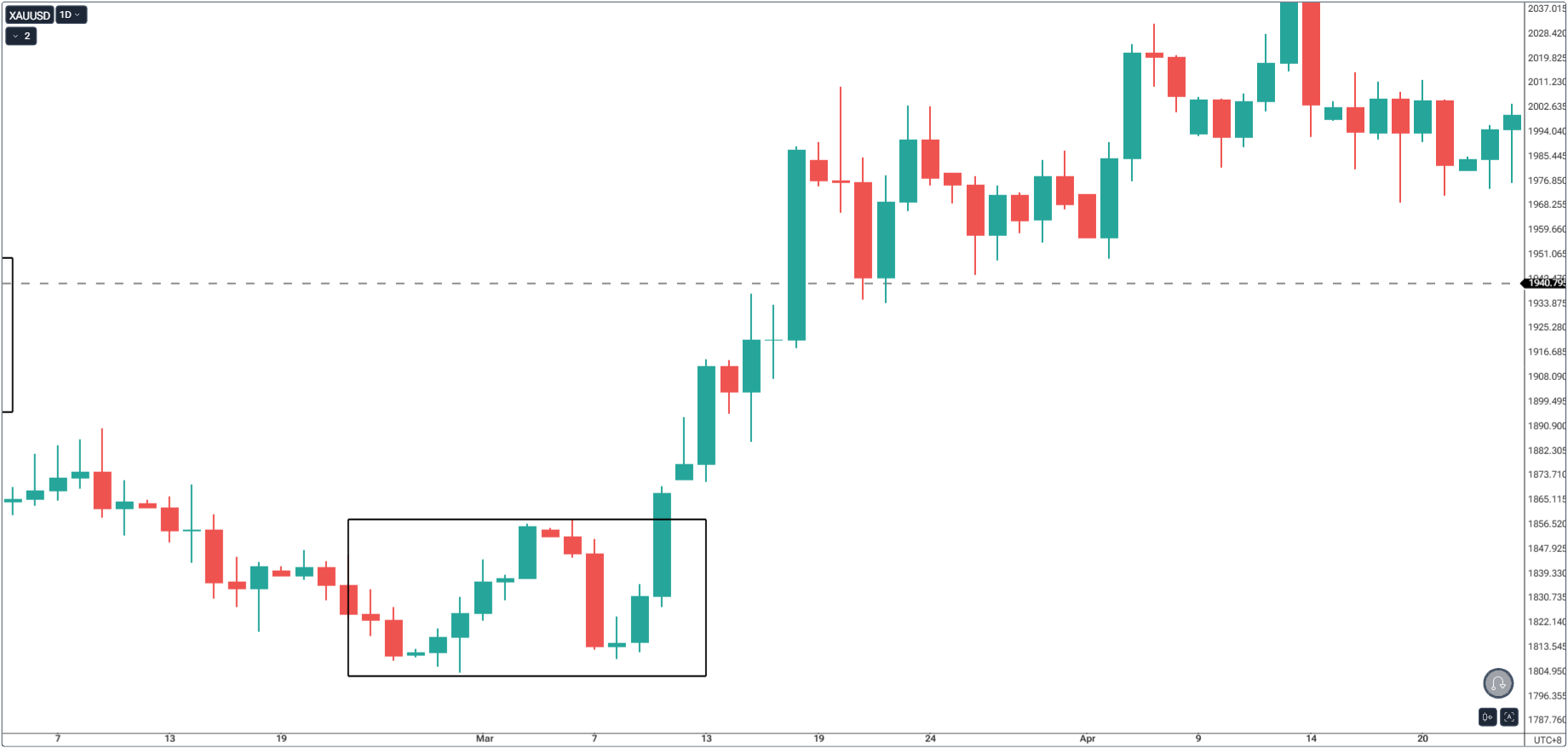

1. Strong Displacement – The Break Out

- Breaks a major liquidity pool (not just a random high/low).

- Keeps driving for multiple candles after the break.

- Leaves behind an imbalance that gets respected on the return.

2. Liquidity Trap Displacement – The Fake Out

- Snaps through a small liquidity level.

- Stalls almost instantly.

- The FVG gets filled and completely invalidated within the same session.

The 3 Tests to Spot a Real Move

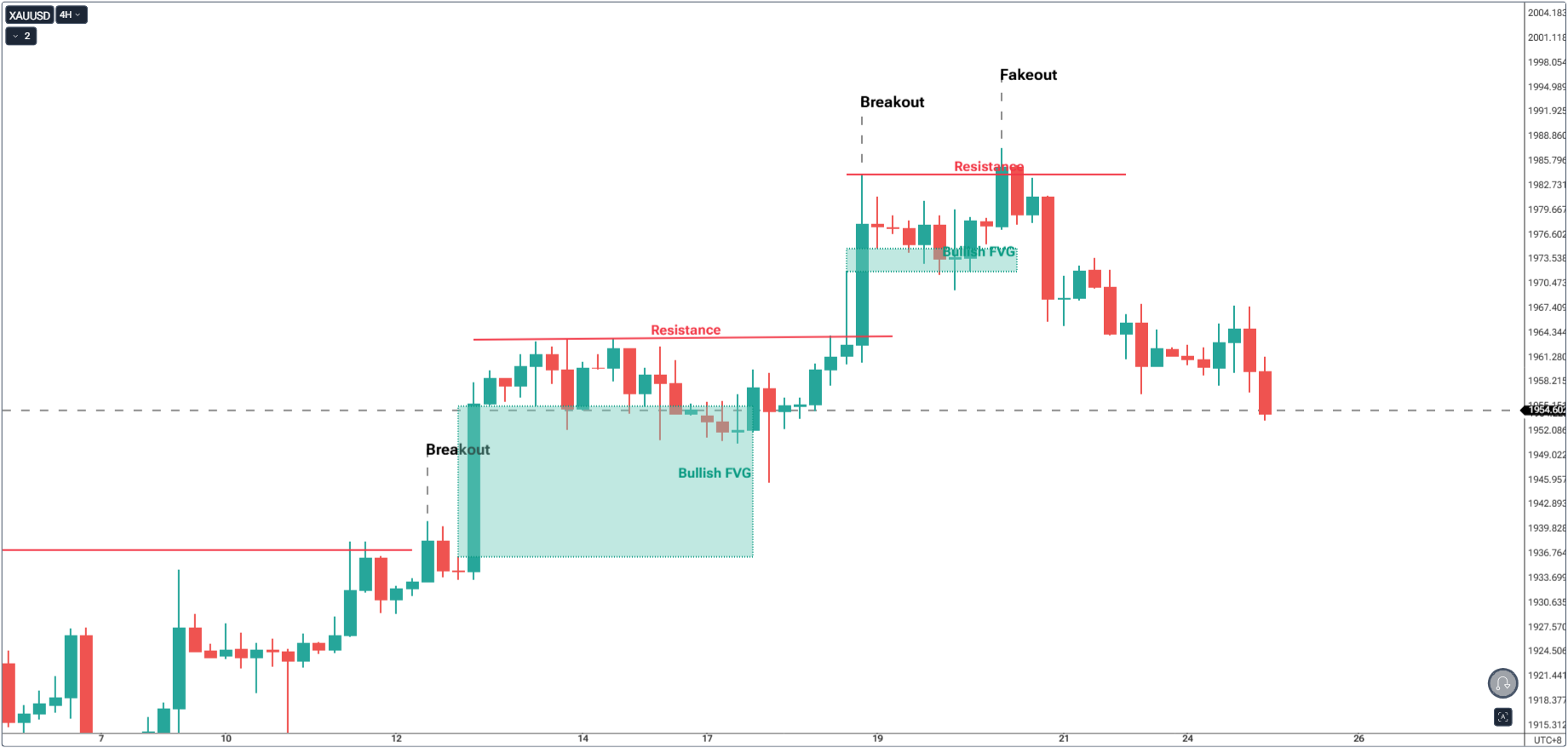

1. Strong Breakout

Like a sprinter blasting out of the blocks, a genuine displacement starts with raw power and doesn’t fizzle out after a few steps.

Fake displacement looks impressive at first - but it’s all flash, no stamina.

- Real moves: Smash through a significant liquidity pool or structure level and keep driving without hesitation.

- Fake moves: Break a small, local level and stall almost instantly.

If it’s not breaking something important on the map, it’s probably not the run you want to chase.

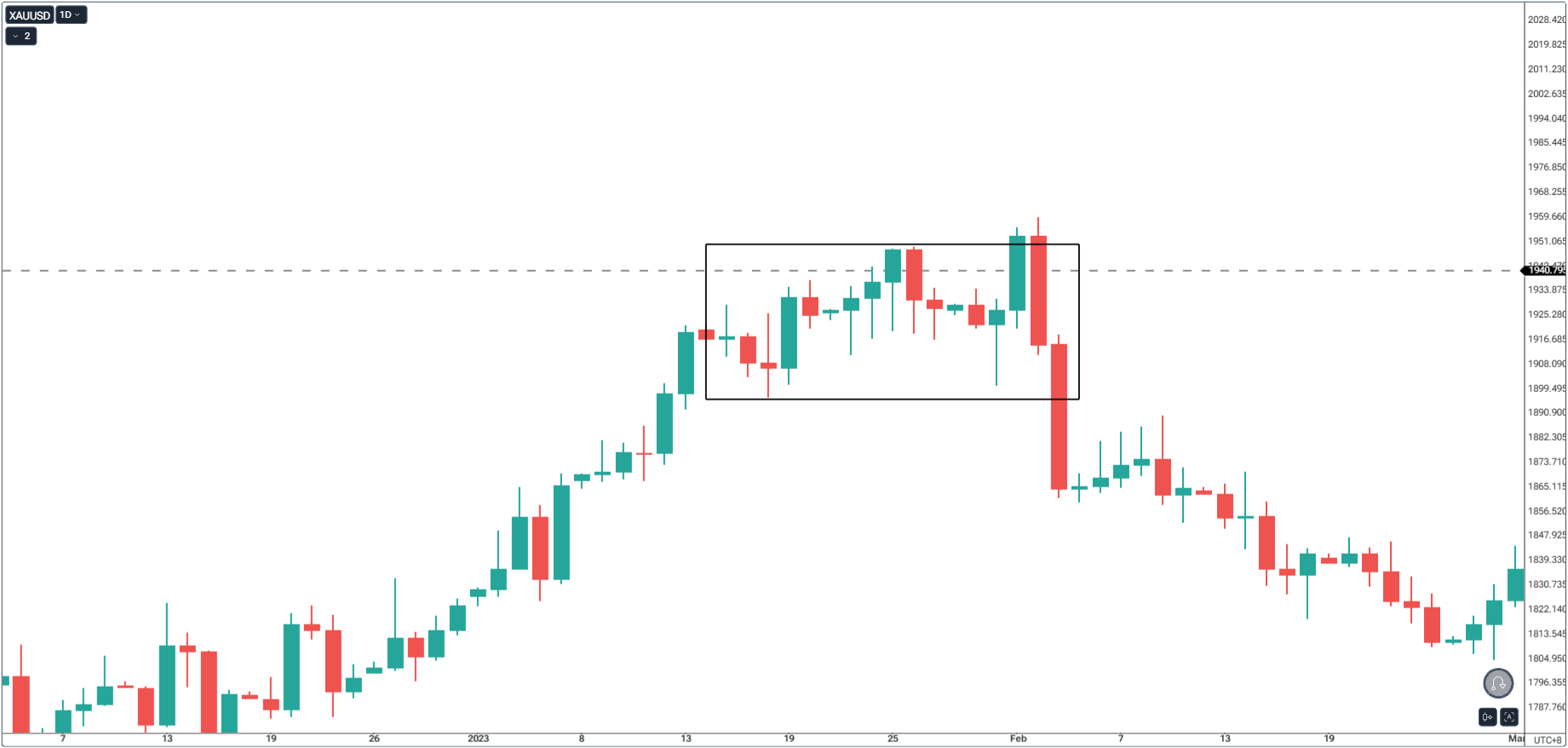

2. Follow-Through

When institutions are serious, they leave breadcrumbs in the form of stacked FVGs along the move.

Each one acts like a checkpoint - and if price respects those checkpoints on the way back, you know the move has backbone.

✅ Continuation: Multiple layers of imbalances form in the same direction and hold on retests.

❌ Trap: Imbalances are quickly filled and broken, signaling the big players never intended to defend them.

Think of it as footprints in fresh snow. If they lead in one direction and stay undisturbed, you follow. If they suddenly double back, you know something’s up.

3. Breakout Sequence

A true breakout isn’t one candle - it’s a story. Institutions often sequence their moves:

- Sweep a liquidity pool to clear the path.

- Explode with displacement that breaks a major high or low.

- Leave a clean FVG as a re-entry point for them (and you) later.

- Control the pullback so price rebalances into the FVG without erasing the breakout.

If the breakout lacks that sequence - if it just spikes and collapses - you’re looking at a liquidity trap, not institutional commitment.

Here’s the mindset shift: don’t just ask, “Did price break out?” Ask, “Did price break out the way smart money usually does?”

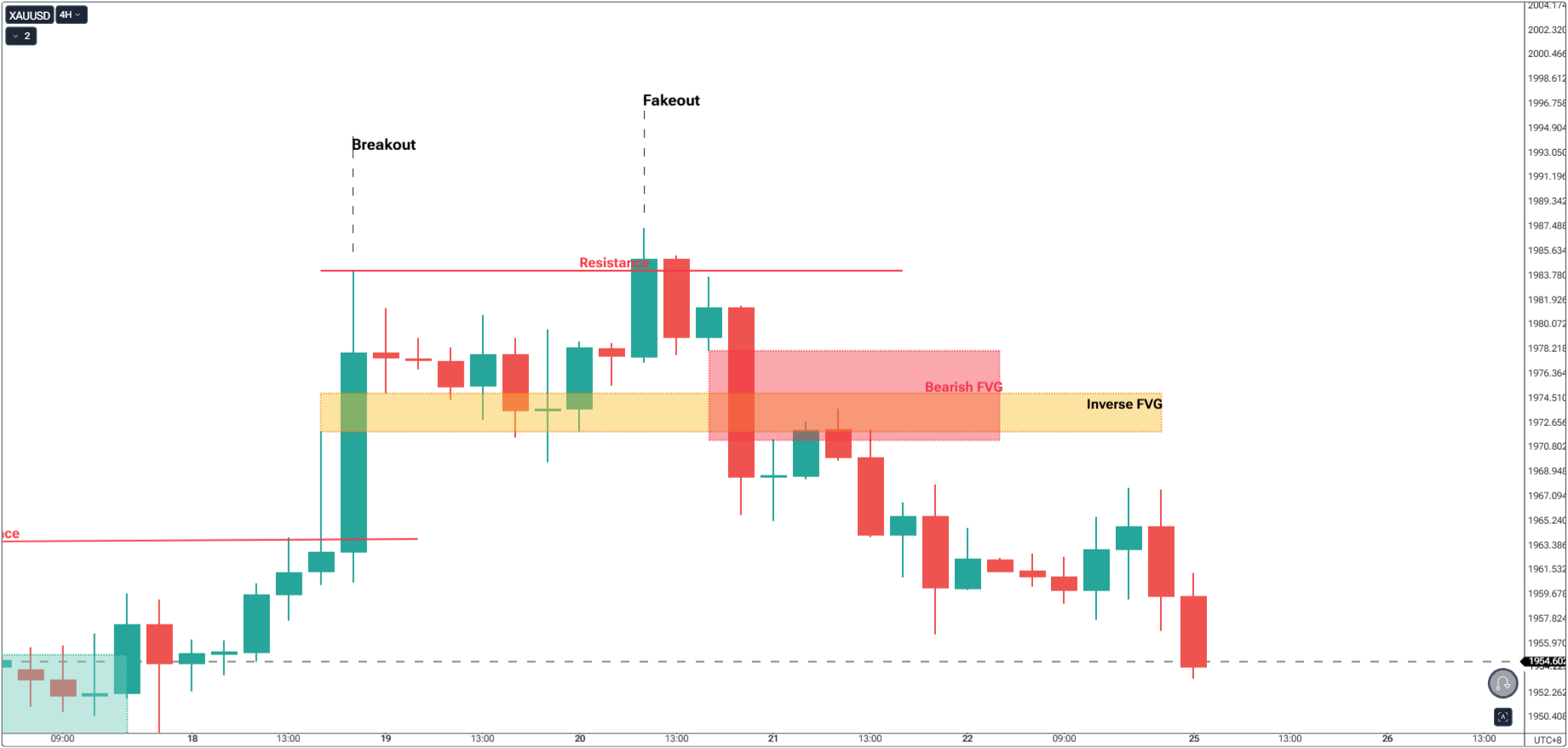

Advanced Moves: The Reversal/Inverse FVG

One of my favorite “pro-only” plays:

- Forms against the current bias.

- Fills fast.

- Acts like a pivot point where institutions flip their position.

If you can spot reversal FVGs in real time, you can ditch bad biases before they wreck your week.

Market Memory – The Secret Weapon

Even after being filled, a high-quality imbalance can become a future reaction zone weeks later.

Why? Because the same players who entered there still have skin in the game - and they’ll defend it.

The Basketball Fake Pass

Think of displacement like a fake pass in basketball.

Retail traders watch the ball (the candle).

Institutions watch the floor space (liquidity zones).

Guess who wins more games?

The Advanced Trading Blueprint

- Anchor to Higher Timeframe Bias – H4/Daily order flow is your foundation.

- Qualify the Displacement – Pass it through the 3 tests.

- Mark the FVG After the Displacement – Signals imbalance

- Wait for the Return – Patience until the retest during a high-liquidity session.

- Trigger With Precision – Confirmation on Lower Timeframe

Mistakes Even Veterans Make

- Overtrusting the first displacement after a range.

- Ignoring reversal FVGs because “trend bias is set.”

- Trading stale imbalances without re-checking higher timeframe.

- Assuming all displacement is continuation.

Final Thoughts – This is Chess, Not Checkers

When you start looking at displacement and imbalance as messages instead of signals, you stop being the one who gets trapped.

The market will always throw fakes - but now you’ll see the setup coming, not the stop-out.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading – A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.