ADX cuts trading commissions by 50% and extends trading hours to enhance market liquidity

August 29, 2021 - The Abu Dhabi Securities Exchange (ADX) has reduced its trading commissions by 50% and will extend its trading hours by one hour, with the market opening at 10am and closing at 3pm.

The reduction in trading fees, to 0.025% from 0.05%, which will take effect starting 1st of September, is the exchange’s second commission cut in 2021, and the third in three years. Meanwhile, the decision to extend trading beyond the previous 2pm close will be implemented from 3rd October and should bring ADX in line with the operating hours of many exchanges globally. The exchange’s latest initiatives are part of the ADX One strategy announced at the beginning of the year to bolster market activity and to deepen market liquidity.

H.E. Mohamed Ali Al Shorafa Al Hammadi, Chairman of Abu Dhabi Securities Exchange said, “We are very pleased to have been able to answer the call by our investors, issuers, and intermediaries for lower trading commissions and longer trading hours, reflecting increased demand to trade Abu Dhabi’s publicly listed companies. The ADX offers unique, high-growth investment opportunities within a strongly-regulated, tax-free and stable business environment and the extension of our opening will serve to attract increased international investment.”

Mr. Saeed Hamad Al Dhaheri, Chief Executive Officer of Abu Dhabi Securities Exchange, said, "The significant reduction in trading commissions and the extension of our operating hours align ADX with international practices and helps us to realise our ADX One strategy’s main aim of enhancing liquidity and increasing our market capitalisation. The fee cuts and extension complement our tireless efforts over the past year to bring the most sought out products and services to issuers and investors. We will continue to nurture liquidity on the exchange as we roll out the ambitious ADX One strategy announced at the beginning of the year.”

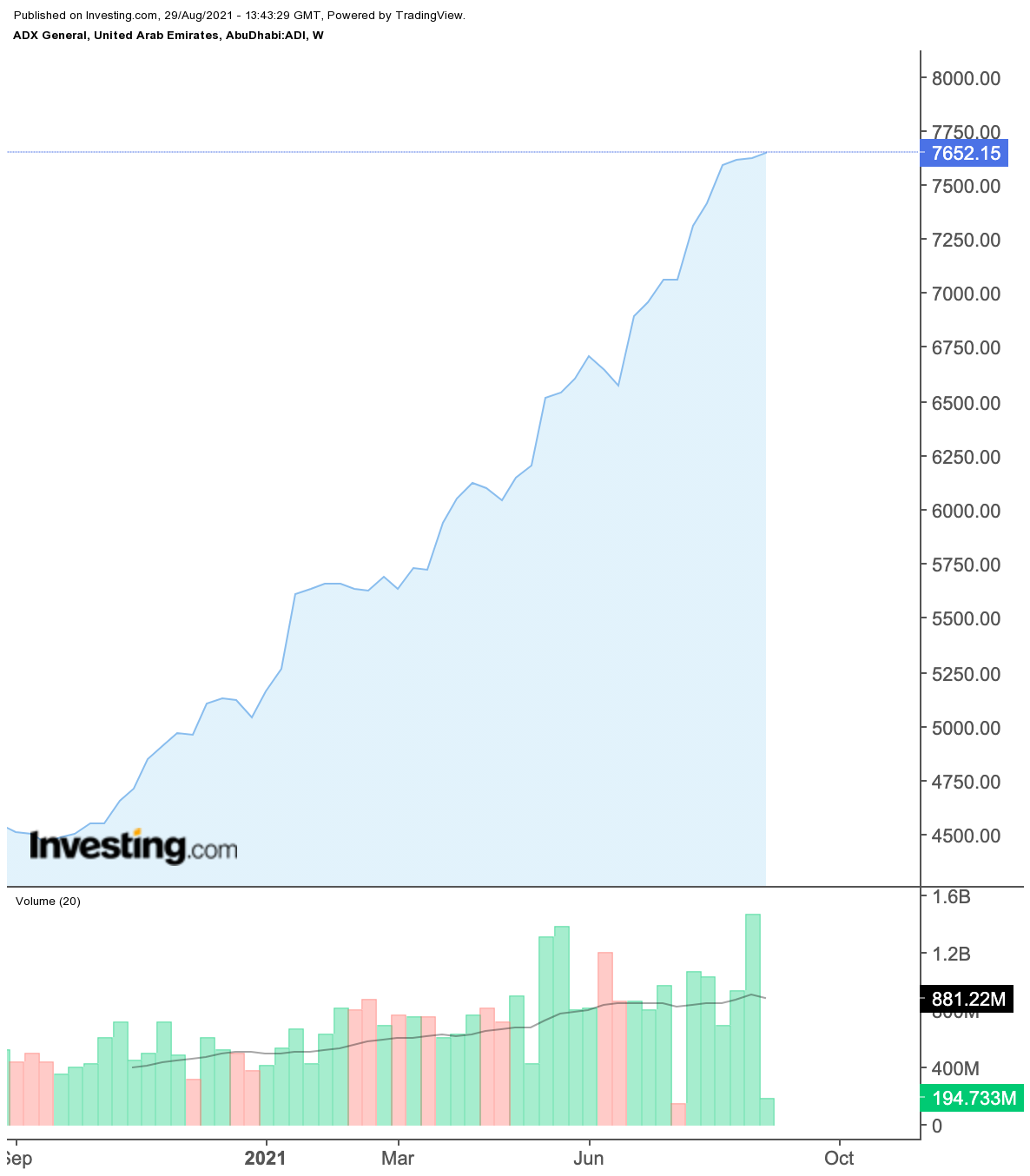

The Abu Dhabi Securities Exchange General Index (ADI) has recently reached 7700 points for the first time, supported by a series of listings and increased participation by international investors. In addition, the index has gained 51% year to date, making it one of the best performing equity indexes in the world.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.