AUD/USD: How to Day Trade the Commodity Currency

ACY Securities - Jasper Osita

ACY Securities - Jasper OsitaAUD/USD speaks in rhythm, and if you listen closely, it often gives you one of the cleanest charts in the entire forex market.

It’s calm, smooth, and technically reliable. But beneath that surface is a macro engine powered by metals, China, risk sentiment, and central bank divergence. To trade it well, you don’t need to predict. You need to understand what fuels it.

Once you do, AUD/USD becomes a favorite, especially for traders who like clean structure, fundamental clarity, and an edge during the Asian session.

What Is AUD/USD?

It’s one of the most actively traded pairs in the Asia-Pacific region and often behaves like a real-time sentiment gauge for global commodities and risk appetite.

- Base currency: AUD (Australian Dollar)

- Quote currency: USD (U.S. Dollar)

- Nickname: The Aussie

- Core theme: Risk-sensitive, commodity-linked, technically clean

Why AUD/USD Is Called the Commodity Currency

Australia’s economy is built on exports, especially iron ore, coal, gold, and liquefied natural gas.

When commodity prices rise, AUD tends to strengthen.

When global growth slows and demand weakens, AUD gets hit, even without a domestic crisis.

But there’s more. AUD/USD doesn’t just reflect Australia. It reflects China too.

Why? Because China is Australia’s largest trading partner.

When Chinese manufacturing slows or policy turns dovish, the ripple effect hits AUD/USD before many even notice.

That’s why traders often call AUD/USD the "China proxy" in the forex market.

A Breaker in the Flow

Unlike the high-volatility chaos of GBP/USD or the yield-driven momentum of USD/JPY, AUD/USD tends to move with structure first and narrative second.

It respects levels. It respects time-of-day. And it responds quickly to macro shifts in risk-on versus risk-off sentiment.

But don’t confuse calm with weak.

This pair can trend with conviction and often with less noise.

When Is the Best Time to Trade AUD/USD?

- Asian Session (7 PM to 11 AM EST): You’ll often find the cleanest structure here. AUD/USD is one of the few majors that behaves well before London

- London to New York Overlap: Watch for follow-through on U.S. data, especially inflation, jobs, and Fed tone

- Avoid trading when both AUD and USD are passive: This pair needs either commodity movement or strong USD momentum to create real opportunity

How to Trade AUD/USD with High Probability

1. Identify macro tone. Is the market in risk-on or risk-off mode? That alone impacts AUD/USD deeply

Wanna learn how? Check my contents below:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

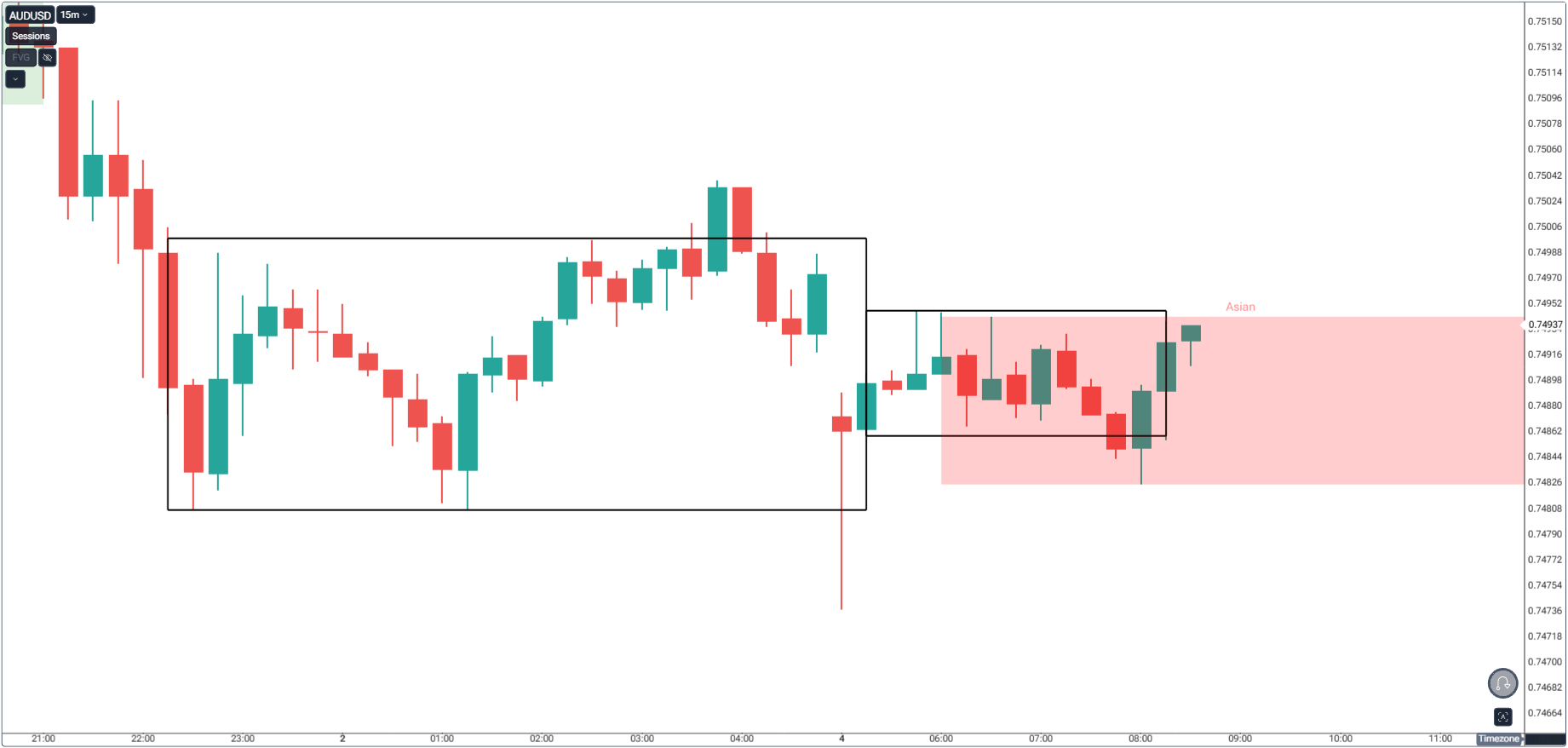

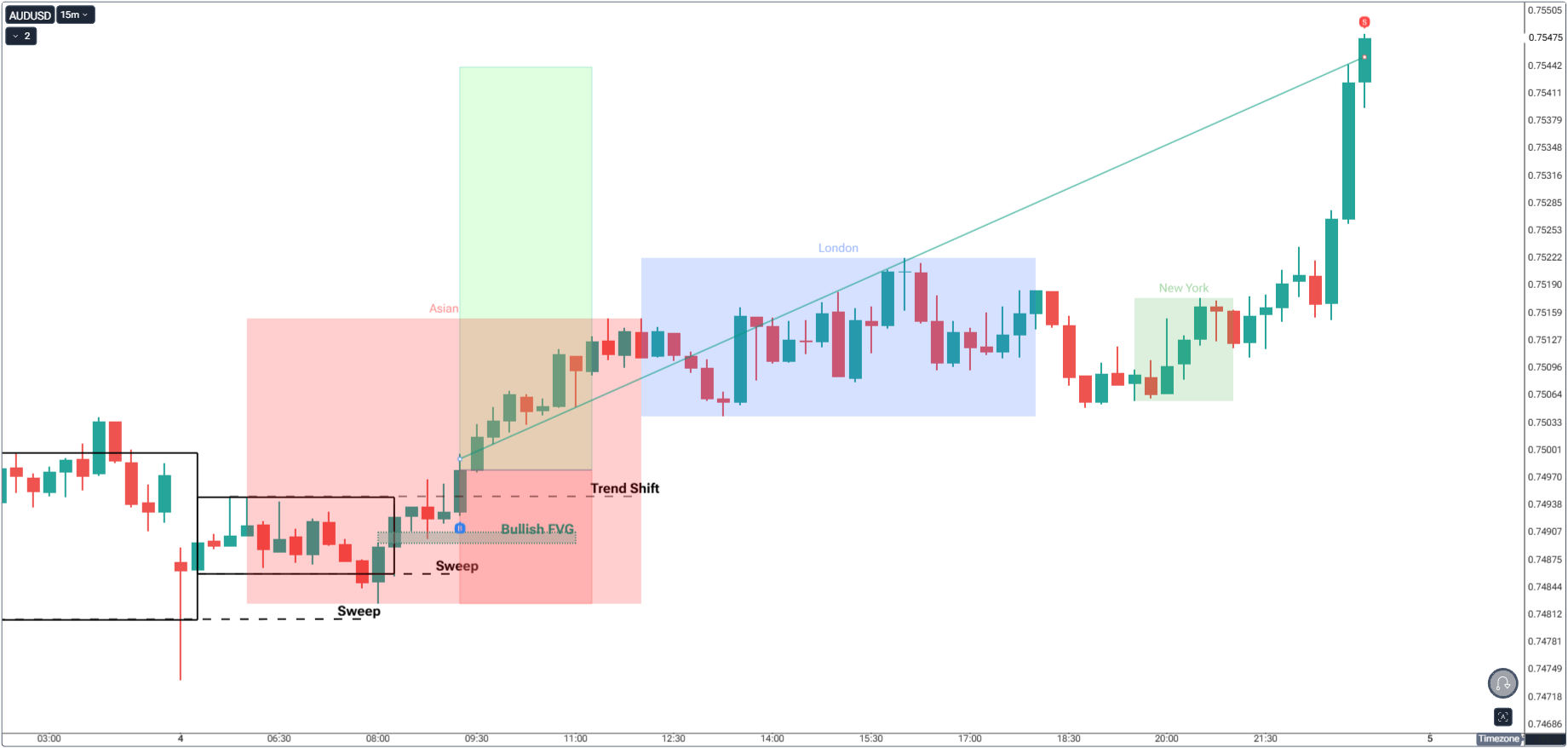

2. Use AMD entry model during Asia. AUD/USD gives excellent manipulation–distribution setups early in the week

Accumulation: Wait for a sideways price action and price testing either side of the range.

Manipulation: Wait for price to manipulate/test either side of the range.

Distribution: Once the other side fakes out, wait for a breakout on the other side and trade the candle close.

3. Watch commodities. Rising gold and iron ore prices support AUD; collapsing commodity demand weakens it

4. Align with clean structure. Look for price respecting FVGs, order blocks, and previous highs or lows with more clarity than other majors, price break outs.

5. Track China PMI and stimulus headlines. These often move AUD/USD before many U.S. traders are even awake

How RBA and Fed Cycles Impact AUD/USD

- A hawkish RBA combined with a dovish Fed often triggers strong AUD/USD uptrends

- If the RBA pauses while the Fed hikes, AUD/USD tends to roll over

- RBA is also reactive to household spending, employment data, and China demand, making its forward guidance a valuable trading signal

Correlated Assets to Watch

| Asset | Why It Matters |

|---|---|

| Gold (XAU/USD) | Australia is a top gold exporter, and AUD often follows gold's direction |

| Iron Ore & Copper Futures | Support bullish AUD trends when prices rise |

| China PMI / Credit Expansion | Stimulus or growth = AUD upside |

| S&P 500 / Risk Indices | Global equity strength supports AUD as a risk currency |

| NZD/USD | Often trades in sync; divergence can signal decoupling or a potential reversal |

AUD/USD vs NZD/USD: Which One Should You Trade?

Both are commodity currencies. Both trade well during Asia. But there are key differences:

| Trait | AUD/USD | NZD/USD |

|---|---|---|

| Volatility | Slightly higher | Slightly lower |

| Macro influence | China + metals | Dairy exports + RBNZ |

| Structure | Cleaner in trending environments | More range-bound, especially in consolidation phases |

| Sensitivity to global risk | Higher (due to metals and China) | Lower but reactive to AUD correlation |

| Best for | Trend-followers and structure traders | Range traders or macro swing setups |

If you want technical precision and macro clarity, trade AUD/USD.

If you prefer small position sizing and slower charts, NZD/USD is a better fit.

Real-Life Analogy: Trading the Market’s Mood Ring

AUD/USD is like a macro mood ring.

When the world is optimistic, metals are climbing, and China is growing, the Aussie glows.

When fear hits, risk-off headlines spread, and gold spikes from panic, AUD/USD darkens.

You don’t need to fight the mood. Just read it. And align your setup.

Challenge for the Week

Pick two Asian sessions this week to trade AUD/USD exclusively.

Mark the previous day’s New York high and low, then track gold and iron ore direction.

Wait for a sweep of liquidity followed by structure shift and fair value gap alignment(for SMC traders).

Before executing, ask yourself: “What is China doing? What is the RBA signaling? What is risk sentiment telling me?”

By Friday, compare your trades. Were you following structure and narrative or guessing against tone?

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading – A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.