Brad’s eye view: US election “October surprise”?

October 14, 2020 - The following is a guest article from Brad Alexander, CEO of FX Large, providing market commentary in the run up to the US Presidential election.

Brad Alexander, FX Large

Over the last few months, I’ve had students, friends, and relatives asking, “How will the markets react to the US Elections?”

The standard answer, since the beginning of time, is that a Republican victory would be good for the USD, and the contrary would be true for a Democratic victory.

Regarding the US Elections next month, normally a democratic win, by Joe Biden for example, would weaken the US dollar, and we in the industry feel the same this time but for different reasons.

Besides the little matter of a global pandemic, one of the biggest drags on the US economy, is its deteriorating relationship with China which is hindering most large American companies from doing the business that they want and need.

Let’s face it: the current administration in the orange office has done an abysmal job in promoting globalization and, in fact, has done the opposite in many cases, especially with a huge trading partner like China.We are assuming that a Biden White House will try to repair global trading relationships, thereby encouraging an environment where investors will convert cash, US dollars, to equity investments thereby weakening USD.

The same can be said for good news on a Coronavirus vaccine which will, of course, encourage domestic and global trade. Worldwide, everyone knows of and has felt the effects of COVID-19, both physically and economically, and we are starting to realize that we are all in a “new normal” regarding health, behaviour, shopping, and cute designer face masks.

This leaves the biggest issue — US/China trade relations — to be resolved.

On another note, should the Democrats win control of the US Senate, analysts feel that they will inject vast amounts of money into the economy, in the form of Coronavirus stimulus, thereby weakening the US Dollar even further and pumping up the equity markets.

It all sounds very simplistic but, at least to me, I wouldn’t be surprised to see some major drama in the next few weeks which will upend the polls and, as a result, the markets.

US history on elections refers very often to the “October Surprise” which ranges from hurricanes, to alleged peace talks, to alleged conflicts, all designed to sway voters.

Personally, I feel that there is a lot in the way of unanswered questions that may rear its ugly head just in time. I’ll come back to that in a minute.

What Happened Last Time?

Meanwhile, let’s look at what happened last time. We all know who won, even with the bizarre American electoral system where Hillary Clinton won the popular vote, the margin wasn’t enough in the Electoral College. Basically, the man and woman on the street wanted a change…a big change…and good, bad, or indifferent, the street found reasons not to trust Mrs. Clinton.

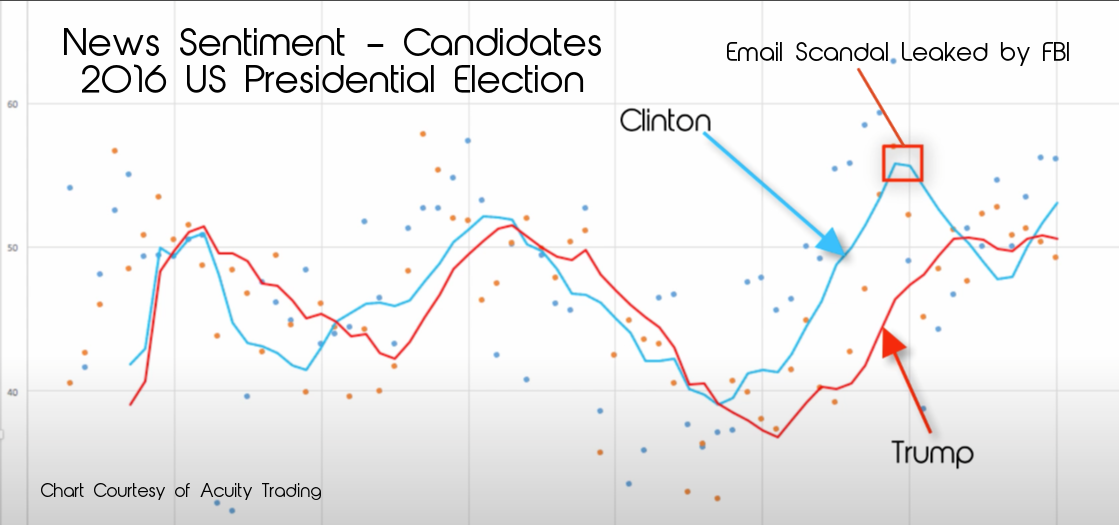

At the time, I was working for some good folks who devote themselves to analysing vast amounts of news and boiling it down to easy-to-read sentiment. From a video I made at the time for Acuity Trading, I grabbed the following screenshot, showing, just before the 2016 US Elections, when the FBI “accidentally” leaked damning news about Hillary’s email server.

The drop in sentiment was devastating! Factor into this, at the time of the leak just before the election, the fact that many Americans were filling in and posting their mail-in ballots. If this was in fact the case, why is the current president so terrified of mail-in ballots? Is he expecting the tide to be turned this month with badly timed revelations from the other side?

Getting back to the last election, the following charts on EURUSD, Gold, and the S&P 500 show the drama after the last time:

USD weakened by over 300 pips then recovered all in a 12 hour period;

Gold moved up and down about $66/ounce in less than a day;

the S&P 500 gapped to the downside and lost 2.7% of its value but recovered with a nice gain during that session.

An important point to note here is that stock markets have always gained during a US presidential term (except for Herbert Hoover’s following the 1929 depression), regardless of their being a Republican or Democrat. The big takeaway for investors and traders then, is that when election results are finally released, that big bad word “Uncertainty” can take a back-seat and we can get back to making informed decisions, hopefully without the unwanted influence of market-moving Twitter accounts.

October Surprise?

Getting back to the topic at hand; what “October Surprise” can we expect?

As mentioned above, there seemed to be a paranoid obsession on the part of the world’s most famous narcissist regarding mail-in ballots. Is President Trump expecting something to come out of the woodwork at the wrong time?

A few months ago, all we heard about was Joe and Hunter Biden’s “activities” in Ukraine. This has all gone quiet. Might we expect a major revelation on this escapade or perhaps regarding new “business ventures” by the Bidens?

President Trump’s tax returns were big news a week or so ago. Might we expect more revelations on this soon?

All of the above is possible and both sides are likely to be planning their own “October Surprise” but there is one recent news item that seems to have gone into hiding. President Donald Trump — owner of resorts, golf courses and real estate — seems to be in serious debt (some estimates are over $500 million) and apparently a 2018 deadline to pay down a lot of that was missed and remortgages were engaged instead. We know that Deutsche Bank holds a lot of the debt but questions remain about who or what holds the rest. All we know is that many of these debts will be coming due in the next 4 years.

So what? Well, over the last 3 1/2 years there has been more than a passing curiosity that the current US President has been quite pliable with other leaders like Putin and Erdogan, strangely hot and cold on Xi Jinping, while being quite aggressive and misogynistic with others like Merkel and May. In Nancy Pelosi’s words, “What does Putin have on Trump?”

My own feeling is that we will find out who holds this remaining debt, what the terms are, and what the consequences might be. If this is the case, this “October Surprise” will come at an extremely advantageous time for the Democrats.

Anyway, keep an eye on your Stop Losses and keep your Take Profit levels intact and buckle-up!

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.