BTC Breaks $124K as 401(k) Adoption and Fed Cut Bets Fuel Rally Toward $132K

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita- Bitcoin breaks above $124K, fueled by dovish Fed bets, ETF inflows, and the landmark U.S. 401(k) crypto inclusion decision.

- Macro tailwinds and strong market structure keep upside momentum intact, with $128K and $132K as the next major liquidity targets.

- Short-term scenarios split between a $123K H4 FVG hold for continuation, or a mild pullback toward $120K before resuming the uptrend.

Bitcoin Rallies to Fresh Highs - Fed Policy, Institutional Flows & Retirement Access Drive Momentum

Bitcoin is riding a wave of macro and structural tailwinds, climbing to $121,792 on August 14, 2025, as traders digest dovish Fed expectations and regulatory breakthroughs. The latest boost comes from the U.S. government’s decision to allow cryptocurrency allocations in 401(k) retirement plans - a move that significantly alters the long-term demand profile for Bitcoin and other top digital assets.

Why the 401(k) Decision Matters for Bitcoin

The 401(k) market represents trillions of dollars in managed retirement savings. Even a small allocation toward Bitcoin could inject substantial liquidity and steady demand into the market. Unlike short-term speculative flows, 401(k) allocations are:

- Long-Term Oriented: Funds are often held for decades, reducing market churn.

- Systematically Contributed: Monthly payroll contributions mean consistent buying pressure, regardless of market volatility.

- Institutionally Managed: Larger custodians and asset managers will need to source Bitcoin directly, amplifying regulated demand.

For Bitcoin specifically, this move cements its role as a legitimate asset class in mainstream U.S. retirement portfolios - a milestone that could bring both credibility and stability to the market over time. It also supports the adoption-driven price thesis that Citi recently emphasized: price is increasingly a function of who’s buying and how consistently, not just supply metrics.

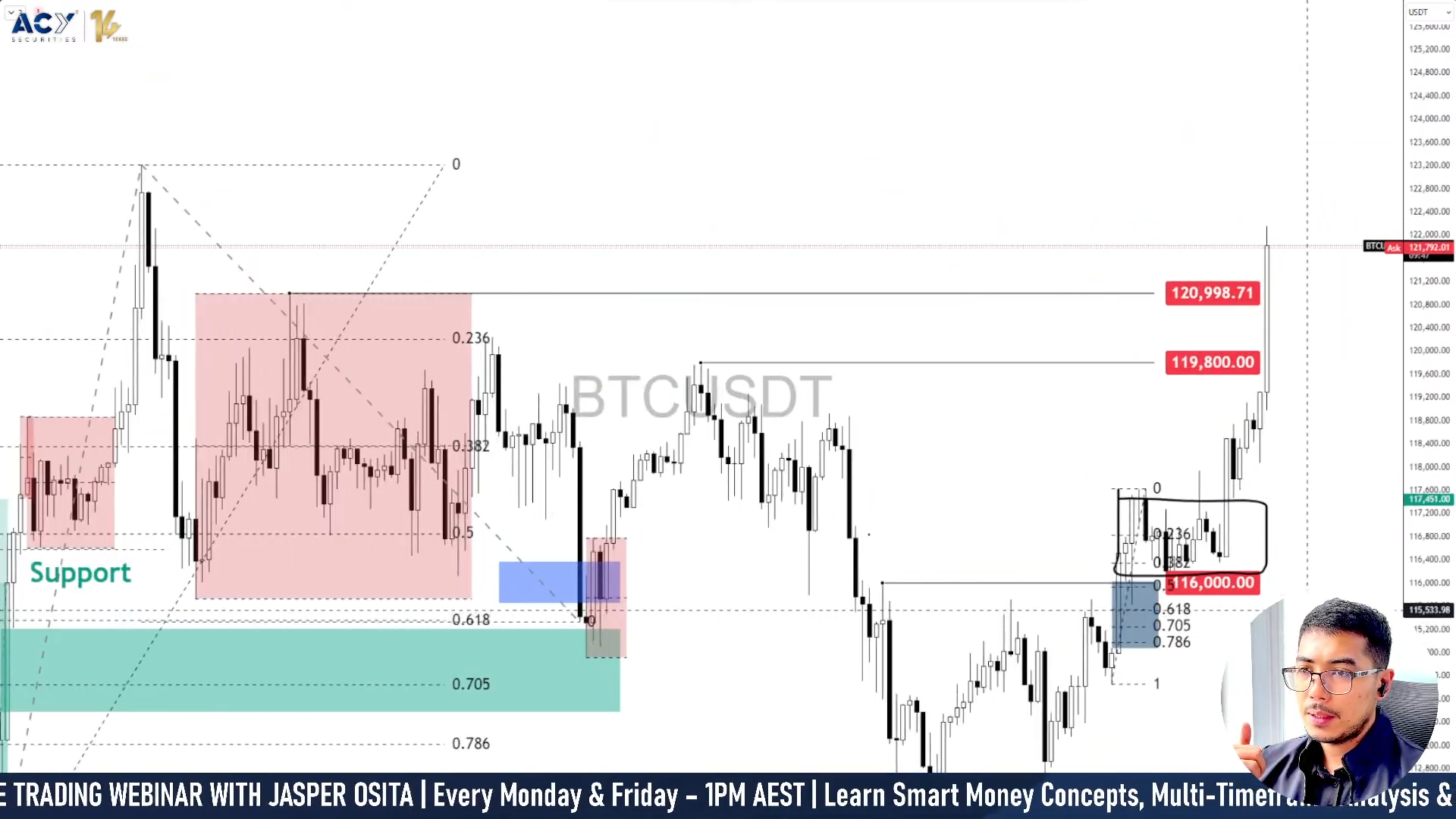

Technical Outlook: BTC’s Path to New Highs

Bitcoin’s recent rally unfolded exactly in line with the bullish bias identified earlier in the week.

Bitcoin is now holding firm after a strong impulsive breakout coming from the $116K levels, origin of the upside continuation, now trading around $124k. The move has cleanly cleared the previous all-time high level, signaling demand and the potential for more highs.

- Momentum Confirmation: After breaking out of the $120k, BTC continued with momentum, adding the 401(k) as fuel for more upside.

- Next Upside Targets:

- $128,000 – First major upside liquidity pool above current levels.

- $132,000 – Extended target aligned with Fibonacci projection and higher-timeframe resistance.

- Market Structure: All near-term resistance levels have been swept, positioning and gearing BTC toward untested highs, close to psychological levels.

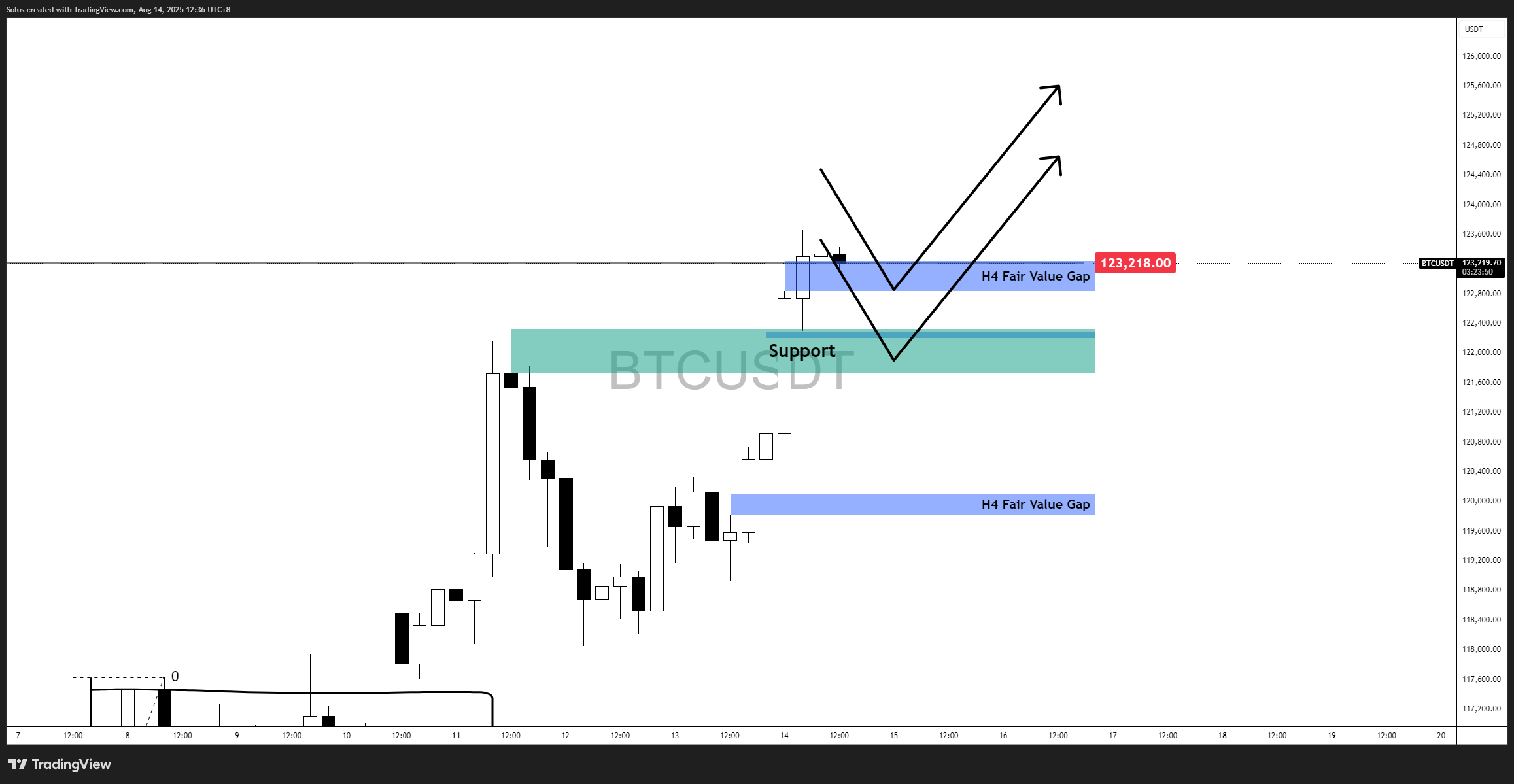

Bullish Scenario: $123k + H4 FVG Support Levels

Bitcoin has extended its breakout beyond the $120k previous resistance turned-support and is now testing the H4 Fair Value Gap. The structure suggests a potential continuation toward new highs if price respects the immediate support zones.

Bullish Triggers:

- H4 FVG Hold – A successful defense of the $122k-$123k zone signals upside continuation as buying pressure is still in play.

- Support Zone Reaction – Pullbacks into the $122k support zone (confluence of structure and prior breakout level) holding firm would confirm re-accumulation and another line of defense for upside.

- Continuation Pattern – Higher lows forming above the $123K region would pave the way for an extended upside push.

Targets:

- 1st Target: $128,000 – Next liquidity zone above current price.

- 2nd Target: $132,000 – Major higher timeframe objective.

Invalidation:

- A close below $122k followed by sustained trading under $121k would weaken the bullish setup and open a deeper retracement toward $119,800–$118,000.

This bullish pathway aligns with Bitcoin’s strong macro tailwinds - dovish Fed expectations, 401(k) retirement plan inclusion, and ETF inflows - making any shallow pullback potentially an opportunity for continuation toward fresh all-time highs.

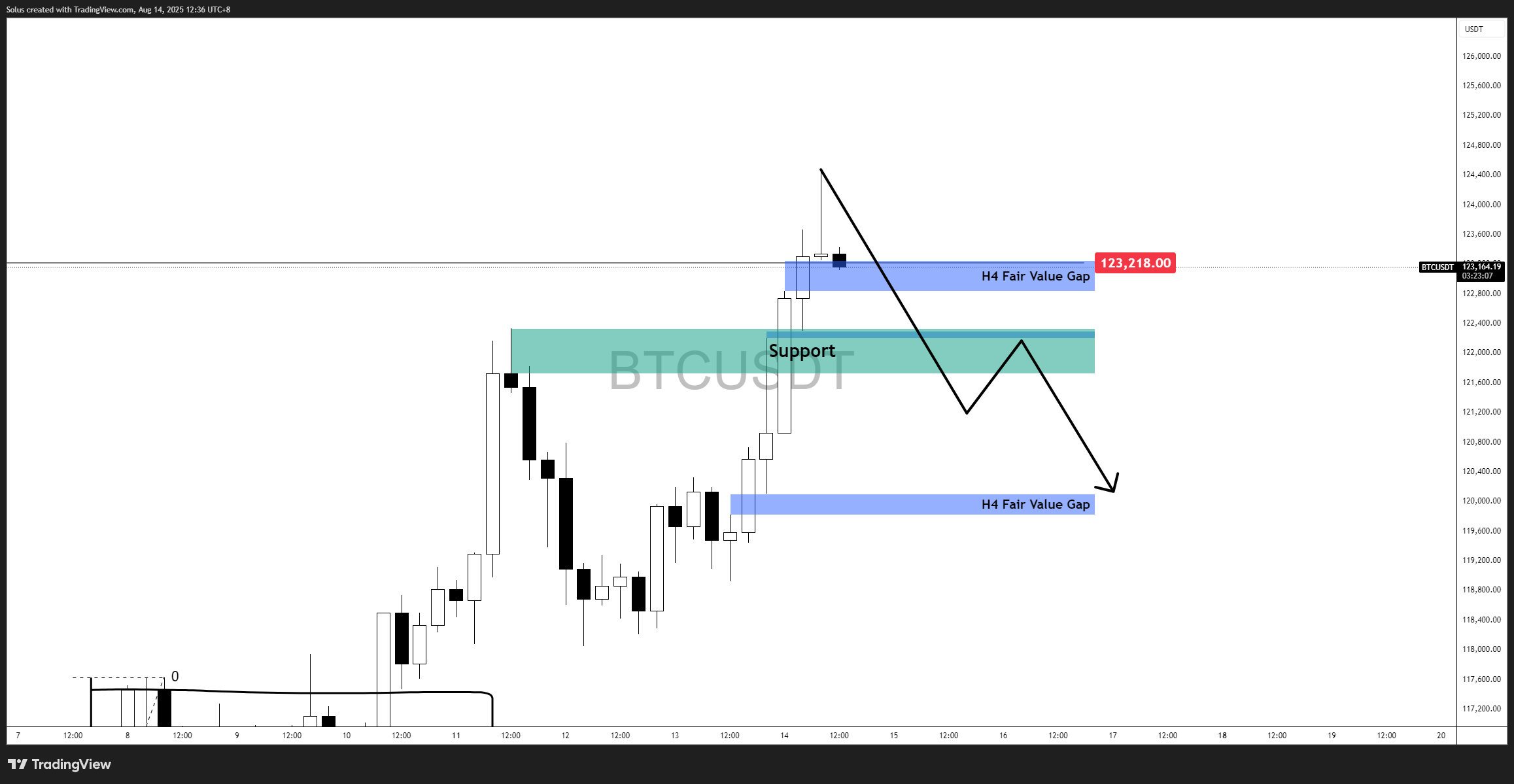

Bearish Scenario: Short-Term FVG Rejection & Pullback

Bitcoin is currently reacting to the H4 Fair Value Gap at $123k, with early signs of rejection. While the higher-timeframe structure remains bullish, a corrective move could develop before continuation toward new highs.

Bearish Triggers:

- H4 FVG Rejection – Sustained rejection from the $123k zone could signal that short-term buyers are taking profits and a deeper pullback.

- Support Zone Break – A move through the $121k–$122k support zone would expose deeper liquidity levels.

- Lower H4 FVG Target – Price could seek the next H4 Fair Value Gap near $120k before buyers potentially re-engage.

Targets:

- 1st Target: $122k–$122,500 – Immediate structure support and retest zone.

- 2nd Target: $122k–$121k – Lower H4 FVG as a potential liquidity draw.

Invalidation:

- A decisive H4 close above $124k would weaken the pullback setup and put the bullish continuation scenario firmly back in play.

This short-term bearish pathway is more of a corrective phase than a reversal, aligning with the overall bullish market structure. If macro sentiment remains supportive and buyers step back in at key demand zones, the pullback could serve as a launchpad for the next leg toward $128K and $132K.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.