Cboe FX to launch hosted algo service with XTX Markets

September 14, 2021 - Cboe FX Markets have announced the launch of a hosted algorithmic execution service in collaboration with leading electronic market-making liquidity provider XTX Markets.

This service will help enable Cboe FX participants to access the XTX Markets Execution Algo (‘XTX Algo’), which is designed to alleviate implementation shortfall (slippage), via the Cboe FX ECN. Significantly for the platform, Cboe FX has been granted exclusive rights over use of the XTX Algo in the anonymous ECN space and this service is available for execution of the most actively traded pairs in the spot FX market, including: EUR/USD; USD/JPY; GBP/USD; AUD/USD; USD/CAD; USD/CHF; USD/CNH.

Jonathan Weinberg, Head of Cboe FX, said, “As the use of algorithms become more prevalent in the spot FX market, we couldn’t be more excited to be utilising the expertise of a best-in-class FX market maker. This service will offer greater choice and transparency to Cboe FX’s participants in how they access liquidity as they seek to improve their execution quality, demonstrate best execution and drive automation within their FX operations.”

Jeremy Smart, Global Head of Distribution at XTX Markets, sai, “We are excited to be working with Cboe FX to enhance the distribution of our FX Algo product, which furthers our ability to reduce the FX community’s trading cost when patiently executing larger orders. We look forward to helping the platform’s participants benefit from our scale and market-making expertise in FX.”

Cboe FX participants can access the XTX Algo on an anonymous or disclosed basis via the Cboe FX ECN using their existing Cboe FX technology and legal arrangements. They will also be able to utilise the credit infrastructure of Cboe FX, which offers easy access to the XTX Algo and its Transaction Cost Analysis (TCA) capabilities. This service will initially be available through the Cboe FX API in its New York-based matching engine, with a planned expansion to London, based on customer demand.

Ben Leit, Global Head of Sales, Cboe FX, said, “Cboe FX is always looking for opportunities to work with its clients to enhance execution outcomes for end investors. XTX Markets was a natural collaborator for us as we sought to launch an algo hosting offering and lower the barriers for entry for clients wishing to adopt advanced agency solutions in the FX spot market.”

This service is highly complementary to Cboe FX’s other services allowing it to offer a comprehensive suite of trading services to meet the diverse needs of the FX trading community, covering all aspects of how participants interact in the market. These include a firm order book (Cboe FX Central), sweepable order book with curated firm and non-firm liquidity (ECN), and full amount trading which provides participants with a solution for larger order risk transference with low market impact (Full Amount).

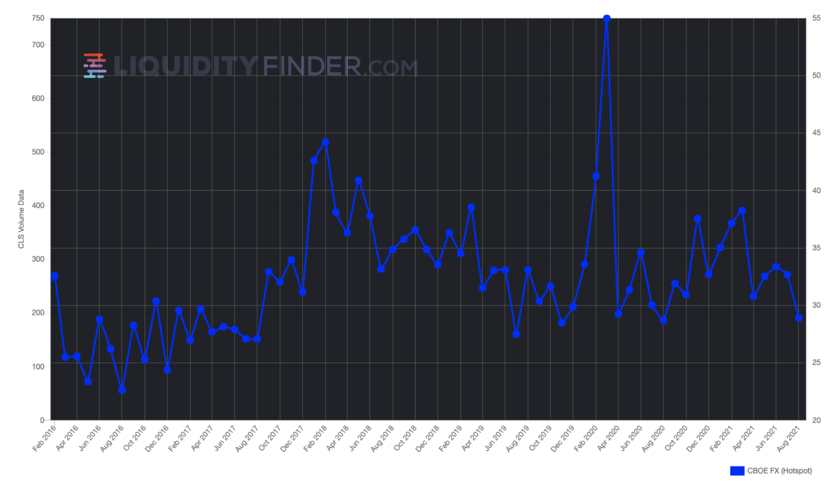

In the first half of 2021, Cboe FX reported average daily volume (ADV) traded of $34.5 billion. To see the historical month by month ADV for the Cboe FX platform, compared to other FX venues, displayed on LiquidityFinder, click here.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.