CMC Markets - Final results for the year ended 31 March 2022

June 09, 2022 - CMC reports final results for the year ended 31 march 2022

Highlights

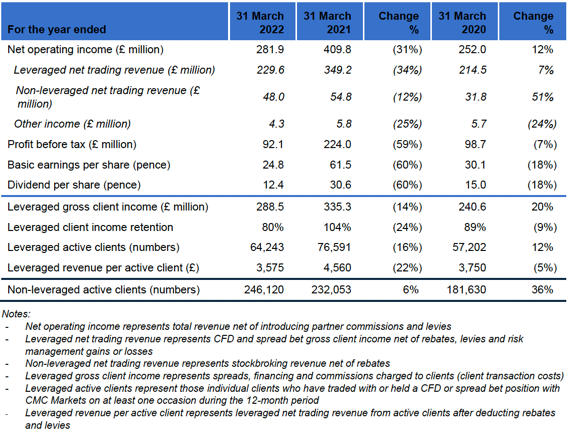

• Net operating income of £282 million is at the top end of guidance and a record performance outside of the pandemic restrictions. • Investment in growth initiatives is expected to result in a 30% increase in net operating income over the next three years. Benefits to be seen from 2023 and are set to deliver profit before tax margin expansion from 2024. • Operating expenses have increased by 2% to £188 million, primarily due to higher personnel costs to support the ongoing strategic initiatives, partly offset by lower sales costs. • Profit before tax of £92 million (2020: £224 million). • Underlying liquidity remains strong. Regulatory OFR ratio of 489%. Net available liquidity improvement to £246 million (2021: £211 million). • The £30 million share buyback commenced on 15th March. As of 7th June, the Company has repurchased and cancelled 4,603,703 Ordinary Shares with nominal value of 25 pence for an aggregate purchase amount of £12.7 million.

Outlook and dividend

• Alongside our focus on delivering strong business performance in 2023 new business expansion is expected to grow net operating income by 30% over next three years based on the 2022 result and underlying conditions. The targeted growth is expected to be broadly linear over that period with benefits expected in 2023. • New investments will focus on seven core initiatives aiming to enhance functionality and capture the broader wallet share as we evolve our execution services and investment platforms. We will continue to utilise our technology to enter new markets and expand our non-leveraged offering. The impact will reduce revenue volatility and grow pre-tax profit margins from 2024. • Our 2023 investment plans are expected to increase operating costs to approximately £205 million excluding variable remuneration, underpinning the expected 30% growth in underlying net operating income by 2025 as well as longer-term growth from the UK non-leveraged business. Over two thirds of the new investment will be associated with people, product development and marketing. The rate of spending will be dependent on the Group’s ability to make additional personnel hires. • CMC Invest Australia continues to expand and invest in its market-leading offering, with reinvestment in mobile and a complete UX redesign. Singapore expansion is on track and planned for 2023. • CMC’s leveraged B2B offering continues to perform well, delivering 60% client income growth in 2022 versus 2021. CMC is expecting future 20% CAGR in B2B client income. B2B expansion continues to be a major growth pillar. • CMC Invest UK: the new UK non-leveraged platform has been successfully soft launched to staff and will be rolled out to new clients over coming months. • The Board recommends a final dividend of 8.88 pence per share (FY 2021: 21.43 pence), equating to £26 million, resulting in a total dividend payment for the year of 12.38 pence per share (FY 2021: 30.63 pence).

Lord Cruddas, Chief Executive Officer CMC, commented on the results, “I am delighted to report another year of impressive performance from both a strategic and financial standpoint. Excluding the exceptional COVID-19 impacted prior year, which due to market volatility saw unusually significant trading volumes, this is a record net operating income result for the Group.

"Over the last year we have taken steps to define the strategic direction and diversification of the Group, building on our existing technology to launch a new investment platform that will unlock significant shareholder value and challenge the existing client transaction fee cost structures.

"There is significant opportunity and growth potential in the self‑directing investment platform space, especially in the UK, not just for improved technology but also transaction costs and fees. We believe commissions, execution spreads and custodial fees are too high and too expensive for retail investors. We will utilise our platform technology, including pricing and execution, to drive down the transaction costs of investments for retail clients, just like we did in Australia, where we are the number two investment platform for retail investors.

"The business is evolving. We continue to improve and grow our existing leveraged business whilst at the same time utilising our technology to enter new markets and expand our non-leveraged offering.

"I look forward to providing further updates as the strategy expands over both the short and long-term.”

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.