CME proposes to convert Eurodollar futures and options open interest into corresponding SOFR contracts on April 14, 2023

September 06, 2022 - The CME has announced that, based on initial client feedback, it is proposing to convert Eurodollar futures and options open interest into corresponding SOFR contracts on April 14, 2023, under the company's previously adopted fallbacks plan. Eurodollar futures and options contracts that expire before June 30, 2023 are excluded from this proposal and will continue to trade until their expiry.

"Our proposed conversion date will help our clients complete their operational work as early as possible in the transition process, while closely aligning with the recently published industry timelines for over-the-counter interest rate swaps," said Agha Mirza, CME Group Global Head of Rates and OTC Products. "SOFR futures and options are now the leading liquidity pool, as open interest has reached 19 million contracts and volume has significantly outpaced Eurodollars. Based on this growth, today's announcement provides a practical timeline by which clients can bring remaining Eurodollar contracts into the SOFR market."

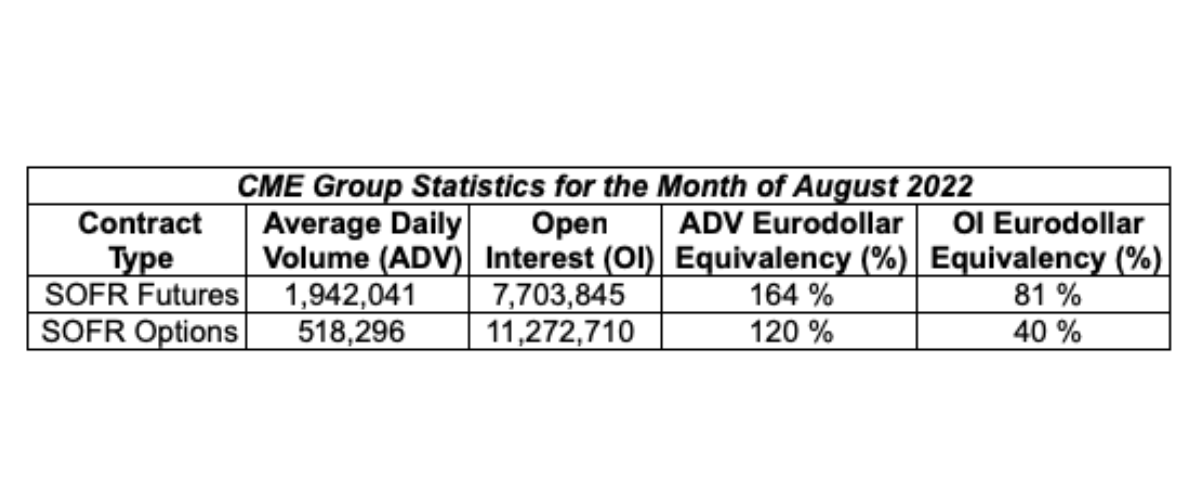

In the month of August, CME Group reported record average daily volume of nearly 2.5 million contracts and record open interest of 19 million contracts for SOFR futures and options contracts. SOFR options had record volume and open interest in August and SOFR futures had record open interest during the same period. Additional highlights include:

Ahead of the final conversion under fallbacks, liquid standard and reduced-tick Inter-Commodity Spread (ICS) instruments are available to facilitate the voluntary conversion of Eurodollar open interest via the SED Spread for futures and the LS Spread for options.

In addition, to further support the deepening of SOFR markets, CME Group plans to add SOFR options to its portfolio margining solution for cleared products in December 2022, subject to regulatory approval. Portfolio margining enables clients to reduce margin requirements by offsetting their exposure on cleared swaps versus interest rate futures and options.

Now among the world's deepest and most consistently liquid markets, SOFR futures and options have broad participation from global banks, hedge funds, asset managers, principal trading firms and other types of traders.

SOFR futures and options are listed with and subject to the rules of CME. For more information, please click here.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.