Dollar Sentiment Weakens, But Bullish Structure Holds

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

As we step into a new week, the U.S. dollar remains at the center of global financial discussions, with recent events shaping its trajectory. Understanding these developments is crucial for traders and investors looking to navigate the currency market effectively.

- USD - Traders Await Tariff Clarity Amid Dollar Steadiness

- Uncertainty over new tariffs from Trump keeps markets cautious.

- Concerns grow over potential recession from trade policies.

- JPY - Yen Weakens as U.S. Yields Rise

- Japan’s CPI data shows cooling inflation in February.

- BOJ policy outlook remains uncertain.

- AUD - Aussie Dollar Weakens on Employment Data

- Dropped following disappointing labor market figures.

- Global trade concerns add to bearish sentiment.

- RBA's next move remains uncertain.

- NZD - Kiwi Remains Under Pressure in Bearish Territory

- A break of 0.57229 could trigger further downside.

- Market sentiment remains cautious amid global uncertainty.

- EUR - Euro Rises Slightly After Declines

- German fiscal measures support growth outlook.

- Market focus shifts to upcoming ECB decisions.

- GBP - Pound Hits Four-Month High on Inflation Expectations

- Markets expect BOE to maintain policy stance.

- Strength supported by reduced recession fears.

- CAD - Loonie Range-Bound Amid Tariff Uncertainty

- No clear directional bias in recent sessions.

- Markets await developments in U.S. trade policy.

- CHF - Swiss Franc Stays in Tight Range

- Minimal movement as markets seek a breakout.

- Safe-haven demand remains stable.

Uncertainty Over Dollar’s Global Role

Concerns about the U.S. dollar’s long-term stability are growing, with analysts questioning its liquidity during financial stress. Ongoing trade policy debates and potential shifts in the global monetary system add to the uncertainty, raising speculation about changes in reserve currency dynamics.

Dollar 3-Day Rebound

Daily

Despite these concerns, the dollar continues to hold its ground with US dominance over trade wars. The U.S. Dollar Index (DXY) posted modest gains as investors adjusted their positions ahead of key economic policy updates, reflecting cautious optimism in the market despite broader economic uncertainties.

Dollar on a Breather? Or poised for more Downside?

Weekly

Over the past two weeks, the Dollar has been in a bearish trend. However, last week, it saw a pause and ended on a positive note, supported by strong economic data favoring the greenback.

Institutions Bet on a Weaker Dollar

The latest Commitments of Traders (COT) report reveals a shift in market sentiment toward the U.S. Dollar Index (DXY). Over the past week, net positions have declined significantly by 9,647 contracts, driven by a reduction in long positions (-4,312 contracts) and a rise in short positions (+5,335 contracts). This suggests that traders are growing cautious about the Dollar’s strength, increasing their bets against it.

Despite this bearish shift, net positioning remains positive at 7,188, meaning there are still more traders betting on Dollar strength than weakness. However, the trend is changing, as reflected in the shrinking bullish bias.

How This Impacts the Weekly Outlook

- Bearish Momentum Building: The increase in short positions indicates a growing expectation of a weaker Dollar. If this trend continues, we may see further downside pressure.

- Support from Economic Data: Last week, the Dollar showed resilience and closed positive, suggesting that strong economic data is helping offset the bearish sentiment in positioning.

- Key Levels to Watch: The Dollar remains within its 52-week net positioning range (-3,224 to 20,210), meaning it has room to move in either direction. If net positioning turns negative in future reports, it could signal a more extended bearish trend.

VIX: Fears Continues to Dissipate

With the markets cooling down, fears in the US market is also dissipating as the VIX is currently below the 20 level which signals a reduced fear on trading risky assets like Stocks.

Bonds: Pausing Its Appeal

With investors getting the hang over trade policies, potential recession, market turmoil, investors are pausing its interest on government bonds as it continues to range.

Daily

4-Hour

Currently, Dollar is gaining traction after breaking out of the range with a potential upside move up-to the 105.00 level.

A break of 104.223 could drive price higher and potential reaction level at the MA 20.

Potential Market Movers for the Dollar this Week

JPY

Daily

The Yen continues to weaken as the Bank of Japan (BoJ) adopts a more dovish stance. While the BoJ previously showed signs of a hawkish shift, the recent rate decision signaled a pause, following softer-than-expected inflation data. This has dampened expectations for immediate policy tightening, putting further pressure on the Yen.

Dovish Yen

The Bank of Japan (BOJ) has been cautious in its monetary policy decisions amid uncertainties stemming from U.S. trade actions. In March 2025, the BOJ maintained its interest rates, citing heightened global economic uncertainty due to potential U.S. tariffs. BOJ Governor Kazuo Ueda highlighted the challenges in assessing the impact of U.S. trade policies on Japan's economy and inflation, indicating a need for careful consideration before making further rate adjustments.

These developments underscore the complexities in U.S.-Japan economic relations, particularly concerning trade policies and currency valuations.

USDJPY

Dollar-Yen continues to gain traction as we are now approaching the next resistance at 150.148 level.

A break of this level could further drive USDJPY to potentially tapping the 151.305 level.

AUDUSD

4-Hour

Australian Dollar continues to weaken after failing to breakout of the previous range.

We are now on fresh lows with potential downside ahead targeting 0.62 level.

1-Hour

A break of the 0.62492 level could trigger price for further downside.

NZDUSD

4-Hour

New Zealand Dollar still hold its ground on the new range. Its currently on a bearish territory as it is trading below equilibrium of the current range.

A break of 0.57229 could be a catalyst for NZD to test the lows at 0.56772 level.

1-Hour

With price trading below the Moving Averages, the New Zealand dollar (Kiwi) remains under pressure. Further weakness is likely unless the price breaks above the Moving Averages in alignment with a range breakout, signaling a potential shift in momentum.

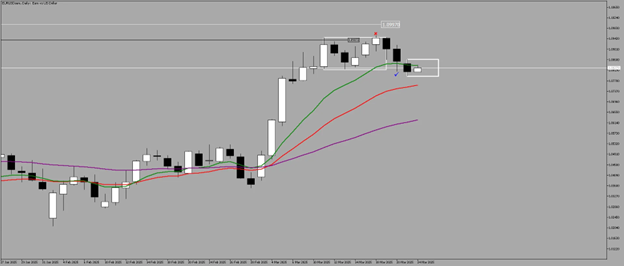

EURUSD

Daily

EUR is currently on a pause after a strong rally. Despite Dollar on a rebound, EUR is holding its ground.

4-Hour

A break of the 1.07970 level could trigger Euro for further downside with Moving Averages acting as resistance levels to send Euro on a weaker sentiment.

GBPUSD

Daily

Like Euro, Pound is also experiencing a slowdown and currently challenging the 10 MA.

4-Hour

Pound is still yet to unveil if its ready to go to the downside.

We are still on a range-bound market with bearish stance looming nearby as it trades below equilibrium.

Pound could experience further bearish stance if it breaks the 1.28612 level.

USDCAD

4-Hour

With ongoing trade tensions and Canada responding with strong retaliatory measures, USDCAD remains range-bound, showing no clear directional bias.

Given the current price action, it’s best to wait for further developments in tariff policies before anticipating a definitive move in either direction.

USDCHF

4-Hour

The same outlook applies to USD/CHF, with no clear signs of strength or renewed weakness for further downside.

The best approach is to wait for a breakout or breakdown of the daily range before seeking opportunities, ensuring better risk management.

Balancing Risk and Reward

"In trading, you have to be defensive and aggressive at the same time. If you are not aggressive, you are not going to make money, and if you are not defensive, you are not going to keep money."

Navigating the markets requires both strategic aggression and disciplined risk management. As seen in recent market trends, successful traders adapt by striking the right balance between offense and defense.

- Aggression drives profit: Spot opportunities and execute with confidence when a clear setup presents itself.

- Defense protects capital: Risk management ensures long-term survival in the market.

- Adaptability is key: The best traders adjust strategies based on market conditions.

Approach: Trading with Controlled Aggression

To apply this mindset effectively, traders should combine calculated risk-taking with strict discipline in execution.

Step 1: Identify Market Conditions

- Determine if the market is trending, ranging, or uncertain.

- Analyze key indicators, price action, and institutional positioning.

Step 2: Plan Aggressive Entries

- Take trades when the market aligns with your bias (e.g., range breakouts, trend confirmations).

- Use confluence factors like moving averages, key levels, and order flow.

Step 3: Manage Risk Defensively

- Set stop-losses and control position sizes to protect against unexpected moves.

- Monitor shifts in fundamentals (e.g., central bank statements, trade policies).

Conclusion

Successful trading requires a dual mindset—knowing when to strike aggressively and when to defend capital. By applying this principle, traders can navigate volatility while positioning themselves for sustainability.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.