Escape the 24/7 Market Grind: Can a Forex EA Finally Reduce Your Trading Stress?

ACY Securities - Francis Palo

ACY Securities - Francis PaloThis article is reviewed annually to reflect the latest market regulations and trends

EAs Combat Burnout: A Forex EA (Expert Advisor) acts as a circuit breaker for human emotion, executing your trading strategy 24/7 without fear, greed, or decision fatigue, directly reducing trading stress.

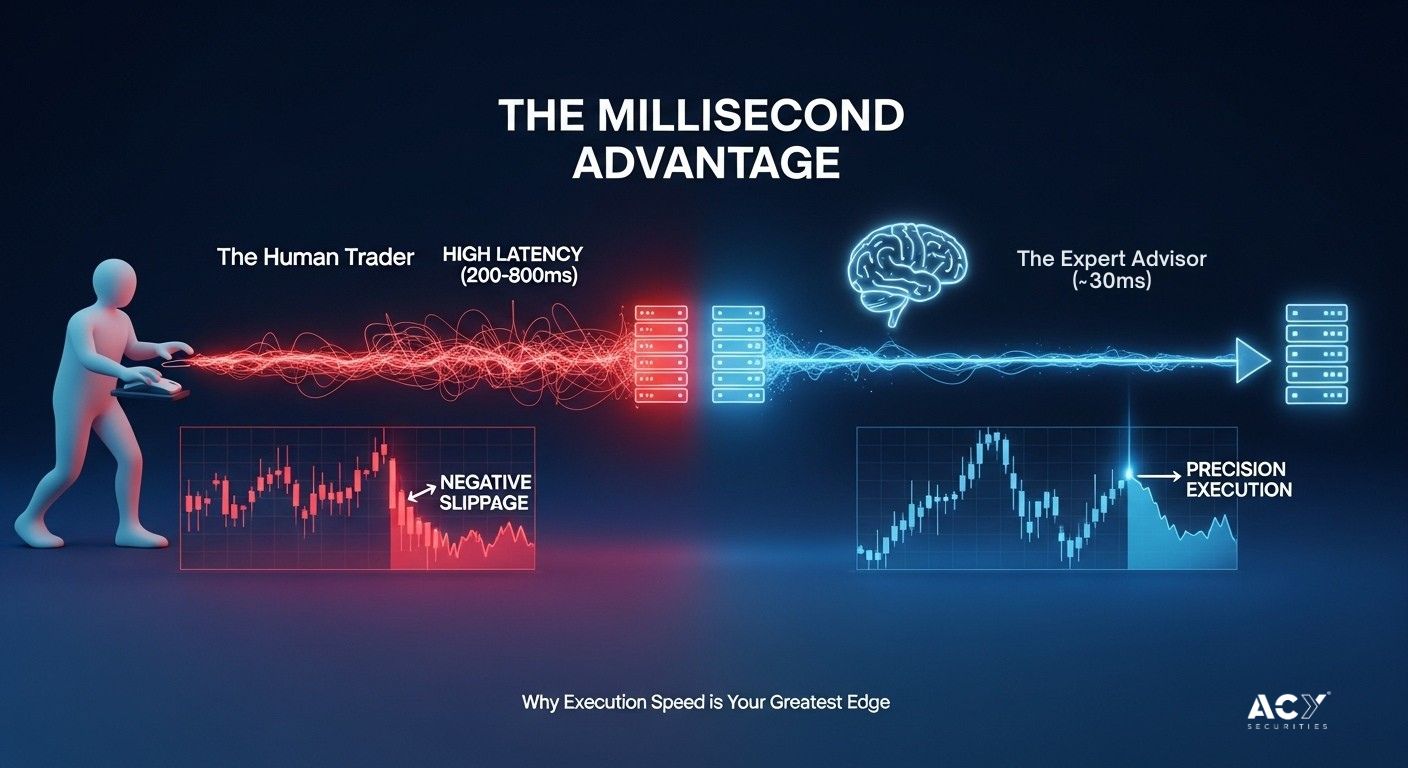

Execution Speed is Key: EAs leverage ultra-fast execution to minimize latency and slippage, capturing opportunities that are physically impossible for a manual trader to seize with the same precision.

- Beware the "Free EA" Fallacy: Most free EAs use high-risk strategies like Martingale or Grid systems that are designed to fail. True automation success comes from empowering tools, not "black box" promises.

Automation Reclaims Time: By automating trade execution, traders can save 9-19 hours of active screen time per week, shifting their focus from the stressful "grind" to high-level system oversight and strategy development.

- Infrastructure is Non-Negotiable: The success of your Forex EA is critically dependent on a low-latency environment with tight spreads, making the choice of a high-performance broker like ACY Securities a foundational requirement.

"You don’t have to be brilliant, only a little bit wiser than the other guys, on average, for a long time." - Charlie Munger

Reduce Your Trading Stress: Your Trading Doesn't Have to Be a Second Job

You became a trader for the freedom, right? The freedom to be your own boss, control your financial destiny, and live life on your own terms. So why does it feel like you've chained yourself to a digital ball and chain, endlessly watching charts flicker in a dark room, your stomach churning with every tick?

What if you could run your trading strategy with the discipline of a machine, capture opportunities while you sleep, and finally reclaim the one asset you can never get back: your time? This isn't about a mythical "get rich quick" button. It's about a strategic shift from being a stressed-out participant to a calm, data-driven system architect. It's time to escape the grind.

Escape the 24/7 Market Grind: Can a Forex EA Finally Reduce Your Trading Stress?

The foreign exchange (Forex) market is a relentless beast. Operating 24 hours a day, five days a week, it presents a profound challenge for the manual retail trader. The constant barrage of economic data, geopolitical shifts, and price volatility creates an environment of perpetual pressure and information overload. For many, this demanding landscape leads to "trader burnout," a state of physical and mental exhaustion that critically impairs motivation and clouds judgment.

This is the modern trader's dilemma. You have a strategy, you've done the research, but the sheer psychological and cognitive burden of manual execution grinds you down. Trading becomes an emotional battlefield dominated by fear, greed, and frustration, directly sabotaging your ability to follow your own rules.

This is where the promise of automation enters the picture. An Expert Advisor (EA), a program that automatically executes your trading strategy,offers a potential solution. But can it truly deliver on its promise of stress reduction and performance enhancement? This comprehensive guide will dissect every facet of automated trading, from the psychology of system management to the critical importance of execution infrastructure, to answer that very question.

How Does Automated Trading Prevent "Chart-Watching Burnout"?

Beyond the acute emotional rollercoaster, manual trading imposes a significant and cumulative cognitive burden. The process requires constant market monitoring and high-stakes decision-making under uncertainty, which is exceptionally mentally draining. This leads to a state of high Cognitive Load, where the brain's information-processing capabilities are impaired, leading to a greater reliance on emotion-based, heuristic decision-making.

The 24/7 nature of Forex exacerbates this, leading to decision fatigue. As your mental resources are depleted, the quality of each subsequent decision degrades. The "grind" is not just about the hours you put in; it's about the cumulative degradation of your decision-making quality under relentless cognitive pressure.

This is the root of chart-watching burnout. An EA fundamentally solves this problem by outsourcing the cognitive load of execution. The algorithm handles the constant monitoring and rule-based decision-making, freeing you from the screen.

Here’s a direct comparison of the mental toll:

| Aspect | Manual Trading | Automated Trading |

| Primary Stressor | Acute, real-time performance of individual trades. | Chronic, strategic performance of the entire system. |

| Key Emotion | Fear/greed related to immediate profit and loss. | Doubt/anxiety related to system validity during drawdowns. |

| Cognitive Task | Real-time chart analysis, pattern recognition, and manual execution. | Statistical performance analysis, system diagnostics, and parameter optimization. |

| Common Mistake | Impulsive, emotionally-driven decisions (e.g., revenge trading). | Premature manual intervention or "tinkering" with a working system. |

| Time Horizon of Focus | Immediate (seconds to hours). | Long-term (weeks to months), focused on statistical expectancy. |

As the table illustrates, automation doesn't eliminate psychological challenges; it transforms them. It shifts your role from a hands-on technician stressed by every price movement to a disciplined, data-driven system manager focused on long-term performance.

Can an EA Execute Trades Faster and More Precisely Than You Can?

For an automated strategy to succeed, its theoretical edge must survive the chaotic reality of the live market. This is where performance is measured in milliseconds, and two factors become paramount: latency and slippage.

Latency is the time lag, measured in milliseconds (ms), between the moment you send an order and the moment it's executed by your broker. This delay is influenced by the physical distance to your broker's servers and the quality of your connection.

Slippage is the direct financial consequence of latency. It's the difference between the price you expect and the price you get. During volatile moments, prices can change multiple times per second. If your order is delayed by even a fraction of a second, the price may have moved against you, resulting in negative slippage, a direct and tangible cost that erodes your profits.

A human trader clicking a mouse is subject to both their own reaction time and the latency of their home internet connection (often 200-800ms). An EA running on a professional Virtual Private Server (VPS) co-located with the broker's servers can slash this latency to under 30ms.

This isn't just a marginal improvement; it's a game-changer. For strategies like scalping, which aim to capture tiny price movements, this millisecond advantage is the difference between profitability and consistent losses. An EA can execute with a speed and precision that is physically impossible for a human, ensuring your strategy is implemented as designed, without the hidden tax of execution delays.

What's the Process for Automating Your Existing Trading Strategy?

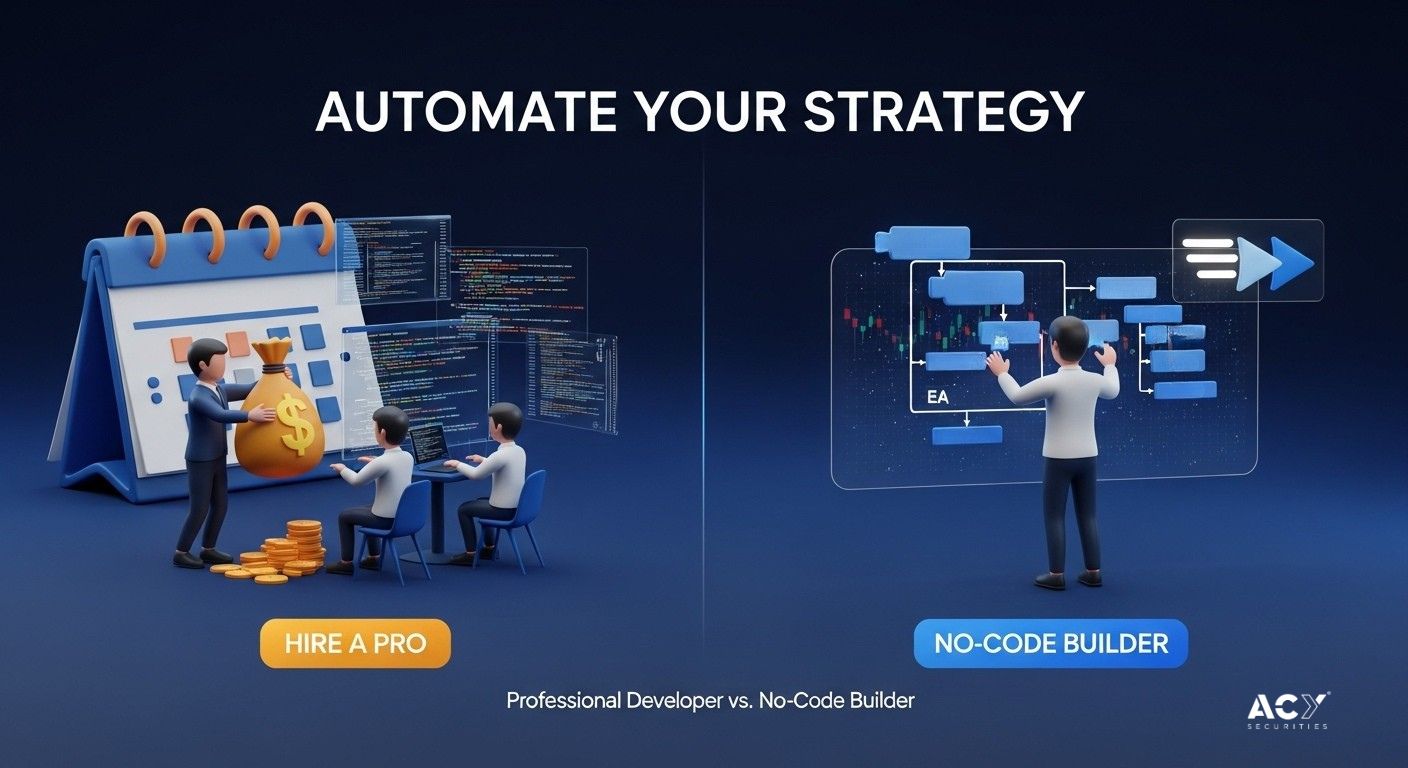

Once you have a defined, rule-based strategy, the next step is translating it into a functional Expert Advisor. You have two primary pathways:

Pathway 1: Hiring a Professional MQL Developer

This is the best route for complex or unique strategies. You meticulously document your strategy's logic and hire a programmer from a platform like the MQL5 Freelance market or Upwork to code it for you.

- Pros: Unlimited customization and professionally written, efficient code.

- Cons: High cost (from a few hundred to several thousand dollars), time-consuming, and dependent on finding a quality developer.

Pathway 2: Using a No-Code/Low-Code EA Builder

These are web-based platforms that allow you to create EAs using a visual, drag-and-drop interface without writing any code. You select indicators, define your rules, and the platform generates the MQL code for you.

- Pros: Low cost (many have free tiers), fast prototyping, and accessible to non-programmers.

- Cons: May be limited in complexity compared to custom coding and the machine-generated code can sometimes be less efficient.

| Criteria | Hiring a Professional Developer | Using a No-Code EA Builder |

| Cost | High initial investment ($250 - $10,000+). | Low to zero initial cost (Freemium or subscription model, ~$100/year). |

| Speed | Slow (Days to weeks). | Fast (Minutes to hours). |

| Complexity | Virtually unlimited. | Limited to platform's features. |

| Required Skillset | Detailed strategy specification. | Basic trading logic; no coding skills. |

| Maintenance | Requires re-hiring the developer. | User can easily modify and re-generate. |

The Tim Ferriss Angle: Automating Your Way to a "4-Hour" Trading Week

Tim Ferriss, in his seminal book The 4-Hour Workweek, champions the concepts of lifestyle design, automation, and effectiveness. He asks a powerful question: "How can you separate your income from your time?" For a Forex trader, an Expert Advisor is a direct and powerful answer to this question.

Applying Ferriss's principles to trading reveals a profound synergy:

Elimination: Ferriss argues for eliminating tasks that are time-consuming and have low impact. Manual trade execution is a prime candidate. It's a repetitive, rule-based task that consumes immense mental energy and time. An EA eliminates this task entirely.

Automation: This is the core principle. Just as Ferriss advocates for automating business processes, an EA automates the "process" of your trading strategy. It works for you 24/7, freeing you from the "work" of watching charts.

- Liberation: The ultimate goal is liberation, reclaiming your time and location to live a richer life. By automating, you are no longer tied to your screen during specific market sessions. You can manage your system from anywhere in the world in just a fraction of the time, achieving the location-independent lifestyle many traders seek.

A Forex EA is the ultimate tool for applying the 80/20 principle (Pareto's Law) to your trading. You front-load the 20% of the work, developing and testing a robust strategy, and then automate the 80% of the execution, yielding potentially better and far less stressful results.

Starting with "Why": 10 Lessons from Simon Sinek for the Automated Trader

Simon Sinek's "Start with Why" teaches that the most successful organizations and leaders think, act, and communicate from the inside out, starting with their purpose. Applying this to trading transforms your approach to automation.

Your "Why" for using an EA shouldn't just be "to make more money." A more powerful "Why" is: "To execute my trading edge with perfect discipline and consistency, freeing my time and mental energy to focus on higher-level strategic thinking and a balanced life."

Here are 10 lessons from this philosophy:

- Your "Why" is Discipline: You use an EA because you want to remove emotion and enforce unwavering discipline.

- Your "How" is the Strategy: How you achieve this is through a clearly defined, rule-based trading strategy.

- Your "What" is the EA: The Expert Advisor is simply the end product, the tool that executes your "Why."

- Clarity of Purpose Prevents Tinkering: When you are clear on why you are automating (to enforce discipline), you are less likely to manually interfere during a drawdown.

- Discipline is More Important than Genius: Sinek emphasizes consistency. A simple strategy executed with perfect consistency by an EA is superior to a brilliant strategy executed poorly by an emotional human.

- The Golden Circle of Trust: You must trust your system. This trust is built by understanding your "Why" and rigorously backtesting your "How."

- Find a Broker that Believes What You Believe: Partner with a broker whose "Why" is to empower systematic traders with superior infrastructure, not just to profit from churn. This is why ACY Securities' focus on low-latency execution and providing powerful tools is so critical.

- Communicate from the Inside Out: When evaluating an EA, start by asking why it was designed that way (its core logic), not just what its backtest results are.

- The Tipping Point is Confidence: You will only "go live" with confidence when you are fully aligned with the "Why" behind your automated system.

- Your Legacy is Your System: As an automated trader, you are not just making trades; you are building a system. This system is the tangible result of your philosophy and research.

The "Free EA" Fallacy: Uncovering Hidden Dangers and Red Flags

In the world of retail Forex, the promise of a "free" EA that generates automated profits is a powerful marketing lure. However, discussions on platforms like Reddit are filled with cautionary tales from traders whose accounts were decimated by these tools.

The reason is that most free EAs are built on one of three dangerous strategies:

Martingale: Doubles the position size after every loss. A statistically inevitable losing streak will cause the position size to grow exponentially, leading to a margin call and a total loss of your account.

Grid Trading: Places a series of orders around a price without stop-losses. A strong, sustained trend will accumulate a massive floating loss, wiping out the account.

- High-Frequency Scalping: These EAs are hyper-sensitive to spreads and latency. A backtest may look incredible, but in a live environment, normal trading costs can turn it into a consistent loser.

These strategies are designed to produce a deceptively smooth backtest, but they are ticking time bombs. Before you lose money, it's crucial to understand the 5 red flags and how to spot a scam Forex Expert Advisor. The "free" EA is often the single most expensive mistake a new trader can make, with the hidden cost being their entire trading capital.

The Superior Path: Why Tools Are Better Than Black Boxes

The failure of "black box" EAs doesn't invalidate automation. It highlights the need for a paradigm shift: from searching for a magic robot to leveraging high-quality tools that empower you to automate your own strategy.

Instead of a rigid, pre-packaged EA, a more effective approach is to use a combination of flexible and transparent tools. If you can't afford a premium EA, there are 3 powerful alternatives for hands-free trading, such as:

Multi-Timeframe Indicators: These tools display indicator readings from multiple timeframes on a single chart, allowing you to instantly see if your short-term setup aligns with the broader market trend, filtering out low-probability trades.

Multi-Strategy EA Builders: Simple, often free, programs that let you build your own EA without code by combining different indicators and rules, creating a nuanced and robust automated system.

- Simple Trend-Following Indicators: Tools designed to do one job perfectly: display a clear, unambiguous visual signal of the dominant market direction, ensuring you are consistently trading with momentum.

This "tools-first" approach puts you in control, fostering skill, transparency, and long-term resilience.

How Much Time Do You Actually Save by Using a Forex EA?

By comparing the typical time commitment of a dedicated manual trader with the revised workflow of a system overseer, a clear picture of the efficiency gains emerges.

- Manual Trading: A dedicated manual trader can easily spend 20 to 30 hours per week in front of the screen, conducting analysis, monitoring positions, and executing trades.

- Automated Trading: The workflow shifts to oversight. This involves a daily check of about 30-60 minutes and a more in-depth weekly review of 4-8 hours. The total commitment is around ~11 hours per week.

This reveals a net time saving of 9 to 19 hours per week of active, high-stress screen time. This is time you can reallocate to researching new strategies, professional pursuits, or simply living your life, preventing the very burnout you sought to escape.

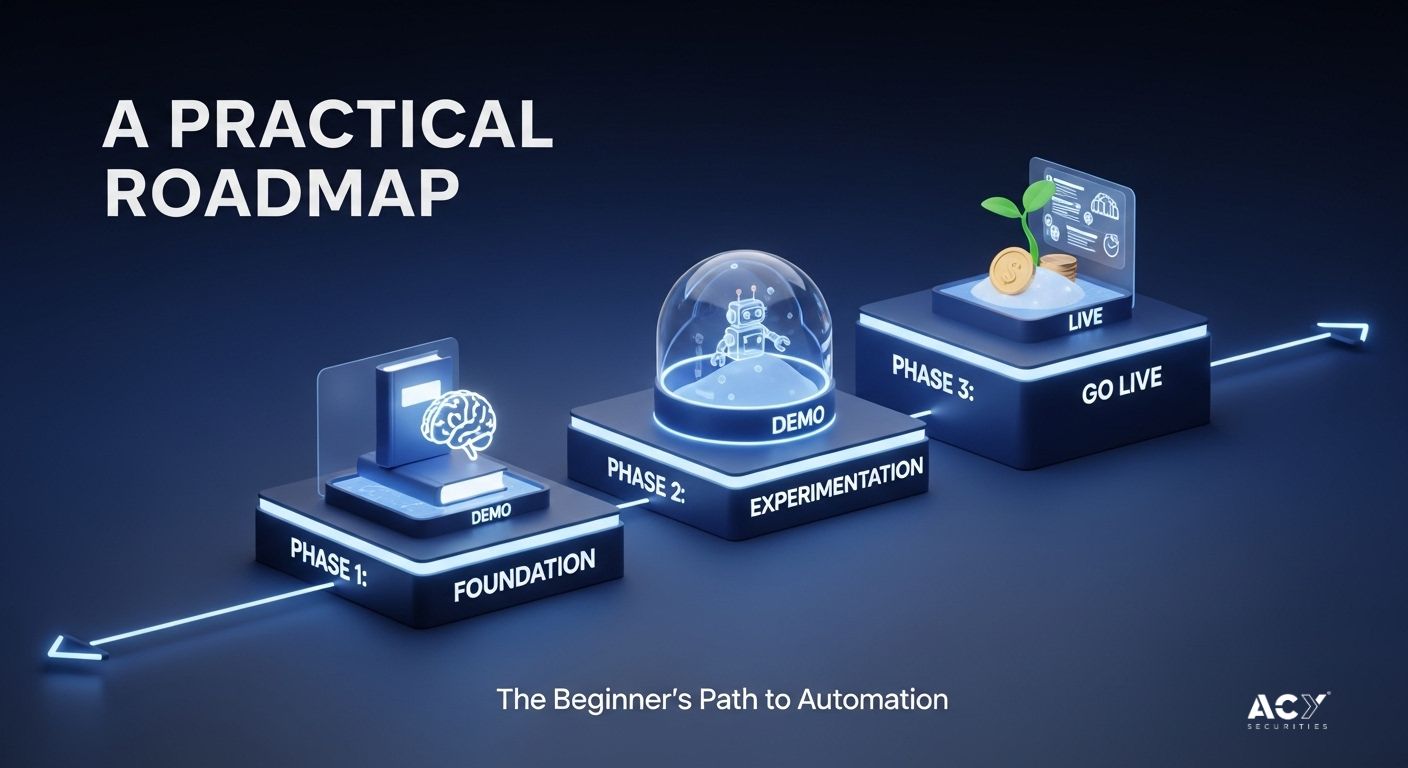

A Practical Roadmap: How Beginners Can Start with Automation

The transition to automated trading should be a methodical process, not a leap of faith. Here is a strategic roadmap that prioritizes education and risk management.

Phase 1: Foundation First (3-6 Months): Focus 100% on education. Learn analysis, master risk management, and practice on a demo account to gain an intuitive feel for the market without risking real capital.

Phase 2: Controlled Experimentation (3-6 Months): Now, begin exploring the free tools and simple EAs described above, exclusively on a demo account. The goal is to learn the mechanics of automation in a safe environment. This is the perfect stage for beginners to learn how to use an Expert Advisor to conquer fear and greed.

- Phase 3: Go Live with Caution: Only after achieving consistent profitability on a demo account should you consider real money. Even then, it is crucial to understand how to trade Forex with a small account using an Expert Advisor, starting with minimal capital risk and treating the necessary VPS subscription as a non-negotiable business expense.

The Final Piece: Why Your Broker Is Your Most Important Partner

The success of your EA is critically dependent on the quality of the trading environment. An EA is only as effective as the infrastructure that supports it. This is where the ACY.com ecosystem establishes itself as the premier choice for traders serious about automation.

| Feature | ACY.com Offering | Why It's Critical for EA Success |

| Execution Speed | Under 30ms | Minimizes slippage, protecting the EA's statistical edge. |

| Spreads | From 0.0 pips | Drastically reduces transaction costs, vital for high-frequency strategies. |

| VPS Hosting | Free for qualified clients | Ensures 24/7 uptime and a stable, low-latency connection. |

| Automation Tools | Capitalise.ai & Free Scripts | Lowers the barrier to entry for building custom strategies without code. |

| Minimum Deposit | $50 | Allows for live testing of EAs with minimal capital risk. |

| Regulation | ASIC Regulated | Provides a secure and transparent trading environment. |

By providing institutional-grade infrastructure and empowering tools within an accessible framework, ACY.com demonstrates a deep understanding of what automated traders need to succeed. Their educational content guides traders toward reputable third-party tool providers like TradingByte, reinforcing a client-centric model focused on empowerment over empty promises.

Conclusion: Escaping the Grind Through Systematic Trading

Escaping the 24/7 market grind is an achievable goal, but it is not accomplished by finding a mythical, self-trading robot. It is achieved by adopting a professional, systematic approach. This requires a paradigm shift: from being a discretionary, emotionally-driven participant to becoming a disciplined, data-driven system architect.

The path is clear:

- Build a foundation of trading knowledge.

- Reject "black box" EAs in favor of transparent tools that automate your own validated strategy.

- Deploy your system within a high-performance ecosystem that gives it the best possible chance of success.

By combining personal skill development with a superior technological environment like that offered by ACY Securities, you can finally reduce your trading stress, reclaim your time, and achieve a more sustainable and systematic form of trading.

Frequently Asked Questions (FAQ)

1. Can a Forex EA really eliminate trading emotions like fear and greed?

An EA eliminates emotion from the execution of trades. The algorithm itself feels no fear or greed. However, the emotions are transferred to you at a higher, systemic level, anxiety about a system-wide drawdown or greed to increase risk on a "hot" system. A successful automated trader must develop the psychological discipline to trust their system and avoid manual intervention.

2. How much does it cost to get started with an Expert Advisor?

The cost varies dramatically. Hiring a developer for a custom EA can cost $250 to over $10,000. Using a no-code EA builder is much more accessible, with many offering free plans or affordable subscriptions around $100/year. Remember to factor in the non-negotiable cost of a VPS, which can be 300 - 600 annually, though brokers like ACY Securities offer it for free to qualified clients.

3. Is it possible for an EA to suddenly stop working?

Yes. An EA's performance can degrade if the market regime it was designed for changes. This is why ongoing monitoring and periodic re-optimization are crucial. It's not a "set-and-forget" solution but requires you to act as a system manager, ensuring the strategy's logic remains valid in current market conditions.

4. Do I need to know how to code to use a Forex EA?

No. While coding your own EA in MQL4 or MQL5 offers the most flexibility, it's not a requirement. You can hire a developer to code your strategy for you, or use no-code platforms like EA builders or Capitalise.ai to automate your strategy using a simple graphical interface or plain English commands.

5. What is the single biggest mistake beginners make with EAs?

The biggest mistake is believing the marketing hype of a "free" or cheap "black box" EA and deploying it with significant real money without understanding its underlying strategy. These EAs often use dangerous risk management (like Martingale) that is statistically guaranteed to blow up an account. The correct approach is to start with education, test extensively on a demo account, and only go live with a system you thoroughly understand and with capital you can afford to risk.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.