EUR/USD & GBP/USD Scenarios to Watch: Technical Outlook Ahead of Core PCE and GDP

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

- Euro and Pound broke out of multi-week ranges, riding smart money flows and dollar (DXY) weakness as both pairs push into premium levels.

- Ceasefire talks and weak U.S. data fueled the rally, but upcoming high-impact U.S. releases could shift momentum.

- As long as 1.1600 (EUR/USD) and 1.3650 (GBP/USD) hold, bulls remain in control, but any strong dollar print may flip the bias.

Euro & Pound on Parabolic

Both the euro and pound have aggressively broken out of multi-day consolidation ranges, driven by a combination of dollar softness and bullish technical confirmations. This forecast was outlined previously in my weekly gameplan: Forex, Indices, Gold Weekly Gameplan: Technical Analysis & Price Action Outlook. Make sure to check this out for reference.

- EUR/USD cleared a key high after the Monday candle broke through the range and reclaiming imbalance between 1.15075-1.15139 Fair Value Gap.

- GBP/USD also created a strong momentum, mirroring the Euro move, since they are high correlated, after sweeping the lows on Monday.

In both cases, the market has moved from accumulation to expansion, signaling a potential shift to trend continuation phases. These moves follow textbook Smart Money Concepts (SMC): liquidity sweep → FVG retest → bullish continuation. With the dollar weakening across the board, both pairs are now in a parabolic move with potential new highs in sight.

Geopolitical Relief Boosts Risk Sentiment

- A tentative ceasefire between Israel and Iran remains intact as of June 26, although initial violations have been reported. Markets have interpreted the calm as a positive, with risk assets rallying and the USD losing some safe-haven demand.

- President Trump confirmed U.S.–Iran talks are expected next week, which may ease investor concern over prolonged geopolitical instability.

Market Reaction

The weaker data and the de-escalation in the Middle East have combined to pull Treasury yields lower and support risk-on flows. EUR/USD and GBP/USD responded accordingly, with breakouts from range highs confirming trend acceleration. Traders are now pricing in a greater chance of Fed rate cuts this year, further weighing on the greenback.

Technical Outlook

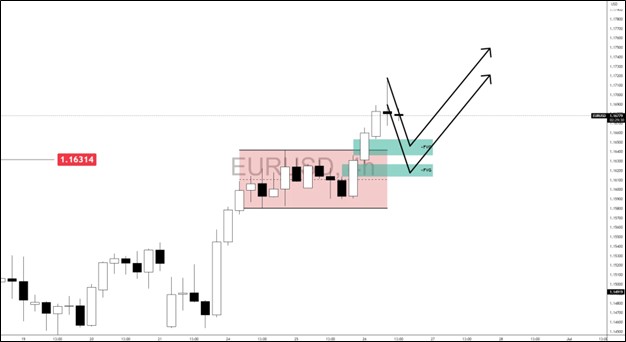

EUR/USD Bullish Scenario

Euro is still on a strong parabolic to the upside with a new range being broken for a bullish continuation after taking out the 1.16314 level.

This momentum left 2 bullish imbalances that could be an entry level for upside continuation.

As long as we stay above the range and the 2 bullish Fair Value Gaps remain intact we could see strength to be intact.

Dollar weakness would also translate to more upside on Euro.

- 1st Layer FVG - 1.16359-1.16533 + 1.1640 Support Level

- 2nd Layer FVG - 1.16135-1.16270 + 61.8%-79% Discount Level

Targets:

- Psych Levels - 1.175-1.180

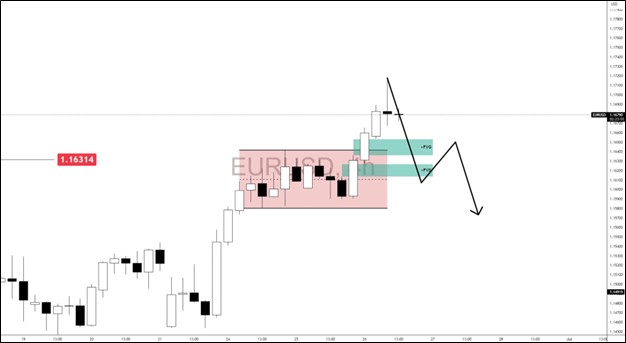

EUR/USD Bearish Scenario

Upcoming U.S. data releases could temporarily cap Euro momentum if the figures come in stronger-than-expected posing risk for Euro and bolster the dollar.

If the imbalances get invalidated by push thru and closing below, Euro might continue to pullback to a more discounted level to 1.1550 level.

Another risk for Euro is if the immediate low resting at 1.1580 level gets invalidated.

Target/s:

- 1.1550 Level

- 1.1500 Level

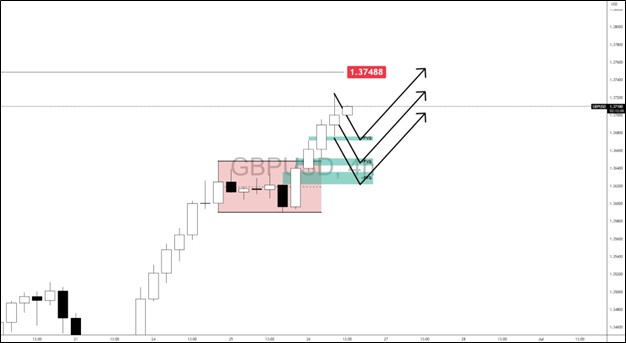

GBP/USD Bullish Scenario

Pound has now broken out of the previous consolidation with 1.37488 level in sight. There are still no signs of weakness and we could see new highs on the horizon.

As long as we stay above the range and not closing below the low of the range, we could see strength to remain for new upside.

- 1st Layer FVG - 1.36712-1.36763

- 2nd Layer FVG - 1.36431-1.36513

- 3rd Layer FVG - 1.36216-1.36362 (Last Line of Defense)

Target/s:

- 1.3750 Level

- 1.3800 Level

GBP/USD Bearish Scenario

If price creates a bearish sequence or a series of lower high and lower lows while taking out the FVGs this could pose risk on pound for downside move.

Ultimately, an invalidation of 1.359-1.360 level could pave way for a reversal to the downside move.

Target/s:

- 1.362 Level

- 1.360 Level

- 1.359 Level

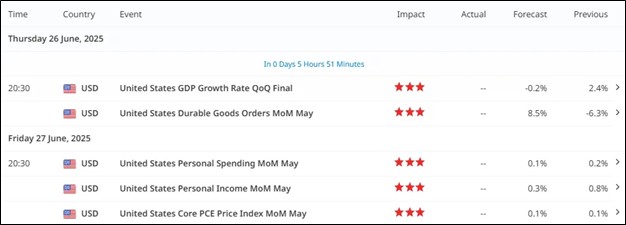

Incoming High Impact News

All eyes are on upcoming Red Folder U.S. data that could shake up the dollar narrative and impact both Euro and Pound pairs.

These data points have the potential to either confirm the breakout momentum or completely reverse it. Expect volatility and plan scenarios accordingly.

Check Out My Contents:

Strategies That You Can Use:

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How To Trade News:

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices:

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold:

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.