.jpg&w=3840&q=75)

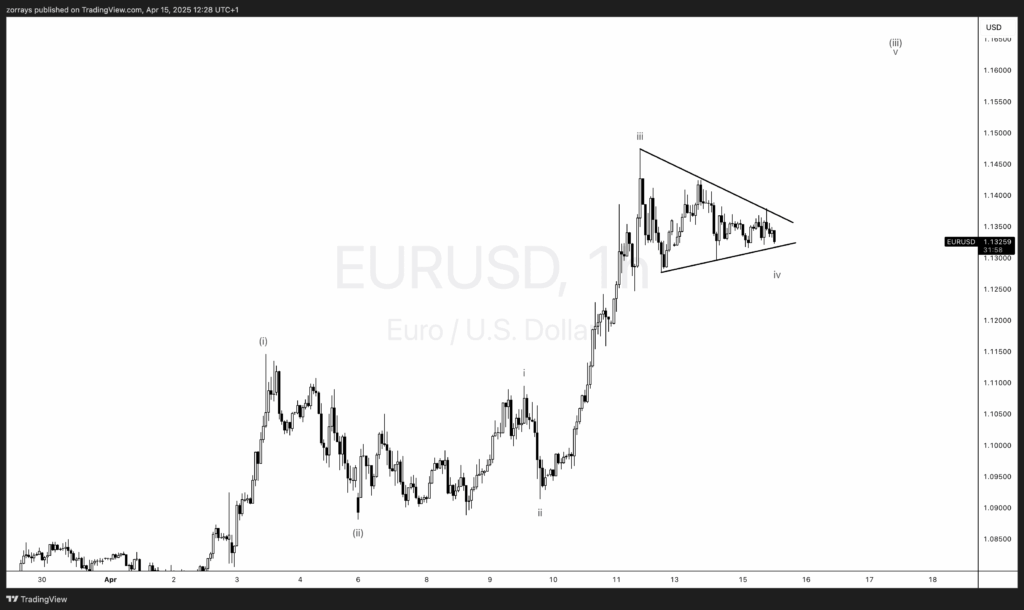

EUR/USD Coils in Wave iv Triangle, Eyes Breakout in Wave v

EUR/USD Consolidates Within Classic Elliott Wave Structure

EUR/USD is setting up for a potential bullish breakout as the pair carves out a textbook Wave iv triangle formation. The pair currently trades near 1.1325, having cooled off from its impulsive Wave iii high, and now compresses in a symmetrical triangle—typical of a fourth wave consolidation.

Wave Count Breakdown (1H Chart)

- Wave (i) and (ii) completed earlier this month, forming the base structure.

- The impulsive surge from April 10–12 forms a clear Wave iii, characterized by strong momentum and large-range candles.

- The current price action is confined within converging trendlines—a contracting triangle—labelled as Wave iv.

- A clean breakout above triangle resistance (~1.1380) would likely confirm the beginning of Wave v, targeting new highs possibly near 1.1550–1.1600, where higher-degree Wave (iii) may complete.

Key Technical Levels

| Support | Resistance | Wave Invalidation |

|---|---|---|

| 1.1300 | 1.1380 | Below 1.1250 (Wave i territory) |

- As per Elliott Wave guidelines, Wave iv must not overlap Wave i, keeping 1.1250 as the invalidation level for this bullish scenario.

Outlook

A breakout from the current consolidation would mark the start of Wave v, completing the five-wave sequence of Minute Wave (iii). The pattern favors the bulls, but confirmation is key.

Watch for:

- A decisive breakout above triangle resistance with volume

- Retest and hold of 1.1300 as support if the triangle resolves upward

Until the pattern resolves, patience remains the best approach.

For educational purposes only. Trading comes with substantial risk, leading to possible loss of your capital. Traders are advised to do their own due diligence before investing.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.