EUR/USD Forecast: Bullish Breakout Targets 1.1830 as Dollar Weakness Deepens

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita- EUR/USD confirms breakout structure, reclaiming key resistance as price aims for 1.1830 with bullish momentum intact.

- Dollar weakness accelerates euro strength, as DXY breaks below 98.00 and markets fully price in a Fed pause through Q3.

- Key decision point at H4 Fair Value Gap, with bullish scenario targeting 1.1900 and bearish case watching 1.1700 breakdown on USD strength.

Euro Poised for New Highs

Previous Forecast: Weekly Forecast: Nasdaq & S&P 500 Hit All-Time Highs, XRP Leads Crypto Breakout, Gold Eyes $3,400

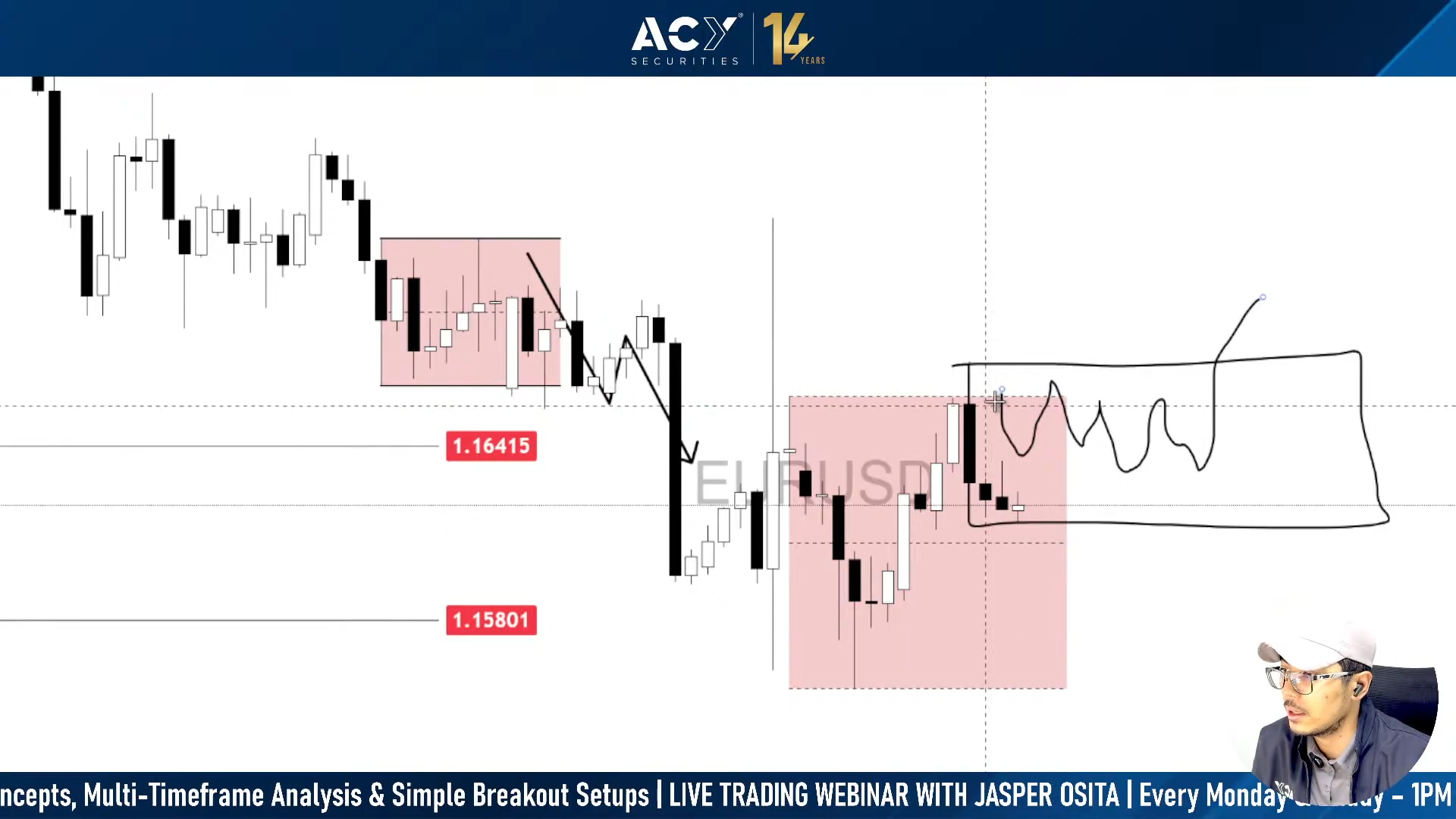

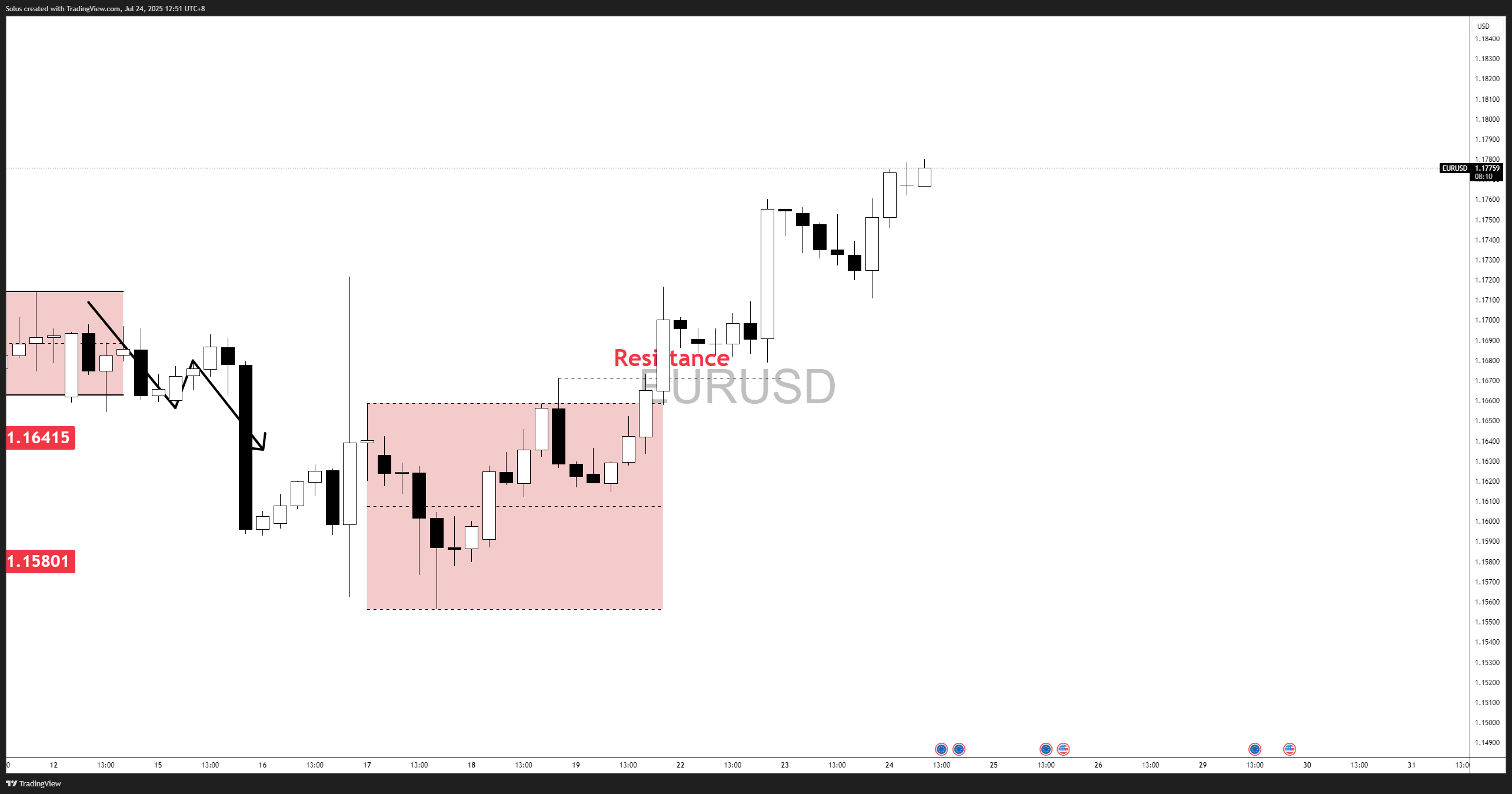

EUR/USD has successfully followed through on the bullish accumulation structure discussed earlier this week. Coming from a continuous trend to the downside, EUR/USD cooled down after a spike last Wednesday, July 16. The accumulation showed signs of bullish traction as it trades above the 50% of the range or the equilibrium level.

On Monday, as forecasted:

- Price broke above resistance near 1.1700–1.1720

- Sustained higher closes now validate a shift in structure

- Price is now aiming toward the 1.1830 target

Dollar Weakness Bolstered Euro Strength

The rally is driven largely by dollar weakness, as the U.S. Dollar Index (DXY) broke structure to the downside after rejecting 98.90 last week. Markets are increasingly pricing out any Fed rate hikes, and recent soft CPI and housing data have further tilted expectations toward a dovish Q3.

Checkout the previous forecast here: Dollar Forecast: US Dollar Fails to Hold 99.00 – Sinks Below 98.00 - What’s Next?

Meanwhile, the Euro has been supported by:

- Easing concerns over ECB cuts as euro strength cools from earlier highs

- Trade deal optimism between the EU and the U.S.

- Technical breakout from accumulation range after retesting broken resistance

Fundamental Highlights Behind the Move

- USD Weakness Deepens: The DXY broke below the 98.00 zone, triggering bearish flows and propping up the euro.

- Fed Pause Priced In: Traders are now betting that the Fed will stay on hold through Q3 2025.

- ECB Stays Flexible: The euro’s cooldown from multi-month highs gives the ECB room to hold steady. Policymakers noted inflation is easing “in line with projections,” reducing urgency for rate cuts.

Technical Outlook

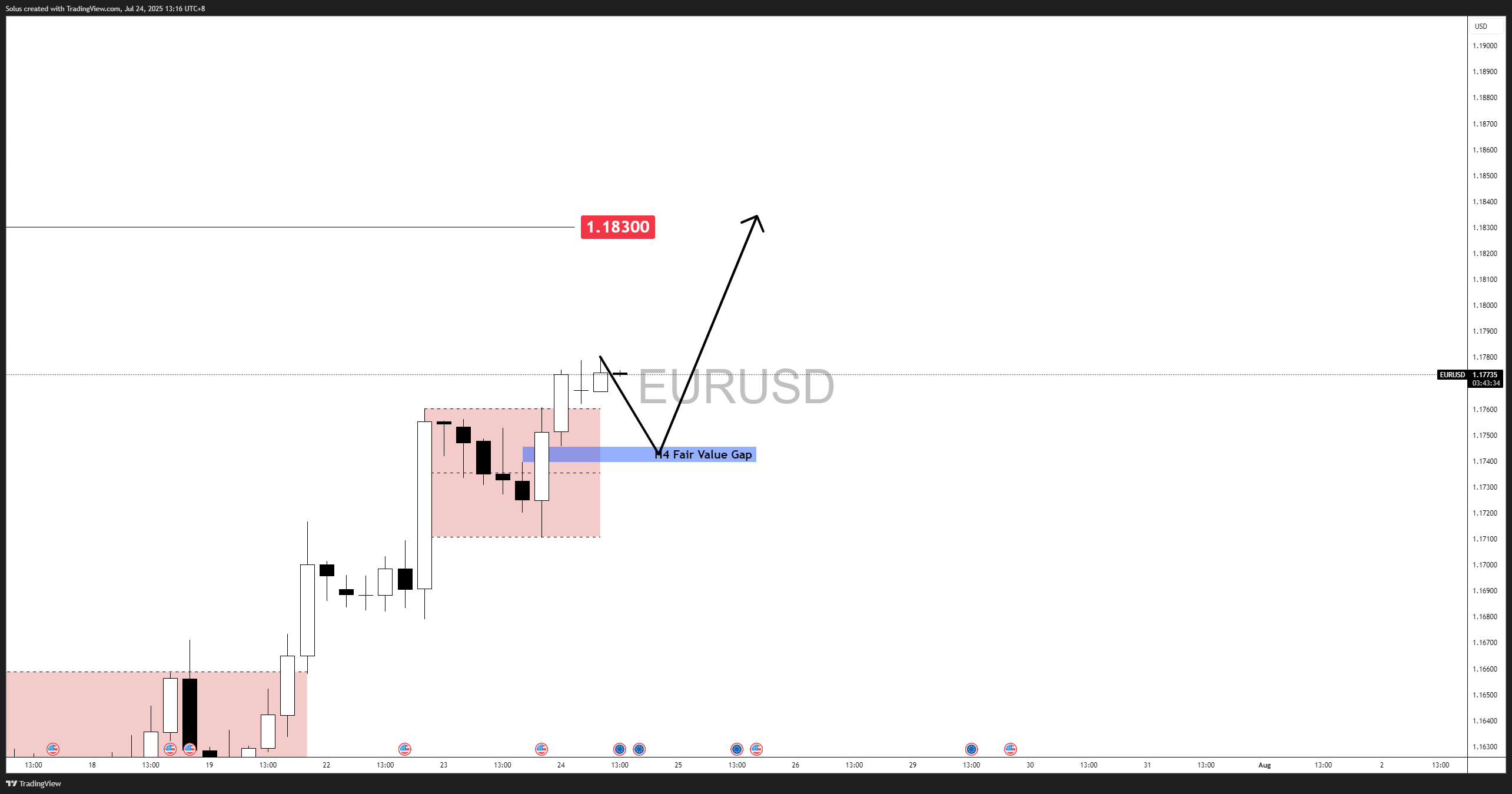

As EUR/USD breaks above its multi-day highs and forms a Fair Value Gap (FVG) on the H4 chart, we’re now entering a potential decision point: Will the pair continue toward 1.1830 or reject from premium pricing?

Bullish Scenario: FVG Reclaim and Continuation to 1.1830

In this scenario, EUR/USD respects the newly formed H4 Fair Value Gap and shows a reaction from the 1.17395–1.17457 zone. Price could pull back into the FVG, rebalance, and continue its upside momentum toward the psychological target at 1.1830. Euro would continue to push up as long as:

- DXY Continues Lower: If the U.S. Dollar Index weakens further (e.g. drops below 97.80), EUR/USD is likely to gain strength and push higher.

- Fed Pause Narrative: Any dovish commentary or weak U.S. economic data (like soft PCE or GDP) can drive more downside in the dollar.

- ECB Neutral to Hawkish Tone: If the ECB avoids dovish guidance and inflation stabilizes, the euro could remain supported.

- 1.1800 Break: Euro could move further to the upside if the 1.1800 zone gets invalidated.

Targets:

- Immediate: 1.1830 (short-term resistance)

- Extended: 1.1900–1.1950 if dollar weakness persists

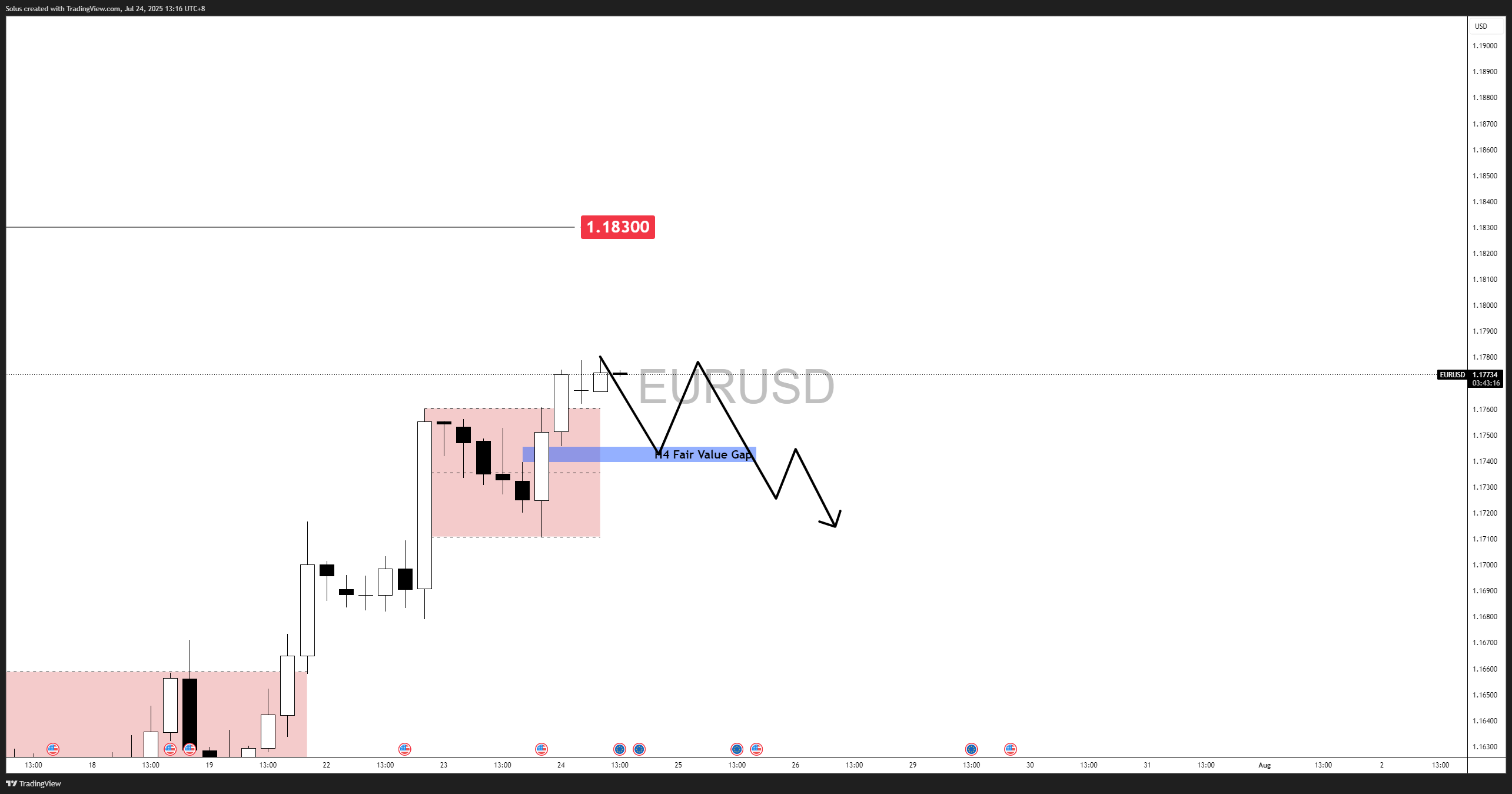

Bearish Scenario: FVG Breakdown and Shift in Structure

In the bearish case, EUR/USD may fail to hold the FVG as support. Instead of a bounce, price could consolidate, then break down, signaling distribution at premium prices. This would confirm a short-term reversal and set the stage for a move back toward the 1.1650 zone. Weakness would increase if:

- USD Rebounds on Strong Data: A strong PCE inflation print or surprise in GDP/NFP could cause a sharp dollar recovery.

- Hawkish Fed Shift: Fed speakers hinting at renewed tightening or pushback against market pricing could reinforce USD strength.

- Risk-Off Sentiment Returns: If equity markets turn lower or geopolitical tensions rise, dollar may regain safe-haven flows.

- 1.1700 Last Line of Defense: Renewed weakness maybe underway if Euro proceeds to lose steam and break the previous support level.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.