EUR/USD: The Rally Hits Resistance Amid Shifting ECB Rhetoric

ACY Securities - Luca Santos

ACY Securities - Luca SantosI've been closely tracking the EUR/USD pair lately, especially after the European Central Bank’s recent tone shift. It’s fascinating to see how market expectations have evolved from no hikes at all this year to pricing in a December move. But let’s take a step back.

Last week, President Lagarde hinted at a more aggressive stance, suggesting inflation could stabilize around 2%.

That pivot sparked a short-lived euro rally. But if you’ve been watching the markets like I have, you’ll notice that the momentum faded rather quickly. Why?

Well, ECB members have since been walking that back. Lagarde herself emphasized there’s "no need to rush to premature conclusions," and Villeroy de Galhau called market reactions “too high.”

That commentary was enough to push the 1-year forward OIS down by 12bps to 0.00% a sign that traders are starting to temper their rate hike bets again.

So where does this leave EUR/USD? We're now caught in a tug-of-war between tightening expectations and cautious ECB communication.

Unless inflation data forces their hand, I don’t expect a broad trend breakout soon.

Especially with 62% of December’s euro-area inflation tied to volatile categories like energy and food, the underlying core remains tame.

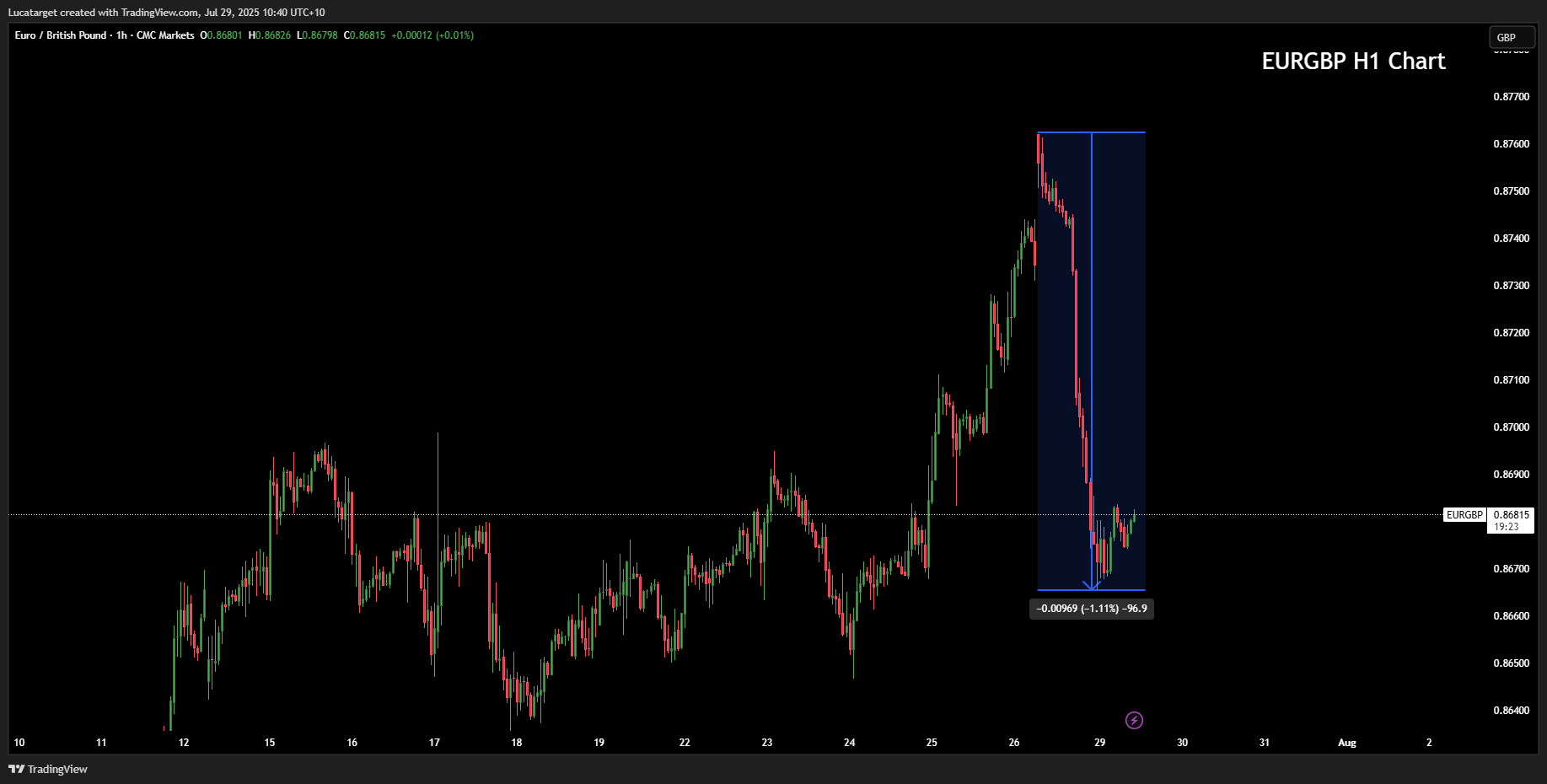

GBP: Is the BoE Hike Already Priced In?

If you were expecting fireworks after the Bank of England's rate hike, you probably felt let down. I know I did.

Despite a 25bps increase, GBP/USD actually slipped. And the pound lost over 1% against the euro. Why the underperformance?

The market had already priced in the move. More importantly, the details from the BoE’s Monetary Policy Report tell a more cautious story: tightening beyond current expectations could actually undershoot the inflation target.

This is a critical point for traders. It’s not just about whether a central bank is raising rates it’s about the trajectory and the messaging behind it.

Chief Economist Huw Pill’s speech (titled “UK Monetary Policy Outlook”) further drove home that excessive tightening isn’t warranted. That’s why we saw the 1-year forward GBP OIS fall 11bps last week.

So, while real yields still favor GBP/USD, broader growth risks like tax hikes and spiking energy bills are likely to limit upside potential. I’m staying nimble on this pair, especially ahead of upcoming UK retail and labor data.

In FX, narratives are changing fast. A central bank comment or a data surprise can reverse trends in a matter of hours.

That’s why I stay grounded in both fundamentals and sentiment shifts. Right now, it feels like the market is hunting for clarity in a fog of conflicting signals.

I’ll be keeping a close eye on upcoming inflation releases and central bank speeches this week particularly for signs that market pricing (especially in Europe and the UK) may be running ahead of policy reality.

Q1: Why did the EUR/USD rally stall after the ECB's hawkish comments?

Even though ECB President Lagarde signaled a shift toward tightening, subsequent comments from other officials dialed back expectations. This inconsistency reduced momentum, and the market started to doubt whether the ECB would follow through aggressively especially given that eurozone inflation is still largely driven by energy and food.

Q2: If the BoE raised rates, why did GBP weaken?

Markets had already priced in the BoE’s 25bps hike. More importantly, the Bank’s guidance emphasized that excessive tightening could actually harm the economy and undershoot inflation. This cautious tone weighed on the pound, despite a seemingly hawkish headline.

Q3: What does the BTP/Bund spread tell us about ECB policy risks?

The widening spread between Italian and German bonds (BTP/Bund) signals stress in the periphery. If it continues, it could pressure the ECB to slow or adjust its tightening plans to avoid fragmenting financial conditions across the eurozone.

Q4: How do real yield spreads influence currency pairs like GBP/USD?

In theory, higher real yields should support a currency. But in practice, broader economic concerns such as slowing growth, tax hikes, and energy costs can offset that support. That’s what’s happening with GBP/USD: strong real yields, weak price action.

Q5: What should traders focus on this week?

Stay alert for speeches by central bank officials (BoE, Fed, BoC), inflation data releases (especially in the US and eurozone), and geopolitical developments. Markets are highly reactive to shifts in forward guidance, and volatility can pick up quickly when expectations change.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.