.jpg&w=3840&q=75)

EURUSD Eyes Wave 4 Correction as Markets Brace for US GDP Print

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidAll eyes today are on the US Q1 GDP release, and it's looking like it might disappoint. Following yesterday’s much wider-than-expected goods trade deficit for March, economists have trimmed their forecasts, with consensus now at a slight contraction of -0.1% QoQ annualised. Our own team is aligned—there’s a solid chance we see a negative print.

But markets won’t just look at the headline. What matters is why growth slowed. A chunk of it might come from rising imports—possibly due to some front-loading ahead of potential tariff changes—rather than genuine weakness in consumption. So, even if GDP misses, a not-so-terrible personal spending number could soften the blow. That opens the door for some resilience in the dollar, despite the top-line negativity.

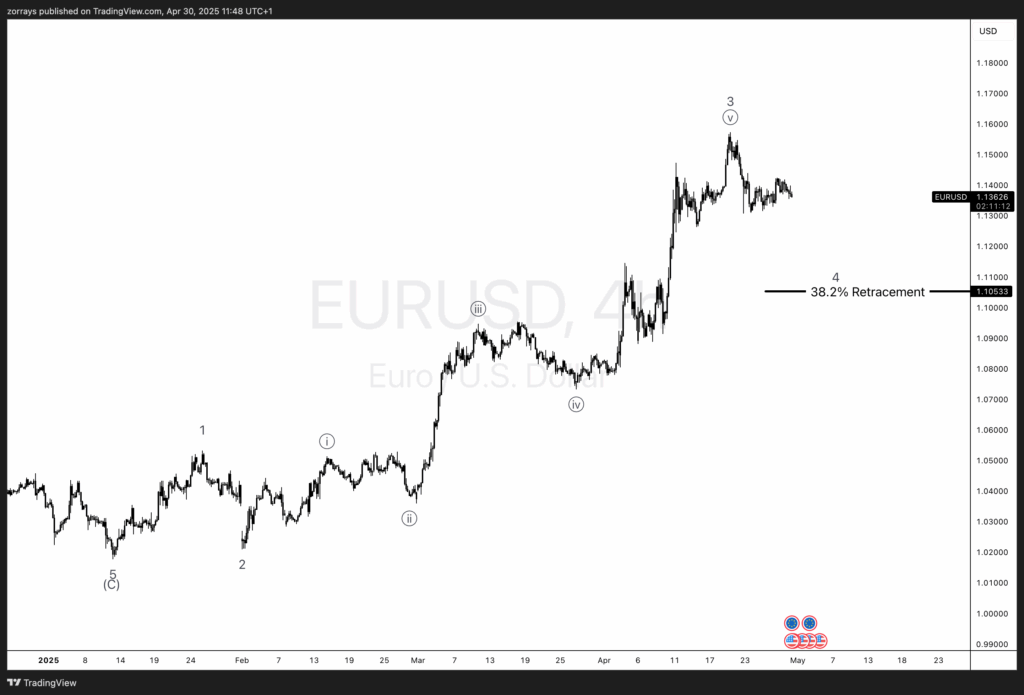

On the technical side, EURUSD is in a clean wave 4 correction following a strong move up in wave 3. The pair has stalled under the 1.1450 area and is starting to drift lower. A classic Elliott Wave guideline says wave 4 tends to retrace around 38.2% of wave 3, and that brings us right into the 1.1050 zone—which lines up with some solid confluence technically as well.

It might not get there in a straight line, but that area should be on the radar over the next few days to a week. If price does tag that 1.1050 level and finds support, it could set the stage for the next leg higher in wave 5.

Bottom line: With macro and technicals both aligning, today’s GDP data could help push EURUSD deeper into the wave 4 retracement—possibly down to 1.1050. That would offer a textbook setup for wave 5 buyers looking for the next bullish leg.

Disclaimer: Trading leveraged products carries a high level of risk and may result in losses exceeding your initial investment; ensure you fully understand the risks involved.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.