Fed Pause Sparks Relief Rally: How Dow, Nasdaq, and S&P 500 Are Reacting

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview:

The Federal Reserve’s rate pause has triggered a relief rally across major U.S. indices, with markets reassessing growth prospects amid persistent inflation concerns. While the Dow benefits from stability, the Nasdaq remains vulnerable to rate pressures, and the S&P 500 balances optimism with caution.

- Dow Jones (DJIA) – A Play on Stability

- Blue-chip stocks gained momentum as the Fed’s pause eased uncertainty.

- Industrials & financials held firm, benefiting from reduced rate fears.

- The Dow is positioned for steady growth in a high-rate environment.

- Nasdaq 100 (NDX) – Rate Pressures Remain

- Tech stocks still face borrowing cost challenges, limiting aggressive upside.

- Fed’s stance prevented a major sell-off, but sustained gains need rate-cut clarity.

- A breakout above key resistance could fuel further gains.

- S&P 500 (SPX) – Cautious Optimism

- The index rebounded after prior declines, supported by Fed stability.

- Higher-for-longer rates could weigh on growth sectors.

- Defensive plays like utilities & healthcare are seeing inflows amid uncertainty.

How the Fed Pause is Shaping U.S. Indices

On March 19, 2025, the Federal Open Market Committee (FOMC) released a statement detailing its monetary policy decisions and economic outlook. Check out this post for Fed details: ACY SecuritiesRate Pause: Fed Cautious, Foreign Pairs on the Move

Dow Jones (DJIA) – Stability Play

- Blue-chip stocks gained as the Fed’s pause reassured markets about economic resilience.

- Industrials & financials remain stable, benefiting from reduced rate uncertainty.

- The Dow is likely to outperform growth-heavy indices in a higher-rate environment.

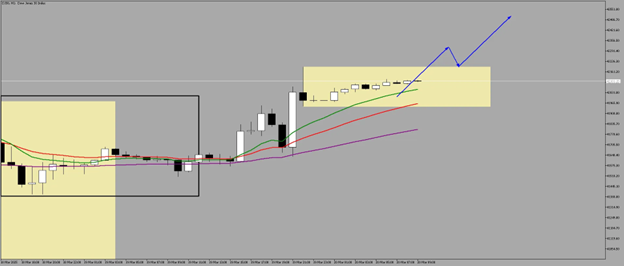

4-Hour

On the 4-hour timeframe, the Dow has been in a sustained recovery since March 13, following a breakout from the first consolidation zone.

It has also surpassed the previous range, signaling the potential for new highs.

Additionally, moving averages are reinforcing the uptrend, with price holding above them.

1-Hour

Potential Levels for Long

- Pullback Trade

- 41842.65 - 41944.64

- 61.8 - 70.5 Fibo Level

- MA 50 Support Level

- Breakout Trade

- 42191.95 Breakout Level

- 41944.75 Stop Level

Once price arrives on those levels, wait for sideways and range-breakout with stop loss behind the range.

Nasdaq 100 (NDX) – Tech Faces Challenges

- Tech stocks remain vulnerable as elevated rates continue to pressure borrowing costs.

- The Fed’s cautious stance kept bond yields steady, preventing a major sell-off.

- Growth stocks may struggle until rate cuts become more certain.

4-Hour

Nasdaq is picking up steam as its now near the breakout level of the current range with price trading above the moving averages.

A break of 19938 level could further trigger NAS for more upside as US stocks benefit with a Fed rate pause.

Potential Long Approach

1-Hour

- 19714.18 - 19665.15 Fair Value Gap Level

- 61.8 - 79.0 Fibo

- 50% Equilibrium / 50% Level of the Range

S&P 500 (SPX) – Cautious Optimism

- Stocks rebounded after recent declines, as the Fed did not signal immediate tightening.

- Higher-for-longer rates could weigh on high-growth sectors, but stability supports broader market sentiment.

- Defensive sectors like utilities and healthcare may see inflows if uncertainty persists.

4-Hour

S&P already broke out of the previous range with the current range testing the resistance.

Strength confluence is price is above the moving averages with potential upside continuation.

Potential Long Approach

1-Hour

Same idea with NAS and DOW:

- Pullback Trade

- 5671.37 - 5657.09

- 61.8 - 70.5 Fibo

- 50% Equilibrium Level

2. Breakout Trade

- 5715.79 Breakout Level

The Fed’s rate pause has provided short-term stability for the Dow, but its long-term outlook depends on inflation and future rate cuts. The Nasdaq remains high-risk, with potential upside if the Fed shifts toward easing. The S&P 500 is caught between bullish rate cut hopes and bearish inflation concerns, with defensive sectors leading for now.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.