Fed Signals Set the Stage for EUR/USD Upside Potential

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidWith markets seeing a steady decline in geopolitical tensions—most notably due to the Israeli-Iranian truce holding since yesterday—investor sentiment has turned decidedly optimistic. The once-feared risk premium in oil prices has already evaporated, indicating that traders are pricing in a sustained ceasefire. However, while the optimism is palpable, the durability of the ceasefire will remain under the microscope in the coming days.

USD Under Pressure: Geopolitics No Longer a Catalyst

The initial fallout of reduced geopolitical tension was clearly negative for the U.S. dollar, but this effect appears to have largely run its course. Moving forward, further dollar weakness would need to come from U.S.-centric developments—namely macroeconomic data, Federal Reserve policy, and political dynamics like Trump’s fiscal agenda and proposed tariffs.

Tuesday saw an intriguing mix of those domestic drivers at play. Consumer confidence took a surprise dip—unequivocally bearish for the dollar. But Fed Chair Jerome Powell’s testimony was more ambiguous. While he maintained a cautious tone on policy easing and pushed back against political influence, his openness to discussing rate cuts offered just enough dovish hint to stir the markets.

Fed Balancing Act: Independence vs. Dovish Lean

Markets, attuned to even the slightest signals, interpreted Powell’s words as a subtle dovish lean—especially after prior calls by Fed members Waller and Bowman for a July cut. This optimism was reflected in Treasury markets, which rallied, suggesting confidence that any forthcoming easing would not undermine Fed credibility.

Is this bearish for the dollar? Not necessarily.

If Powell manages to guide market expectations toward moderate easing without compromising the Fed’s perceived independence, the negative impact on the dollar could remain contained. In fact, a more balanced Fed could support the dollar through stabilizing Treasury yields, particularly longer-dated ones, which hold more weight in FX valuation than short-term spreads.

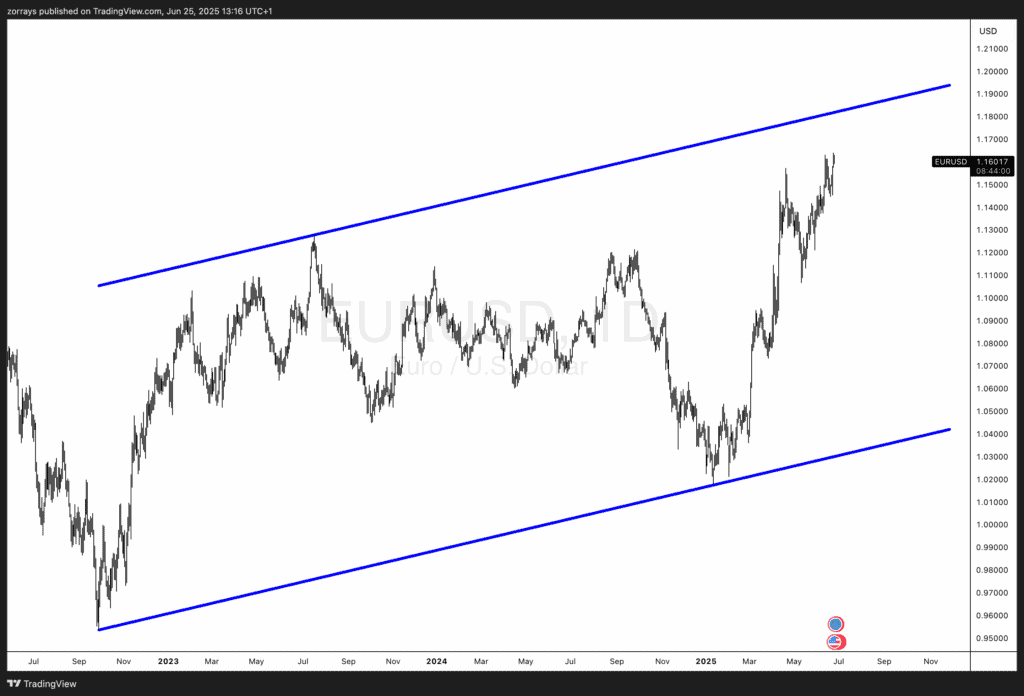

EUR/USD Technicals: Room to Climb Before Resistance

From a technical standpoint, the EUR/USD appears poised for further gains. As illustrated in the chart (see image), the pair is trading within a well-defined ascending channel, currently approaching the upper boundary near the 1.17 level. With strong momentum and little immediate resistance, the euro still has room to run.

However, breaking above the channel is another story—one that would require either a sharply dovish turn by the Fed or an unexpected negative shock to the dollar. Until then, the upper bound may act as a ceiling, inviting caution among bulls.

Looking Ahead: Powell Part Two and Housing Data

Today brings the second half of Powell’s congressional testimony, accompanied by U.S. housing data for May. While not market-moving in isolation, any dovish nuance in Powell’s remarks could extend dollar weakness. That said, some stabilization may occur as markets digest recent moves and reassess positioning.

Conclusion

With geopolitical fears receding and Powell walking a delicate line between caution and dovishness, the dollar finds itself on uncertain ground. Meanwhile, the euro is capitalizing on this ambiguity, buoyed by strong technical support and sentiment. As EUR/USD approaches the top of its channel, bulls may find more room to climb—but should be wary of overstaying the rally without a fundamental catalyst to break higher.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.