Federal Reserve Holds Rates at 4.25–4.50% as Two Governors Dissent

ACY Securities - Luca Santos

ACY Securities - Luca SantosOn July 30, 2025, the Federal Open Market Committee (FOMC) held the federal funds rate steady at 4.25%–4.50%, in line with broad market expectations.

This marks the third consecutive meeting without a rate change.

However, the vote wasn’t unanimous. Two members of the Board of Governors Michelle Bowman and Christopher Waller dissented, each favoring a 25 basis point cut.

It was the first time since 1993 that more than one governor dissented from the consensus.

In his post-decision comments, Chair Jerome Powell stated that current policy remains “modestly restrictive,” suggesting that interest rates are not holding back the economy inappropriately.

He reinforced the Fed’s data-dependent approach, noting that inflation is still running around 2.7%, and flagged that upcoming tariffs scheduled for August 1 could place additional upward pressure on prices.

Although the Fed did not explicitly commit to any future rate action, Powell left the door open for a cut later in the year if the economic data especially labor and inflation metrics support such a move.

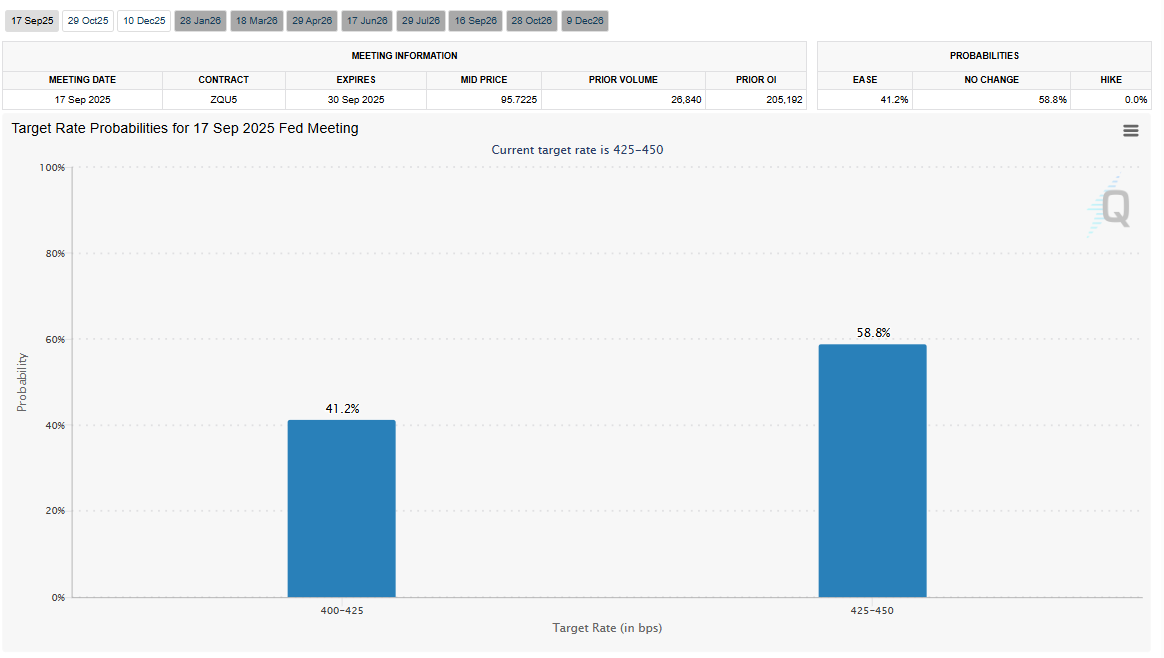

With the market pricing nearly a 50/50 change of no cuts for Sep 25

Dollar Strength Surges as FX Markets React

Markets moved decisively following the announcement. The U.S. Dollar Index (DXY) surged more than 2% on the week, supported by higher Treasury yields and a resilient macro backdrop.

EUR/USD was hit hard, falling from pre-FOMC levels near 1.1600 to around 1.1400 a 200-pip drop that reflects shifting interest rate expectations and diverging central bank paths.

Meanwhile, USD/JPY rallied sharply from 147.80 to as high as 149.50. The move was driven by the twin effects of a stronger dollar and continued yen weakness as the Bank of Japan holds firm on its accommodative stance.

These moves collectively signal that traders are repricing risk around the Fed’s renewed hawkish tone and the fading likelihood of an imminent rate cut. The well known Higher For Longer!

The Road Ahead: Jackson Hole, Inflation Data, and September Risk

Looking forward, the market’s focus now shifts to key incoming data. The August jobs report and CPI release will be crucial in shaping expectations ahead of the next FOMC meeting in September.

Chair Powell’s remarks at the Jackson Hole symposium in mid-August are also likely to be market-moving. Any shift in tone toward easing or further emphasis on staying the course will influence both yields and FX valuations.

The divergence between the Fed and other major central banks, particularly the European Central Bank and the Bank of Japan, is creating renewed momentum in favor of the dollar.

Traders are increasingly positioning for a continued carry environment, especially if the Fed holds rates steady through Q3.

The FOMC delivered no surprises on the rate decision itself, but the internal dissent and Powell’s reaffirmation of a “modestly restrictive” stance sent a clear signal: the Fed is not ready to pivot just yet. Despite political pressure and pockets of softness in the data, the Committee remains focused on inflation and macro resilience.

As the dollar reasserts its strength across major pairs, traders will be watching closely for signs of deceleration in core inflation or cracks in labor market resilience. Until then, the Fed’s steady hand may continue to dominate directional bias in FX.

1. Why did the Fed keep rates unchanged if inflation is still above 2%?

The Fed believes its current policy stance is “modestly restrictive,” meaning it's tight enough to keep inflation in check without stalling growth. Powell emphasized a data-dependent approach, allowing time to evaluate the impact of previous hikes.

2. What does dissent within the Fed mean for markets?

Dissent signals division within the Committee. When multiple governors vote against the majority, it suggests growing internal debate often a precursor to future policy shifts. In this case, two governors favoring a rate cut adds weight to dovish expectations later this year.

3. How does a steady Fed rate impact the U.S. dollar?

When the Fed holds rates steady while other central banks consider easing, it strengthens the dollar. The higher relative yield attracts capital inflows, which supports the USD across the board—as we saw with EUR/USD and USD/JPY post-decision.

4. What are the key dates to watch next?

Watch for the August nonfarm payrolls (NFP), the CPI inflation print, and Jerome Powell’s Jackson Hole speech in mid-August. These events will help shape expectations ahead of the September 17 FOMC meeting.

5. Could tariffs influence future rate decisions?

Yes. New tariffs, especially if inflationary, may force the Fed to hold off on cuts or even signal further tightening. However, if tariffs slow growth or hit consumer sentiment, they could support a policy shift toward easing.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.