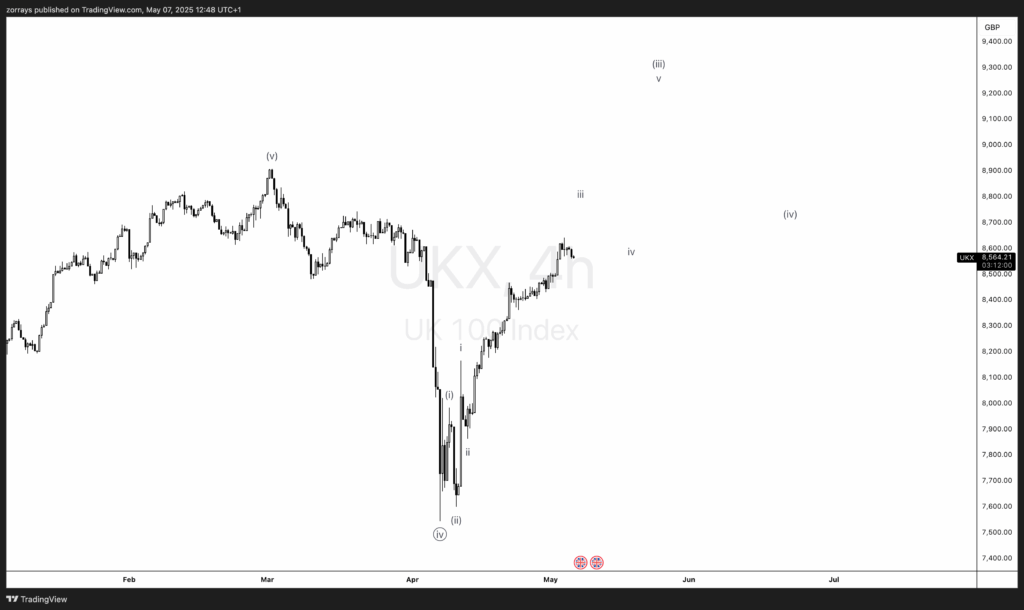

FTSE 100 Outlook: Bullish Momentum Building Toward Wave (iii) – Targeting 9300

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidThe FTSE 100 (UKX) continues to display impressive resilience, playing strongly to the upside and currently forming what appears to be a developing Elliott Wave (iii). Based on the chart structure, this third wave targets the 9300 level, aligning with typical wave extension characteristics in bullish impulsive structures.

Technical Analysis (Elliott Wave Perspective)

- The recent recovery off the lows in early April (labelled as wave (iv)) appears to have marked the beginning of a new five-wave impulse.

- Wave i, ii, and now iii are unfolding as per classic Elliott Wave rules.

- The minor pullback currently underway likely marks wave iv within this larger wave (iii).

- If this count holds, we are positioned to rally towards the 9300 area before a larger correction sets in.

Fundamental Tailwinds Boosting Sentiment

Several geopolitical and macroeconomic developments are providing fundamental support:

Sterling Stability and Political Optimism

Sterling is trading steadily, and political undercurrents are supportive:

- A UK-India trade deal was finalized yesterday, boosting investor sentiment around trade liberalisation.

- Speculation is heating up around a potential US-UK trade deal this week. Even partial reductions in tariffs—especially the 25% rate on cars and steel—would be a win for UK manufacturing and the FTSE 100's industrial components.

Upcoming UK-EU Summit – 19 May

- The first UK-EU summit since Brexit is set for 19 May. Historically, warming relations with the EU correlate with sterling rallies and positive FTSE 100 performance due to reduced trade uncertainty.

Sectoral Implications

- Industrials and Automotives: Tariff reductions could lift stocks in the car and steel industries.

- Financials: Stability in sterling supports FTSE-listed banks with international exposure.

- Exporters: A trade deal could benefit export-heavy companies through expanded market access.

Conclusion:

With both the Elliott Wave structure and fundamental backdrop aligning, the FTSE 100 looks poised for continued upside. The target into wave (iii) remains 9300, supported by technical momentum and positive geopolitical shifts.

Disclaimer: Trading leveraged products carries a high level of risk and may result in losses exceeding your initial investment; ensure you fully understand the risks involved.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.