FX Weekly Recap: September 18 – 22, 2023

ACY Securities

ACY Securities

Central banks stole the spotlight this week as they reacted to persistent worries about inflation and indications of a slowing economy.

Among the various currencies, the New Zealand dollar emerged as the top performer, while the British pound struggled, impacted by the Bank of England's recent policy shift.

In case you didn't catch the most important forex updates, here's a summary of the FX market happenings from last week.

USD Pairs

Once again, the U.S. dollar found itself swayed by speculations concerning the Federal Reserve's actions. This time, those speculations were confirmed with the release of the latest monetary policy statement by the FOMC.

As expected, there were no alterations to the Fed funds target range. However, what caught many off guard was the committee's hawkish stance, signalling a strong likelihood of another interest rate increase in 2023 and a diminished likelihood of substantial rate reductions in 2024.

Initially, this development prompted the dollar to recover from a significant decline leading up to the event. Nevertheless, by the end of the week, the performance of the greenback was mixed, as upbeat U.S. weekly initial jobless claims data on Thursday seemed to spur some risk-on sentiment.

Bullish Headline Arguments

- U.S. Preliminary Building Permits for August exceeded expectations at 1.54 million (forecasted at 1.43 million; previous figure: 1.44 million).

- The Fed, on Wednesday, maintained the Fed funds target range at 5.25% – 5.50%, in line with expectations. However, the Fed's dot plot forecasts suggested the likelihood of at least one more rate hike in 2023 and only a 50-basis-point rate cut in 2024, compared to the 100-basis-point rate cut estimated in June.

- U.S. initial jobless claims decreased by 20,000 to reach an eight-month low of 201,000.

- The U.S. current account deficit unexpectedly narrowed from $214 billion to $212 billion in Q2, driven by surpluses in services and primary income, partially offset by an increased goods deficit.

Bearish Headline Arguments

- The NAHB U.S. housing index declined from 50 to 45 in September, with high mortgage rates negatively impacting builder confidence and consumer demand.

- U.S. Existing Home Sales for August showed a month-on-month decrease of 0.7% to 4.04 million units, falling short of the forecasted 1.5% increase and following a 2.2% month-on-month decline in the previous reading.

- The Philadelphia Fed Manufacturing activity index contracted, dropping from 12.0 to -13.5 in September.

- U.S. Flash Manufacturing PMI for September came in at 48.9, surpassing the previous reading of 47.9. While there was increased hiring activity, the sales and demand environment remained subdued.

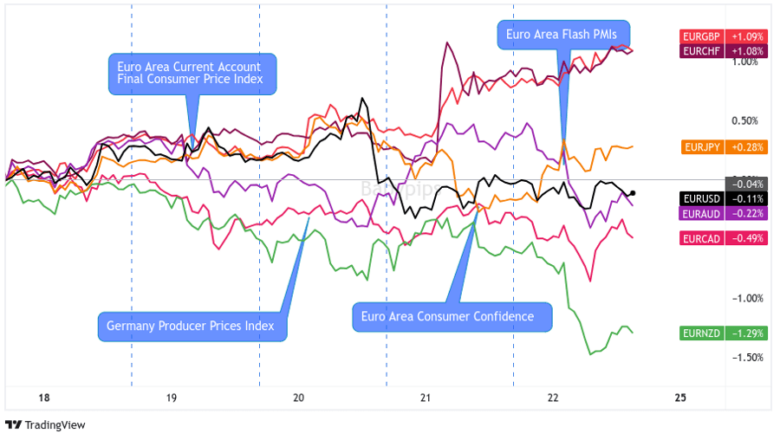

EUR Pairs

Throughout the week, the Euro's performance was a mixed bag, indicating that the actions of opposing currencies played a more substantial role than European news and data releases.

However, by Friday, the Euro sustained a consistent bearish trend due to disappointing updates regarding the Euro area Purchasing Manager's Survey data. This negative data seemed to overshadow any positive factors and added to the downward pressure on the Euro's value.

In the bigger picture, the Euro ended the week as a net loser when compared to most major currencies, with the exceptions being the Swiss franc and the British pound. Both currencies faced their own bearish pressure after their respective central banks unexpectedly opted not to raise interest rates.

Bullish Headline Arguments

- In a late Thursday interview, ECB Chief Economist Philip Lane stated that interest rates have reached a level that could help reduce inflation. However, he also emphasized that the ECB would maintain these rates at sufficiently restrictive levels for as long as necessary.

Bearish Headline Arguments

- Eurozone's current account surplus declined from 35.8 billion EUR to 20.9 billion EUR in July.

- The Eurozone's final headline CPI was adjusted from 5.3% to 5.2% year-on-year, while the core CPI remained steady at 5.3% year-on-year.

- Germany's producer prices increased by 0.3% in August but saw the fastest annual decline since records began in 1949, with a year-on-year decrease of 12.6%.

- The Euro Area Flash Consumer Confidence Index for September came in at -17.8 (forecasted at -17.3; previous reading: -16.0).

- HCOB Flash Eurozone PMI for September was 43.4, slightly lower than August's 43.5. This decline reflected reduced confidence in the year-ahead outlook, with new orders falling. Input prices rose much faster than output prices.

- HCOB Flash Germany PMI for September was 39.8, showing a slight improvement from the previous 39.1. However, the demand for goods and services continued to decline, and output prices increased at the slowest rate since February 2021. Employment also fell in Q3 as companies remained cautious.

GBP Pairs

The British Pound had a tough week, to be blunt. It faced a continuous decline in value, primarily stemming from prior statements made by the Bank of England, which indicated that additional interest rate hikes were unnecessary. This cautious stance from the central bank raised concerns among investors and had a negative impact on the Pound's performance.

Two specific events exacerbated the pressure on the Pound. Firstly, the release of UK inflation figures on Wednesday disappointed, likely causing unease among investors about the state of the economy. Then, on Thursday, the Bank of England had a close vote of 5-4 to maintain interest rates at 5.25%. While the decision wasn't unanimous, it sent a mixed message and added to the challenges faced by the Pound.

Bullish Headline Arguments

- According to GfK, the UK's consumer confidence improved from -25 to -21, the highest level since January 2022, surpassing expectations.

- UK retail sales rebounded by 0.4% in August, slightly below the 0.5% forecast but recovering from a 1.1% decline the previous month.

Bearish Headline Arguments

- Rightmove reported that over a third of UK properties had experienced at least one price reduction, the highest level since January 2011. Additionally, the average size of price reductions reached its highest point since January 2011.

- UK's inflation unexpectedly weakened in August, with the annual headline CPI increasing by 6.7%, falling short of the expected 7.0%, and core CPI rising by 6.2% instead of the anticipated 6.8%. These decreases were driven by slower food price increases.

- UK's producer input prices dropped by 2.3% year-to-date in August, compared to a 3.2% decline in July. Output/factory gate prices also decreased by 0.4% year-to-date, in contrast to a 0.7% decrease in July.

- The Bank of England decided to maintain its main policy rate at 5.25% on Thursday, as expected, following a lower-than-expected UK CPI reading earlier in the week. The vote was 5-4 in favor of holding rates.

- UK Public Net Borrowing (excluding PSNB) for August reached £11.6 billion, £3.5 billion higher than in August 2022, making it the fourth-highest level for any August on record but still less than the OBR forecast of £11.6 billion.

- UK Flash Manufacturing PMI for September was 44.2, compared to the previous reading of 43.0, while Services PMI stood at 47.2, down from 49.5.

CHF Pairs

The Swiss Franc indeed faced a difficult week, and there's no need to sugarcoat it. The situation took a negative turn when the Swiss National Bank (SNB) decided to keep their key interest rate at 1.75%, going against the expectations of many who had anticipated a 25-basis point increase.

It was as if the SNB made an unexpected move, and this had a substantial impact on the value of the Swiss Franc. To be fair, some recent data had hinted at the possibility of the SNB delaying rate hikes, but it still caught many by surprise, resulting in a bearish sentiment surrounding the Franc's value throughout the week.

Bullish Headline Arguments

- Switzerland's trade surplus expanded from 3.13 billion CHF to 4.05 billion CHF in August, driven by a 5.9% month-on-month increase in exports, outpacing a 1.5% month-on-month rise in imports.

- SECO's Swiss Economic forecast for 2023 was upgraded to 1.3%, compared to the previous projection of 1.1%. However, the forecast for 2024 was lowered from 1.5% to 1.2%.

Bearish Headline Arguments

- The Swiss National Bank unexpectedly maintained its main policy rate at 1.75% on Thursday and left the door open for further actions if necessary.

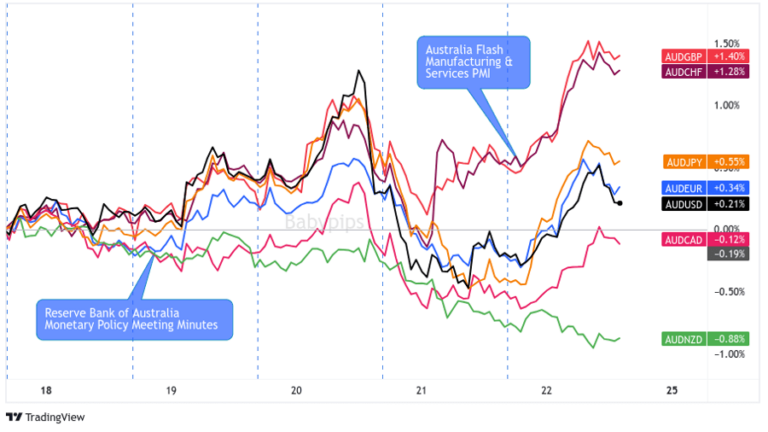

AUD Pairs

The Australian dollar had a robust week, primarily fuelled by the positive sentiment that had been gaining momentum ever since China implemented stimulative measures.

Nonetheless, there were some hurdles to overcome. The introduction of a hawkish tone by the Federal Reserve didn't sit well with Australian traders initially. However, the currency managed to rebound on Friday, aligning with the release of Australia's Composite Purchasing Managers' Index (PMI), which showed an increase. This uptick indicated an improvement in business sentiment in Australia.

In summary, the Australian Dollar had a volatile week but exhibited resilience in navigating through market fluctuations.

Bullish Headline Arguments

- Australia's services PMI rose from 47.8 to a four-month high of 50.5.

Bearish Headline Arguments

- RBA minutes revealed that members considered a rate hike but ultimately decided to hold due to concerns about the potential economic slowdown.

- The Westpac-Melbourne Institute Leading Index improved slightly from -0.56% in July to -0.50% in August, but negative readings suggest that the economy is likely to grow at a below-trend pace.

- Judo Bank's flash Australian PMIs showed a decline in the manufacturing PMI from 49.6 to a three-month low of 48.2.

CAD Pairs

The Canadian Dollar kicked off the week on a strong note, outperforming major currencies, with only the New Zealand Dollar surpassing it in strength by the week's end. There was a minor setback on Tuesday following the release of higher-than-expected inflation data from Canada, potentially driven by profit-taking and a shift in focus towards declining oil prices.

On Wednesday, risk sentiment prevailed as a hawkish statement from the Federal Reserve impacted global markets. This led to some losses for the Canadian Dollar against major currencies, except for the Australian and New Zealand Dollars. However, the bullish momentum was swiftly regained, likely bolstered by the rise in oil prices after news emerged that Russia would temporarily halt fuel exports to bolster its domestic fuel economy.

Bullish Headline Arguments

- Canada's Housing Starts for August came in at 244K, surpassing the previous month's figure of 242K.

- Canada's Raw Material Prices Index for August showed a 3.0% month-on-month increase, exceeding the forecast of 2.7%, and the Industrial Producer Prices Index rose by 1.3% month-on-month, surpassing the expected 0.5% increase.

- Canada's CPI for August showed a year-on-year increase of 4.0%, exceeding the forecast of 3.9%, and Core CPI was at 3.3% year-on-year, surpassing the expected 3.5%.

- Canada's New Housing Price Index for August increased by 0.1% month-on-month, beating the forecast of a -0.3% decrease.

- Retail sales in Canada for July grew by 0.3% month-on-month to C$66.1 billion, exceeding the forecast of 0.2%, and core retail sales increased by 1.3% month-on-month.

- Additionally, a summary of Governing Council deliberations indicated that the Council still saw a possibility where monetary policy was not yet restrictive enough.

NZD Pairs

The New Zealand Dollar had a favorable week, with its strength likely influenced by the positive economic conditions in the Asia region, particularly driven by China's recent economic stimulus measures. Despite a mix of economic data updates, there were notable highlights that contributed to the Kiwi's robust performance.

Bullish Headline Arguments

- Dairy auction prices in New Zealand increased for the second consecutive auction, with both overall prices and key whole milk powder (WMP) prices rising by 4.6%.

- New Zealand's current account deficit decreased from 4.66 billion NZD to 4.21 billion NZD in the second quarter, marking its second consecutive quarterly decline.

- New Zealand's GDP grew by 0.9% in the second quarter, surpassing expectations of a 0.4% increase and rebounding from the -0.1% reading in the first quarter.

Bearish Headline Arguments

- According to Business NZ, New Zealand's service sector weakened from 48.0 to 47.1 in August, with negative comments primarily related to uncertainty regarding the upcoming General Election and ongoing adverse economic conditions.

- Westpac reported a 2-point decline in New Zealand household confidence from 83.1 to 80.2 in September, attributed to rising living and mortgage costs.

- New Zealand's trade deficit widened from 1.2 billion NZD to 2.3 billion NZD in August, mainly due to weaker demand from China impacting exports.

JPY Pairs

The Japanese Yen experienced a somewhat turbulent week, leaning towards a negative performance. Several factors contributed to this trend, including positive developments in Asia, particularly China's economic stimulus efforts, and the anticipation of the Bank of Japan (BOJ) maintaining its ultra-easy monetary policy during its decision on Friday.

There was a moment when the Yen strengthened in response to a hawkish event by the Federal Reserve, which triggered a risk-off sentiment and drove traders towards safe-haven assets. However, this rally was short-lived, and the sentiment shifted during the U.S. session on Thursday, possibly due to better-than-expected U.S. jobless claims data, which supported the idea of a "soft landing."

When the BOJ finally announced its decision on Friday, they adhered to expectations by keeping ultra-low interest rates unchanged at -0.10%, cementing the Yen's bearish trajectory for the remainder of the week.

Bullish Headline Arguments

- Japan's trade deficit narrowed from 0.60 trillion JPY to 0.56 trillion JPY in August, as the decline in imports (-17.8% year-on-year) exceeded the decline in exports (-0.8% year-on-year).

- Japan's national core CPI grew by 3.1% year-on-year in August, surpassing expectations and matching the previous reading.

Bearish Headline Arguments

- The BOJ maintained its ultra-low interest rates at -0.10%, in line with expectations. Governor Ueda expressed caution regarding currency movements and their potential impact on inflation.

- Japan's Flash Manufacturing PMI for September was 48.6, lower than the previous reading of 48.9, while the Services PMI was 53.3, down from 54.3. Employment in the services sector declined, while manufacturing saw stronger growth. Inflation also grew at a slower pace, and the outlook showed signs of positivity but with a weakening trend.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.