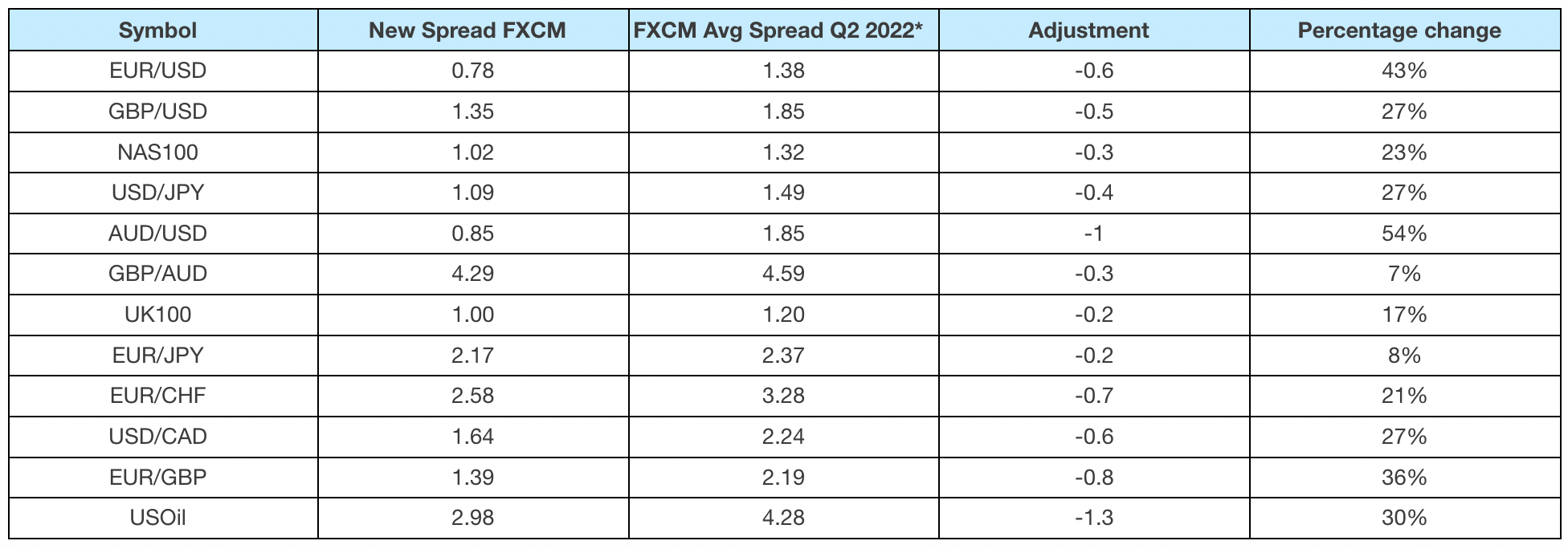

FXCM Reduces Spreads By As Much As 54%

25th July 2022 - FXCM has today announced it has reduced its spreads by as much as 54% on major currency pairs and indices. The new spreads will be available for clients under Forex Capital Markets Limited, FXCM EU LTD and FXCM Australia Pty. Limited.

In addition to reduced spreads, FXCM continues to deliver quality execution with 84% of all orders receiving positive slippage or zero slippage. This means those trades were executed at the rate the client clicked on or better with FXCM.

Check out FXCM’s new spreads, available on desktop, mobile and web trader platforms, below:

*Calculations are derived from FXCM Group spreads from April 1, 2022 to June 30, 2022. Spreads can vary. Past Performance is not an indicator of future results.

Brendan Callan, FXCM CEO

Brendan Callan, CEO of FXCM, said: “In recent months, big swings in global currencies such as the euro’s decline against the dollar have created opportunities for retail investors, driving many towards the FX market. In line with our ‘Client First, Trader Driven’ mantra, we have made our pricing more competitive than ever before and are committed to continue offering quality execution and the best possible experience for our clients.”

FXCM, recently named Broker of the Year at the Ultimate Fintech Awards, has continually expanded its services throughout 2022, underlining its commitment to a “Client First, Trader Driven” approach. In addition to expanding its CFD offering with the doubling of its French, German and UK share offerings, the firm also launched Australian single share CFD trading with zero data fees and commissions to enhance the service provided to clients.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.