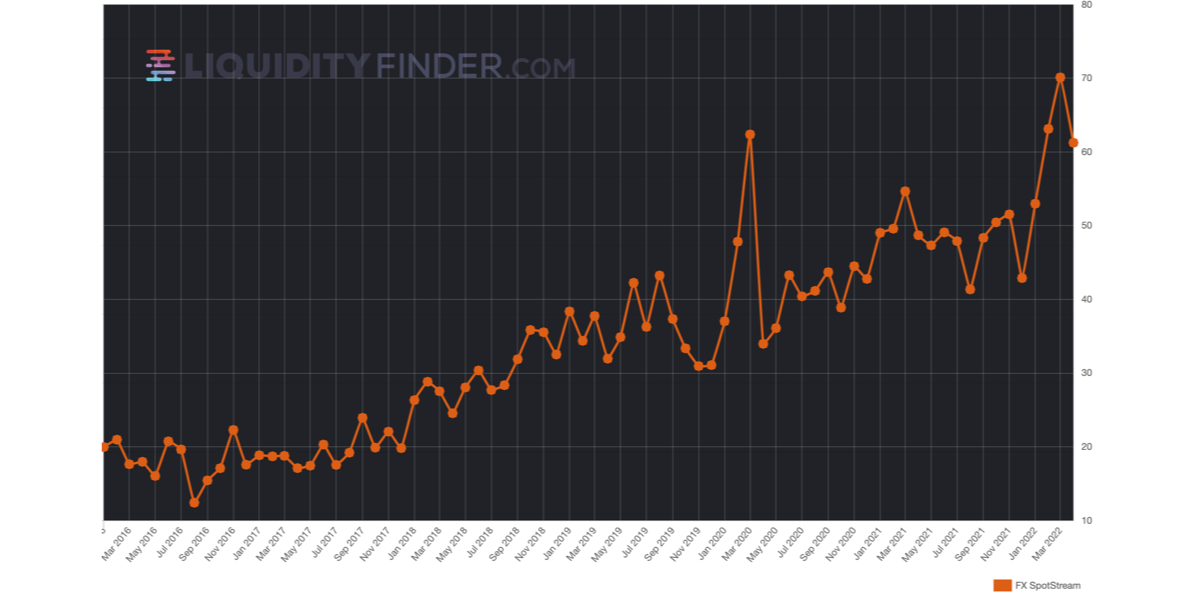

FXSpotStream Posts April ADV Down 12.64% On March ($61.25 billion), 25.76% Up On April 2021

May 02, 2022 - FXSpotStream recorded the highest Average Daily Volume (ADV) in the company's history in March 2022, at $70.1 billion, but April 2022's ADV saw a decline Month on Month of 12.64%. However, compared to a year ago, April 2021, last month saw an increase of 25.76%.

FXSpotStream's ADV in the first 4 months of 2022 is $62.051 billion, exceeding the ADV during the same period last year by 22.61%.

FXSpotStream’s ADV Year-on-Year (April 2022 vs April 2021) increased 25.76% to $61.250billion.

FXSpotStream’s ADV Month-on-Month (April 2022 vs March 2022) decreased 12.64%, following a record high ADV in March at $70.1 billion.

FXSpotStream’s Overall Volume Year-on-Year (April 2022 vs April 2021) increased 20.04% to $1.286trillion, the 4th month in a row with supported volume comfortably over $1 Trillion.

FXSpotStream's ADV Year-To-Date (Jan-April 2022) is $62.051 billion, an increase of 22.61% compared to the same period last year.

ADV figures for April are based on 21 trading days.

To view FXSpotStream's Bankk FX Algo Webinar series, please click here.

To view an interactive chart showing historical average Daily Volumes of FXSpotStream compared to other major FX venues, please click here.

To view current open job positions at FXSpotStream, please click here.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.