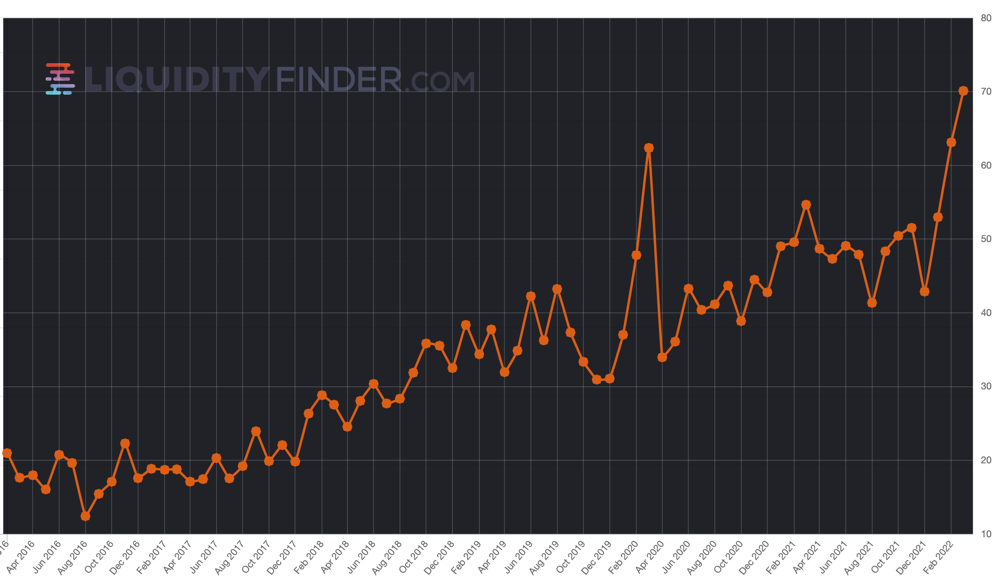

FXSpotStream Records New Record ADV High In March 2022

April 01, 2022 - Bank-owned FX and Precious Metals streaming price provider FXSpotStream has released volume figures for March 2022, showing that company has registered a new Average Daily Volume (ADV) record high during the month, surpassing the previous record set in February. March's ADV of $70.115 billion is an 11.06% increase over February's ADV of $63.135 billion. The company has stated that March 2022 completes the highest volume quarter in the company's history.

• March proved to be a record month for FXSpotStream in terms of monthly ADV ($70.115 billion) and overall volume ($1.613 trillion) • FXSpotStream’s ADV Month-on-Month (March 2022 vs February2022) increased 11.06% • FXSpotStream’s ADV Year-on-Year (March 2022 vs March 2021) increased 28.24% • FXSpotStream’s Overall Volume Year-on-Year (March 2022 vs March 2021) increased 28.24% to $1.613 trillion • FXSpotStream's ADV Year-To-Date (January-March 2022) is $62.313 billion, an increase of 21.54% compared to the same period last year

In March FXSpotStream was named Most Innovative API Framework in the A-Team Innovation Awards 2022. To see an overview of other awards earned by FXSpotStream, please click here.

To view the services provided by FXSpotStream, or to contact the company's sales team, please use the links below:

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.