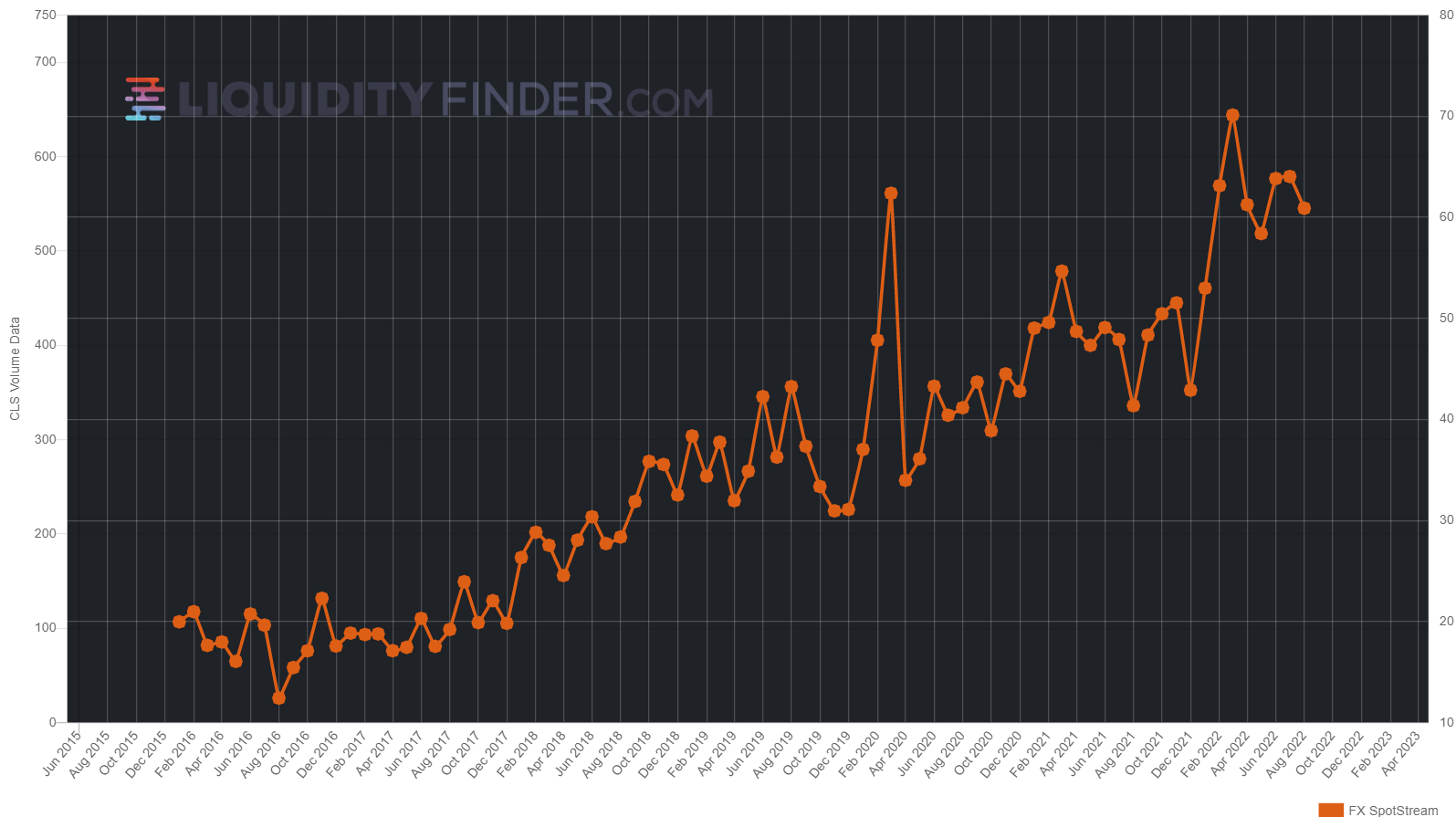

FXSpotStream Releases August Volumes - ADV Of $60.898 Billion, Up 47.24% YOY

September 1, 2022 - FXSpotStream announced volume figures for August 2022. August's ADV of $60.898 bn surpassed July as their largest Year-on-Year volume percentage increase of any month so far in 2022 at 47.24%.

This was on top of July, which had marked a 33.66% growth in terms of ADV, and was then their second highest ADV ever.

Year to date (January-August), in 2022 FXSpotStream has supported over $10.709 trillion, with an ADV of $61.90 billion during that period. This is an increase of 27.67% when compared to the same period last year (January-August).

A summary overview of FX SpotStream volume data can be seen below:

• FXSpotStream’s ADV Year-on-Year (Aug'22 vs Aug‘21) increased 47.24% to $60.898billion • FXSpotStream’s ADV MoM (July‘22 vs June'22) decreased 4.9% - following the second highest ADV ever in July • FXSpotStream’s Overall Volume Year-on-Year (August 2022 vs August 2021) increased 53.94% to $1.401 trillion, the 8th month in a row with supported volume well over $1 Trillion • FXSpotStream's ADV Year-To-Date (January-August 2022) was $61.90 billion, an increase of 27.67% compared to the same period last year

See FXSpotStream Monthly ADV history and their relative performance against other venues by clicking this link to LiquidityFinder's Market Volumes charts.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.