FXSpotStream Releases Volume Figures For April 2021

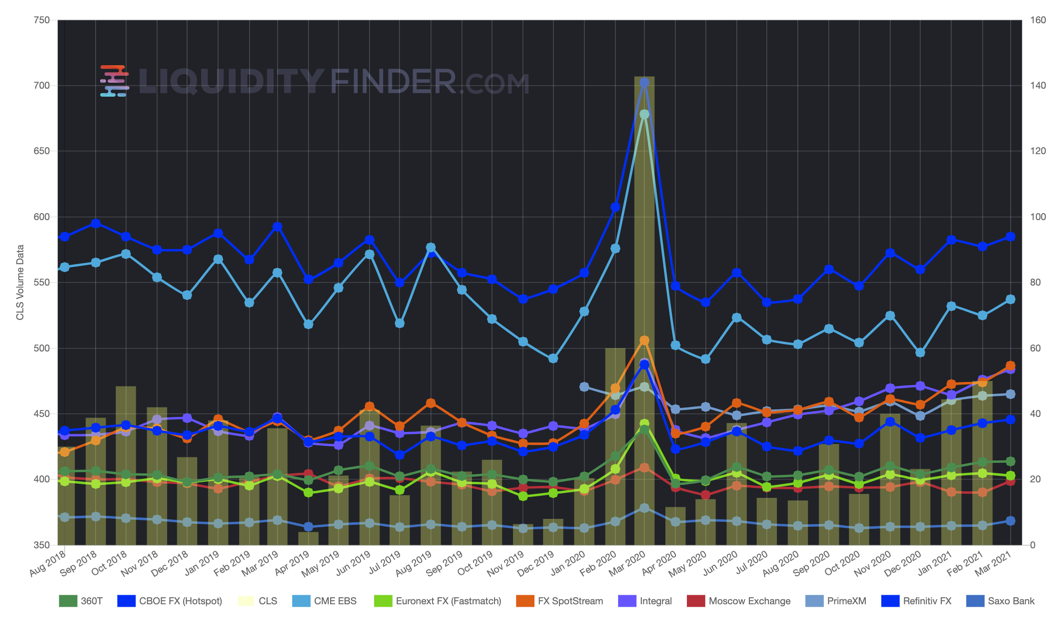

May 03, 2021 - Bank-owned FX and Precious Metals streaming price provider FXSpotStream has released volume figures for April 2021 over its network of 15 banks The company posted an Average Daily Volume (ADV) of $48.705 billion, a decrease of 10.92% Month-on-Month compared to March (ADV figures for April are based on 22 trading days.) April ADV trading volumes for all venues and platforms are significantly down due to the additional 2 days of Easter holidays, as can be seen on the LiquidityFinder ADV tracker here. 360T recorded a decline in ADV of 17.59%, Cboe Hotspot a decline of 19.54% and EuronextFX a decline of 15.66%. Relatively speaking FXSpotStream has held up well. March 2021 was the second-highest ADV month on record for the company.

The April figure of $48.705 billion represents an increase of 43.35% compared to April 2020, and during the last month total volume exceeded $1 trillion for the third time in the company's history, totalling $1.07 trillion.

During 2020, FXSpotStream added Barclays and Societe Generale to its list of Primary Bank Liquidity Providers, making a total of 15 banks supplying liquidity over its network. The full list of banks include:

• Bank of America • Barclays • BNP Paribas • Citi • Commerzbank AG • Credit Suisse • Goldman Sachs • HSBC • J.P. Morgan • Morgan Stanley • MUFG • Societe Generale • Standard Chartered • State Street • UBS

Today's volume figures announcement also confirmed that FXSpotStream's launch of support for FX Algos and Allocations is on track to go live later this month/early June.

See FXSpotStream's Monthly ADV history and their relative performance against other venues by visiting the LiquidityFinder Market Volumes chart for Major FX Trading Venues here:

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.