FXSpotStream Releases Volume Figures For July 2021

August 02, 2021 - Bank-owned FX and Precious Metals streaming price provider FXSpotStream has released volume figures for July 2021 over its network of 15 banks. Average Daily Volume (ADV) was $47.911 billion, a decrease of 2.40% compared to June 2021, but Year on Year volumes continue to grow double digits on a percentage basis. (ADV figures for July are based on 22 trading days.)

FXSpotStream’s ADV Year on Year (July 2021 vs July ‘2020) increased 18.55% to $47.911 billion.

FXSpotStream’s overall volume Year on Year (July 2021 vs July 2020) increased 13.39% to $1.054 trillion, crossing the $1 trillion mark for the 5th time in the company’s history

FXSpotStream’s ADV Year To Date (January-July 2021 vs January -July 2020) increased 15.10% to $49.459 billion when compared to the same period last year.

FXSpotStream has also confirmed that launch of support for FX Algos and Allocations is now live, with clients trading.

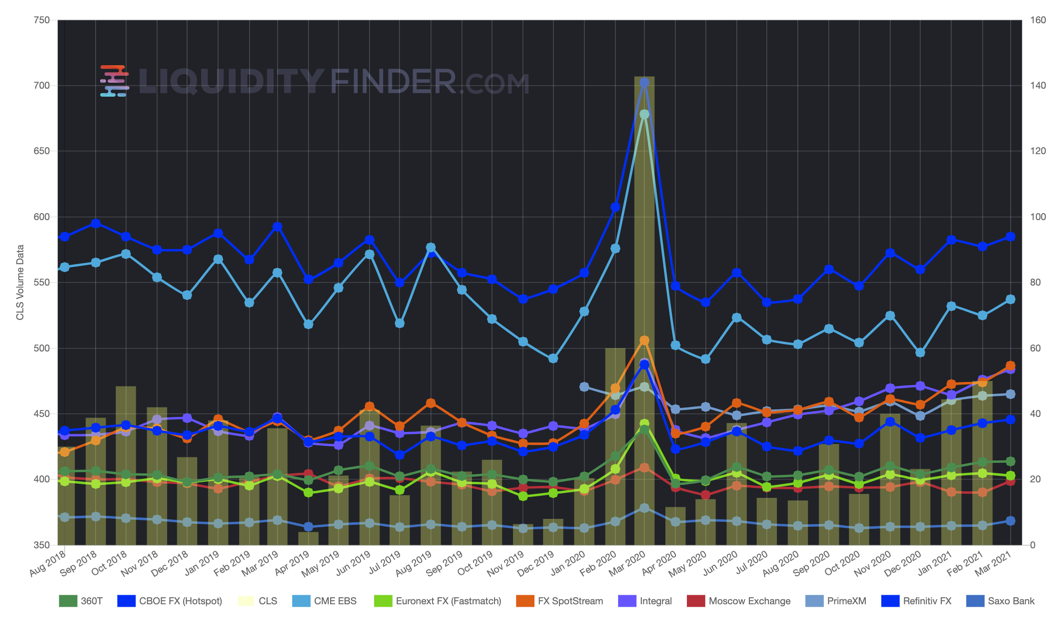

Other platforms that have reported volume figures for July so far are also showing a slight decline, with 360T down 2.25% Month on Month and Cboe (Hotspot) down 2.06%.

See FXSpotStream's Monthly ADV history and their relative performance against other venues by visiting the LiquidityFinder Market Volumes chart for Major FX Trading Venues here:

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.