GBP/USD Elliott Wave: Declining in Wave 2

Alchemy Markets - Jeremy Wagner, CEWA-M

Alchemy Markets - Jeremy Wagner, CEWA-MExecutive Summary

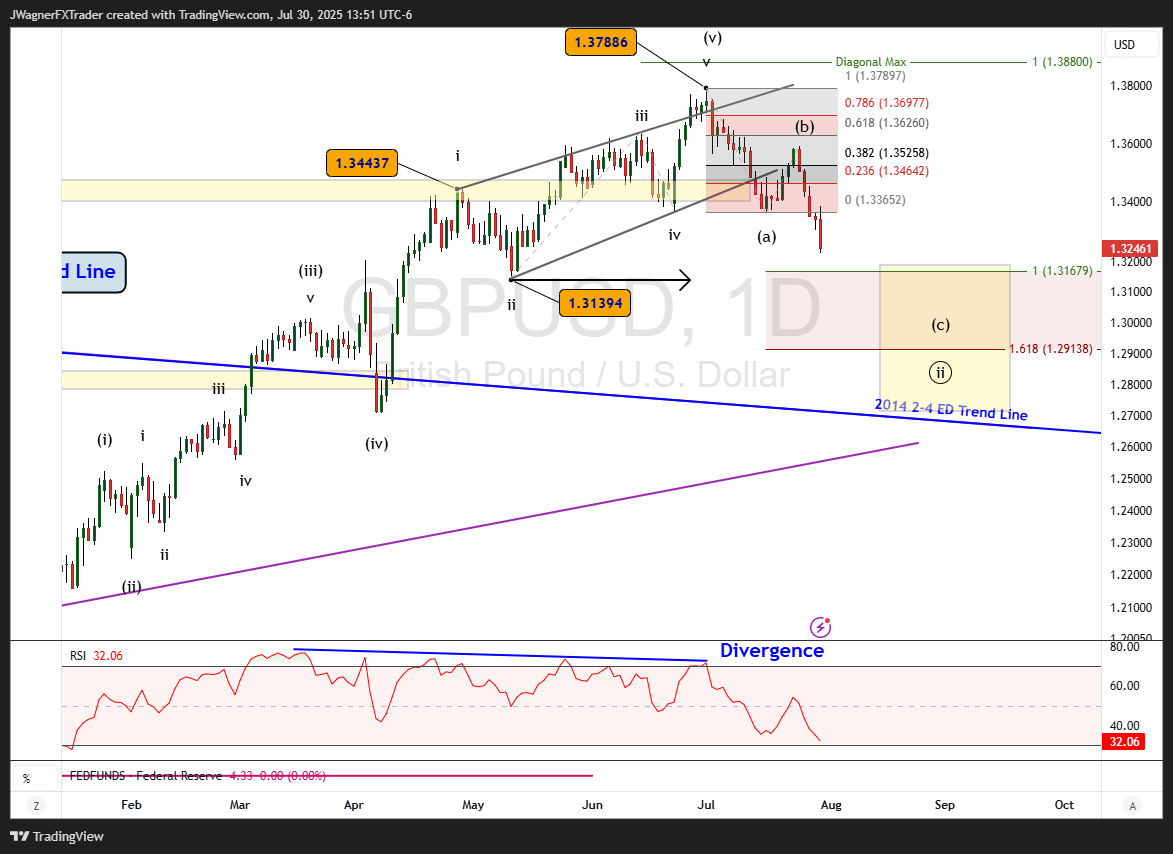

- GBPUSD completed wave ((i)) of a larger bullish impulse sequence.

- Current decline is viewed as wave ((ii)) and may reach 1.31 and possibly 1.27.

- Current forecast for additional declines holds while prices remain below 1.3589.

GBPUSD Elliott Wave Count

The current Elliott wave count is that GBPUSD is declining in wave (c) of a larger (a)-(b)-(c) correction. This downtrend is anticipated to reach 1.3139 and possibly as low as 1.27.

This downward correction would consolidate the rally from January to July 2025. The rally needed 5 months to unfold, so this decline may need 2-8 months to consolidate.

Wave (v) of the H1 2025 impulse rally was an ending diagonal pattern, shaped like a rising wedge.

When an ending diagonal pattern appears, oftentimes there is a quick retracement back to the origination of the diagonal. In this case, the forecast is for a swift retracement back to 1.3139 and possibly lower levels.

If lower levels are sought after, there is a support trend line developed from 2014 that passes through near 1.27. Also, in the same area is the 61.8% Fibonacci retracement level.

Bottom Line

GBPUSD has progressed through the first wave of a larger degree wave 3. The decline from July 1 is viewed as wave ((ii)) of 3 and opens the door for the bearish count and lower levels down to 1.27-1.31.

Once lower price levels are established, then the prospects for a large and booming rally likely increase later on in 2025.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.