GBP/USD – Major Rejection at Channel High, Bearish Setup Brewing

Alchemy Markets - Zorrays Junaid

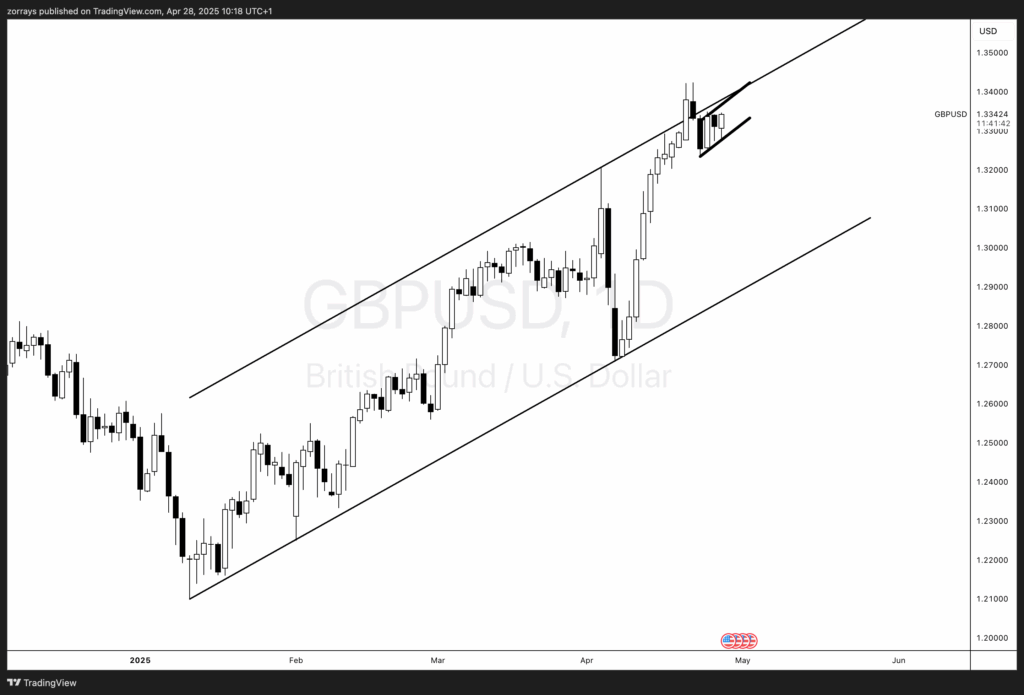

Alchemy Markets - Zorrays JunaidGBP/USD has recently extended its bullish trend, climbing to the upper boundary of the ascending channel visible on the daily timeframe. However, price has now rejected sharply from this resistance zone, suggesting a potential shift in momentum.

Technical Analysis:

Daily Timeframe:

On the daily chart, GBP/USD had been riding an impressive uptrend within a well-structured ascending channel. Price action pressed into the upper boundary but failed to break higher, resulting in a clear Shooting Star rejection wick.

This kind of reaction at a major trendline often signals buyer exhaustion and introduces the possibility of a larger corrective move.

Key observation:

- Strong rejection from the channel top

- Consolidation just below resistance

- Momentum running out of steam

If selling pressure intensifies, we could start seeing a drift toward the midline of the channel or even a larger breakdown.

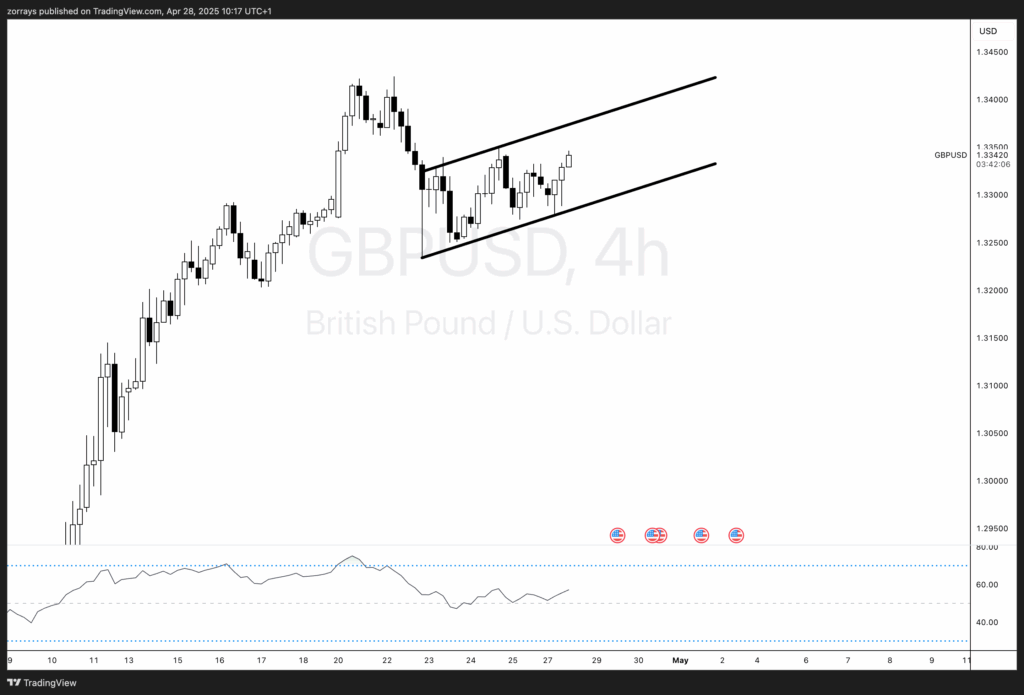

4H Timeframe:

Zooming into the 4H chart, GBP/USD has developed a flag pattern just below the rejected zone.

This type of price action often acts as a continuation signal, and in this context, it suggests a potential downside break.

What’s important to monitor:

- A decisive break of the flat pattern's lower boundary

Accompanying bearish volume

Additionally, on the RSI (Relative Strength Index), price is hovering near the neutral 50 mark.

A clear and sustained breakdown below the 50 RSI level would indicate a shift from bullish to bearish momentum, aligning with the bearish scenario.

A breakdown here would likely trigger a move towards new lower lows in the short term.

GBP/USD sits at a major turning point. After reaching and rejecting from the channel high, combined with a flat consolidation on the 4H timeframe, the pair is hinting at a potential bearish breakout.

Confirmation will come from a break of the lower boundary of the consolidation, ideally accompanied by RSI dropping firmly below the 50 level, signalling a shift in market sentiment.

Patience is key — wait for clear confirmation before engaging in any setups.

Disclaimer: Trading leveraged products carries a high level of risk and may result in losses exceeding your initial investment; ensure you fully understand the risks involved.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.