Gold Awaits the Fed: Breakout or Breakdown? Here’s What to Watch

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

- Gold (XAU) consolidates near $3,400 as traders await the Fed’s rate decision and geopolitical risks remain elevated.

- Cooling U.S. inflation supports dovish expectations, keeping bullish momentum alive above key support.

- Fed’s tone will define direction - a dovish tilt could push gold to $3,500+, while hawkish signals risk a drop below $3,350.

Geopolitical Risk and Dovish Expectations Drive Gold

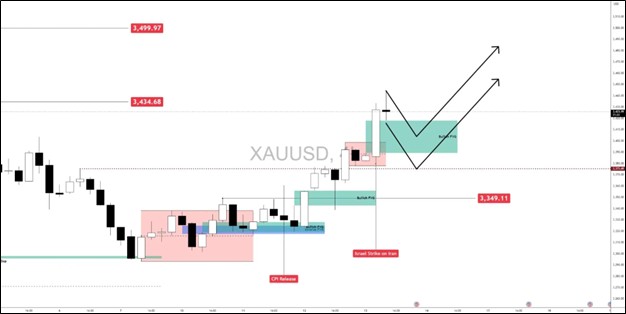

Gold is currently trading at a tight range after pulling back from $3,450 level. Previously, created a new impulse leg to the upside fueled by the soft-CPI release and Israel-Iran renewed conflict.

Now, gold is now trading near the Israel-Iran Conflict candle prior to the Federal Reserve’s rate policy decision coming in a few hours.

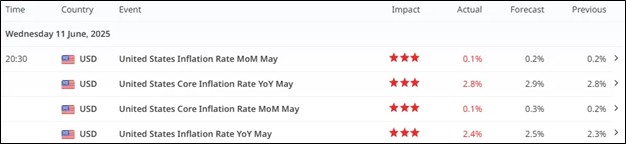

Inflation Eases in Line with Fed Goals: Is a Rate Cut Next?

With the U.S. CPI data came in cooler than expected the odds of the Fed reviving cut bets for September increases, adding fuel to gold’s rally. As we continue to see a cooling inflation in the United States, either we proceed 1 rate cut this year or 2 cuts as originally forecasted.

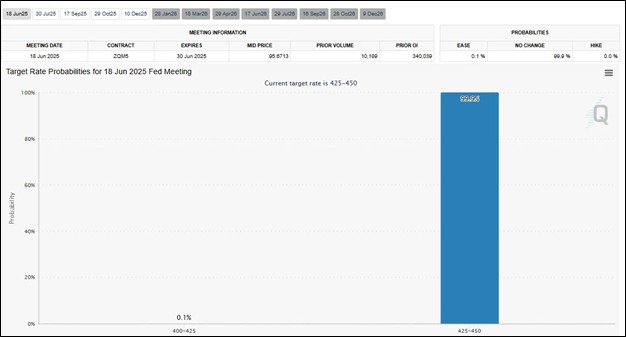

Fed Signals Patience with Steady Rates

Markets are now pricing in a rate hold, but the forward guidance and dot plot could determine whether gold continues its march toward all-time highs or sees a healthy retracement.

How the Fed Rate Decision Impacts Gold

- Interest Rates: Higher rates make gold less attractive since it doesn't yield interest. A rate hike = bearish for gold, while cuts = bullish.

- U.S. Dollar: A hawkish Fed strengthens the dollar (DXY) , pressuring gold. A dovish stance weakens the dollar, lifting gold demand.

- Inflation & Real Yields: Gold thrives when real yields fall. If the Fed is behind inflation, gold rallies. If it tightens aggressively, gold weakens.

- Safe-Haven Demand: Dovish or uncertain Fed outlook boosts gold as a hedge. A confident Fed may reduce gold’s appeal.

Technical Outlook

Gold is holding the line between the $3,400 - $3,365 level as markets await Fed decision, which is already priced-in, later today.

Previously, I outlined both bullish and bearish scenarios for gold. As of this writing, the bearish setup appears to be unfolding. However, with the upcoming Fed decision acting as a key catalyst, gold could either extend its decline or regain momentum for a fresh push to the upside, making this a pivotal moment for direction confirmation.

The bullish case is still on the table, as price has yet to break down from the previous range with any strong momentum. Despite some hesitation in recent candles, the structure remains intact, suggesting buyers still have a chance to defend key support. Unless we see a clean and impulsive breakdown below the range low, the bullish scenario remains valid.

Bullish Case: Dovish Fed + Range Breakout above $3,400

Should gold hold above the $3,350 - $3,400 level and the Fed delivers a dovish hold or hints at rate cuts by September, we may see a clean continuation toward key resistance levels, with $3,500 in sight.

- 4H FVG at $3,342.73 - $3,356.06 remains intact

- Price forming higher lows and higher highs, creating a shift in structure

- Dovish Fed rhetoric could ignite fresh bullish momentum

Targets:

- First resistance at $3,450 - $3,470

- Next leg: $3,500 - $3,550

- Extended move: $3,550 - $3,600 (near record highs)

Bearish Case: Rejection, Retracement to $3,349 or Deeper

A failure to hold the $3,370 - $3,400 level, combined with a hawkish Fed tone, could lead to a breakdown toward prior imbalances and liquidity pools beneath the structure.

- Failure to maintain bullish FVG structure

- Close below $3,375 risks shift in sentiment

- Fed surprises with hawkish language or upgraded inflation outlook

Downside Targets:

- Initial retracement toward $3,350

- Extended downside to $3,300–$3,280, below the CPI reaction

- Major liquidity zone below $3,200 if safe-haven flows ease

Check Out My Contents:

Strategies That You Can Use:

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

The Ultimate Guide to Understanding Market Trends and Price Action

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

How To Trade News:

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices:

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold:

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.