Gold Holds Ground above $3330 Despite Dollar Rebound

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

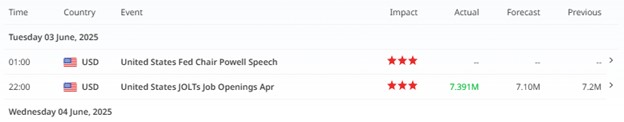

- Dollar (DXY) rebounded off 98.700 after invalidating a key FVG, supported by a strong JOLTS print.

- Gold (XAU/USD) remains firm above $3330, showing resilience despite rising yields and a stronger dollar.

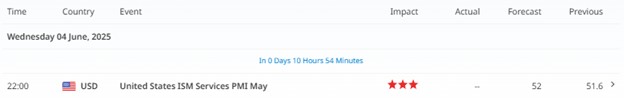

- All eyes now on ADP, ISM, and NFP to confirm whether dollar strength continues or gold reclaims momentum.

Dollar Recovering Amidst All-Time Downside Move

Dollar has exhibit signs of recovery as it bounced off the 98.700 level, invalidating the 4-hour fair value gap resting between the 99.112-98.871 level.

This invalidation was not just purely data-driven; buying pressure had already started intraday at the start of the trading day yesterday. The move gained conviction after the JOLTS Job Openings report showed 7.391 million positions, well above the expected 7.1 million which added to dollar’s rebound.

This data reinforces the view that the U.S. labor market remains tight, complicating the outlook for rate cuts and providing a supportive backdrop for the dollar.

Gold Remains Resilient Despite Dollar Rebound

Mentioned in my last analysis: Gold eyes $3,400 as Dollar struggles ahead of NFP, $3325-$3345 could act as a support level for a renewed upside move on gold. The scenario outlined materialised and if we are looking for a sustained upside, we’d like this to stay in tact by not trading and closing through it on a downside trajectory.

The last line of defense for this upside move is the $3330 low remaining intact. We don’t price to revisit this level again or else, we might see a deeper pullback on gold.

The fact that gold hasn't broken down despite rising real yields and dollar strength suggests some degree of underlying demand, possibly from geopolitical risks, portfolio hedging, or traders positioning ahead of Friday’s Non-Farm Payrolls.

Key Data Ahead: ADP, ISM, and NFP in Focus

If these reports echo the strength shown in JOLTS, we could see another leg higher for DXY and potentially, adding capping gold’s upside. On the flip side, if labor and services data underwhelm, gold could find a fresh bid and retest the resistance level near the $3400 level.

Bottom Line: Gold Steady, But At a Crossroads

Gold’s ability to hold above above $3330 in the face of a stronger dollar shows that bearish pressure hasn’t fully taken control, more upside is still aheaad. But that could change quickly depending on incoming data. For now, price action remains range-bound and we yet to see a move testing the highs and lows with the incoming catalysts this week.

Check Out Our Market Education

How to Trade & Backtest Gold:

Why Gold Remains the Ultimate Security in a Shifting World

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment — With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

Follow me on LinkedIn: Jasper Osita

Join me in Discord: The Analyst Guild

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.