Has Wave 4 Bottomed in EUR/USD or Is Sideways Grind Still in Play?

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidAs we head into today's European session, EUR/USD traders are digesting a delicate mix of technical signals and fundamental tension, both of which could shape the pair's direction over the next few weeks.

Macro Picture: Eurozone Inflation and ECB Policy in Focus

Yesterday’s Eurozone CPI data for April came in largely in line with expectations, with headline inflation steady at 2.2%. However, the surprise came in core inflation, which ticked higher to 2.7% from 2.4%, primarily due to stronger services inflation—possibly reflecting seasonal Easter effects.

This paints a mixed picture for the European Central Bank. On one hand, inflation is cooling enough to justify further easing. On the other, sticky core pressures might keep policymakers cautious. Markets are still pricing in another rate cut to 1.75% by year-end, but the path might not be as smooth as anticipated.

Economically, growth projections have also been revised down to 0.9% for 2025, dampening the euro’s upside potential, especially relative to the more resilient U.S. economy. So while the ECB may ease, sticky inflation complicates things—and that’s what keeps EUR bulls guessing.

Technical Outlook: Is Wave 4 Done or Just Beginning?

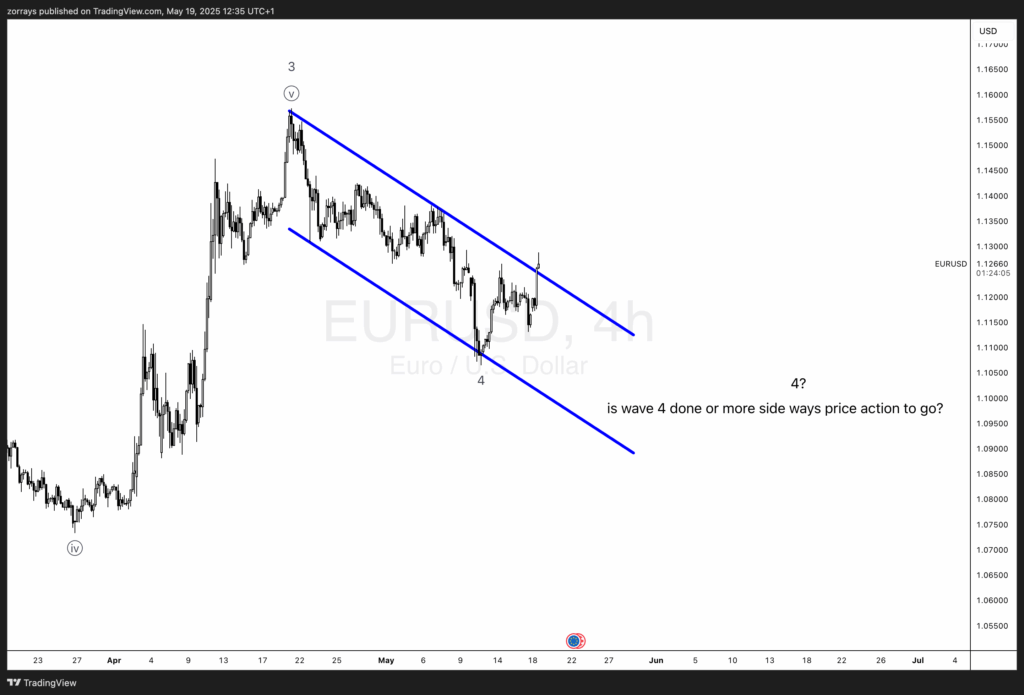

On the 4-hour chart, EUR/USD appears to have completed a clean impulsive structure into wave (3), with price now potentially forming or completing wave (4).

As shown in the chart, the move off the recent low has broken above the upper boundary of a descending channel, suggesting a possible end to wave 4—but the structure isn’t fully convincing just yet.

Here’s what to keep in mind:

- Wave 4 could be complete, with Friday's break from the channel acting as early confirmation.

- However, given typical Elliott Wave behaviour, there’s a fair argument for more sideways price action, forming a flat or triangle structure instead of a simple zigzag. This would align with the uncertainty around core inflation and ECB policy.

- Sideways movement would naturally depress euro strength, frustrating bulls until a clearer macro signal emerges.

Until there’s a decisive move above 1.13, the risk of prolonged consolidation remains on the table.

The Interplay: Fundamentals Meet Technicals

With fundamentals leaning dovish but inflation not collapsing fast enough, EUR/USD is stuck in a “neither here nor there” zone. This creates fertile ground for a drawn-out wave 4 correction, especially if U.S. data continues to support the dollar.

From a trading standpoint, patience is key. A confirmed break above the wave 4 highs could reignite bullish interest toward 1.15+. Until then, the euro may remain vulnerable to macro noise and sideways churn.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.