How to Lessen Risk From Stop Hunts in Trading

ACY Securities - Jasper Osita

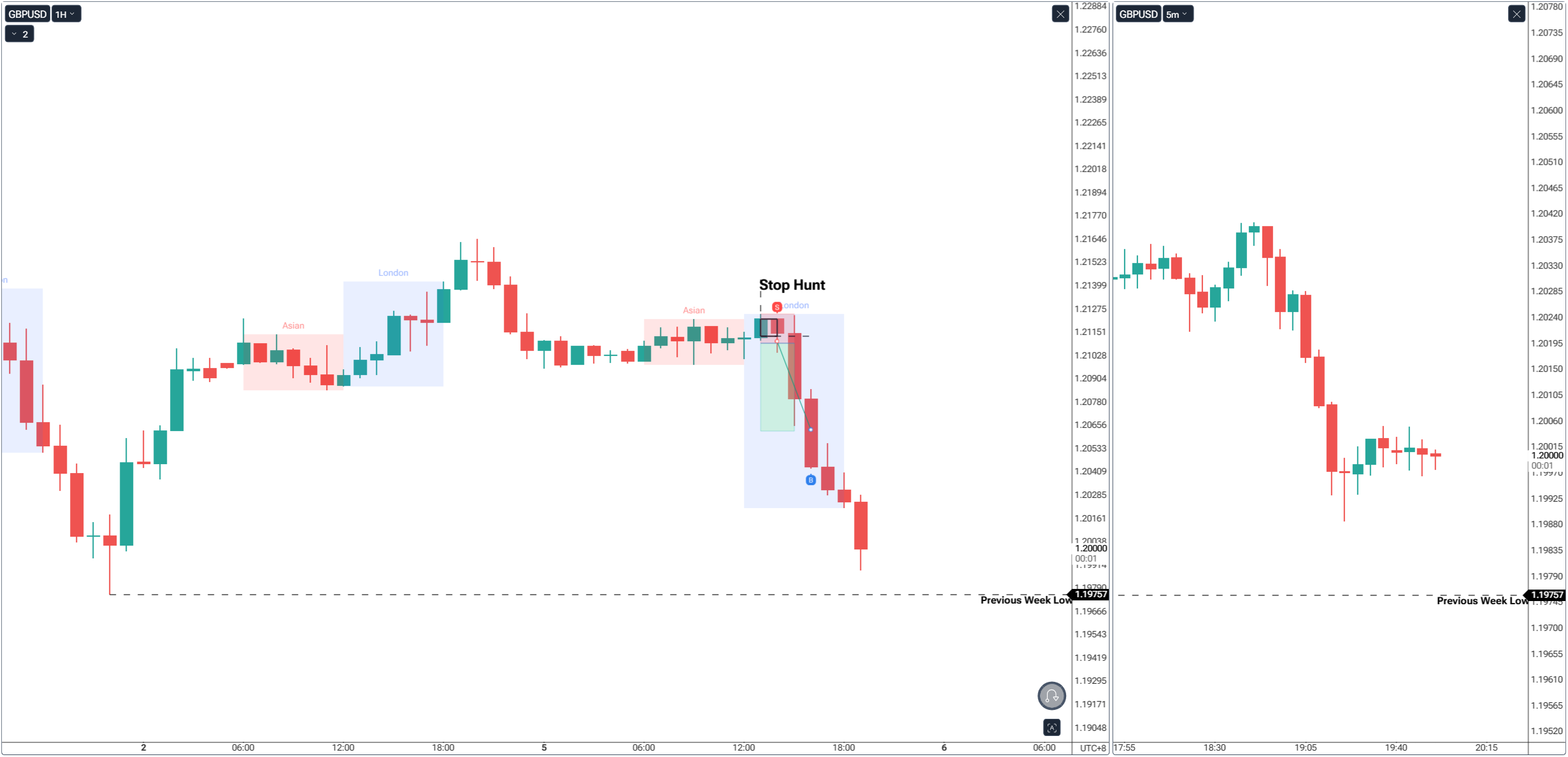

ACY Securities - Jasper OsitaEvery trader has felt it: price spikes just enough to take your stop, then turns and runs in the direction you expected. That’s the sting of a stop hunt - and it matters more than you think.

Stop hunts aren’t just small inconveniences. If ignored, they can slowly erode your confidence, tilt your psychology, and destroy your edge. They don’t just hurt your account balance; they attack your discipline. That’s why learning how to reduce risk from stop hunts is not optional - it’s a survival skill.

Why You Need to Be Aware

Stop Hunts Target Predictability

Retail traders tend to cluster stops at the same obvious levels - swing highs, swing lows, and round numbers. Institutions exploit this predictability. If you don’t adjust, you’ll always be on the wrong side of their play.

They Amplify Emotional Mistakes

It’s not the stop hunt itself that kills accounts - it’s what happens next. Anger leads to revenge trades. Fear leads to hesitation on the next valid setup. Without awareness, stop hunts trigger a spiral of bad decisions.

Risk Compounds Quietly

Even small stop hunts, if frequent, bleed an account dry. Over 50 trades, one bad habit (like placing stops right under obvious lows) could mean dozens of unnecessary losses.

Being aware of stop hunts gives you the ability to step back, manage risk smarter, and stop being the liquidity.

Why It Matters for Long-Term Success

Think of trading like running a marathon, not a sprint. Every unnecessary stop-out is like carrying extra weight on your back. You might survive the first few miles, but the longer you go, the heavier it feels.

By learning to lessen risk from stop hunts, you’re not just protecting your next trade - you’re protecting your mental capital and ensuring you have the stamina to stay in the game long enough to win.

How to Lessen Risk From Stop Hunts

1. Widen Your Perspective With Higher Timeframes

Most stop hunts happen at obvious intraday levels. Zooming out to the daily or weekly bias helps you separate:

- A small sweep → just noise inside the bigger picture.

- A higher timeframe raid → a true setup worth trading.

2. Avoid Placing Stops at Obvious Swing Levels

The market knows retail stops sit under swing lows and above swing highs. Instead, place stops beyond the liquidity zone, not inside it. This cushions you against the sweep itself.

3. Use Partial Positioning (Scale In / Scale Out)

Commit small size on the initial sweep, then scale in only after confirmation (MSS or FVG). This way, if the first entry gets tagged, you’re still in position when the real move develops.

4. Risk Smaller Near Liquidity

Treat liquidity levels as danger zones. Cut position size in half around yesterday’s highs/lows, Asian range, or weekly extremes. Scale up only once confirmation arrives.

5. Let the Market Take Liquidity First

One of the simplest rules:

- Don’t enter before the sweep.

- Let liquidity get taken.

- Trade the reaction, not the trap.

This single habit keeps you out of most stop hunts.

6. Journal Stop Hunts to Spot Patterns

Track where they happen most (London open? NFP week?), how they behave, and what comes after. Over time, you’ll build a personal stop hunt map tailored to your market.

The Edge Awareness Creates

Most traders think avoiding stop hunts makes you safe. The truth? It gives you an edge. By seeing stop hunts as part of market design, you flip the script:

- Retail = liquidity provider

- Smart trader = liquidity hunter

You no longer fight the market - you flow with it. That awareness is what separates frustrated traders from consistent ones.

Driving Near an Intersection

Stop hunts are like intersections. Most accidents happen there because that’s where paths cross. Smart drivers don’t avoid roads - they slow down, check mirrors, and give space where risk is highest.

Trading works the same way. Swing highs and lows are intersections of liquidity. If you reduce speed (risk), check both sides (confirmation), and wait for the light (bias alignment), you pass safely while others crash.

Final Thoughts

At the end of the day, we will never know exactly what the market will do. What we can do is prepare: mark levels where stop hunts are likely, wait for confirmation, and execute according to plan. If the trade fails, accept the loss and walk away.

Profitable traders aren’t judged by avoiding every stop hunt or showing a perfect PnL. They’re judged by how well they manage losses, preserve capital, and keep discipline intact. Risk is the only thing you can control - and mastery of that control is what separates long-term survivors from blown accounts.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.