How to Read Central Bank Statements: A Simple and Complete Guide for Traders

ACY Securities - Luca Santos

ACY Securities - Luca SantosWhen the U.S. Federal Reserve or the European Central Bank makes a decision about interest rates, it doesn’t just affect banks it can shake up stock markets, currencies, and bond yields around the world.

But if you’ve ever seen the market jump or drop after one of these announcements, you might wonder: was it really just about the rate decision?

The truth is, the biggest market moves often happen after the interest rate is announced. Why? Because what truly matters is not just what the central bank does, but what it says and how it says it.

Traders and investors pay close attention to the central bank statement, and even more so to the press conference that follows, usually after 30 minutes to 1hr.

In this guide, I will break down exactly how to read these statements, understand what “dovish” and “hawkish” language means, and learn how to spot the clues that can move markets, no financial background needed.

1. What Is a Central Bank and What Does It Do?

A central bank is like the financial steering wheel of a country’s economy. It helps guide growth, control inflation (rising prices), and keep the financial system stable. In the U.S., the central bank is the Federal Reserve, often referred to as “the Fed.”

In Europe, it’s the European Central Bank (ECB). Other examples include the Bank of England and the Bank of Japan.

The main way a central bank influences the economy is by changing interest rates. When inflation is rising too quickly, the bank might raise rates to slow things down. If the economy is weak, it might lower rates to encourage spending and investment. These decisions are made in scheduled meetings, usually every few weeks or months.

2. What Is a Central Bank Statement?

After each meeting, the central bank releases a short statement. This document explains what decision was made such as keeping rates steady, raising them, or lowering them, and the reasons behind it. Think of it like a short press release that shares the central bank’s current view of the economy.

Here’s what you’ll usually find in a central bank statement:

The current interest rate decision

An assessment of the economy (inflation, jobs, growth)

Hints about what might happen next ( What we call forward guidance)

These statements are usually just a few paragraphs long, but every word is carefully chosen, because markets analyze them for clues about the future.

3. Why Markets React to the Statement (Not Just the Rate)

Most of the time, the rate decision itself is already expected by traders. Financial markets spend weeks analyzing data and speeches to figure out what the central bank is likely to do.

So if the bank does exactly what everyone expected, there may be little reaction at first.

However, if the language of the statement changes, even slightly, that can signal a shift in the bank’s outlook.

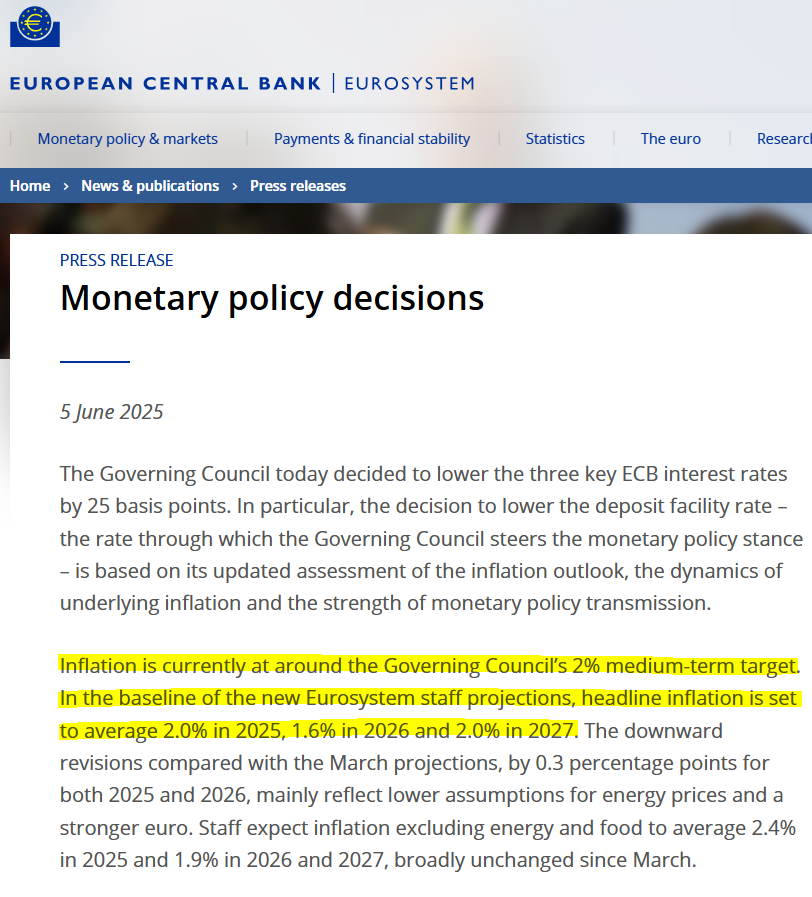

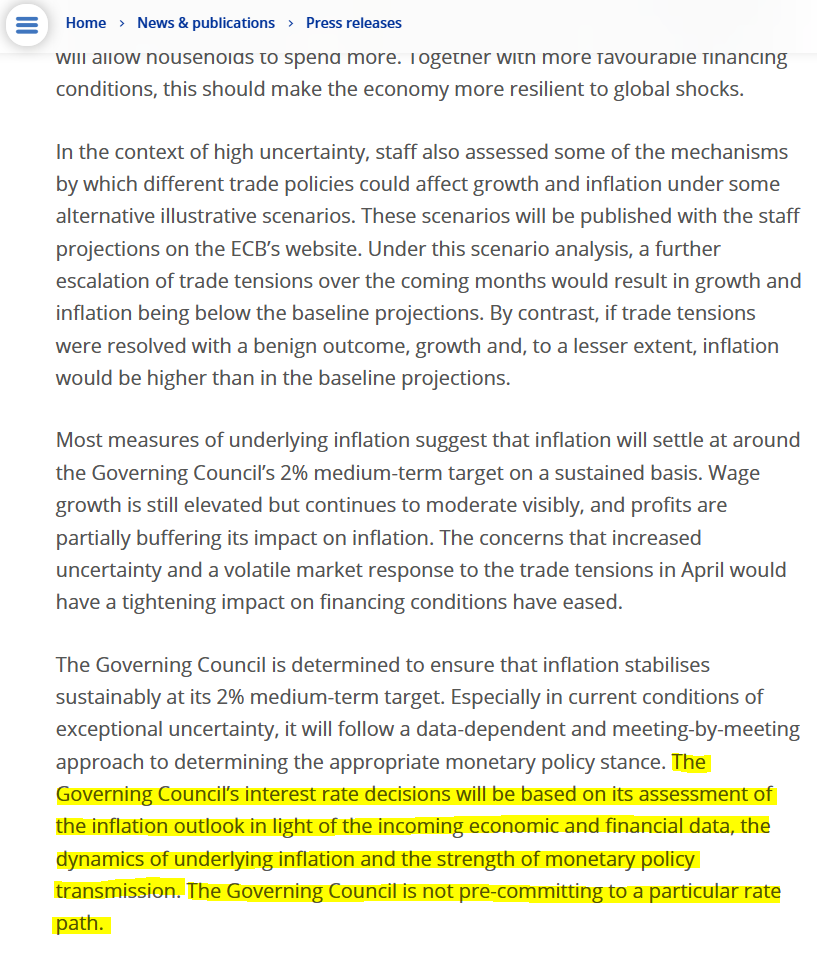

For example, if the statement used to say “inflation is elevated” but now says “inflation is moderating,” that suggests the bank might be less aggressive with future rate hikes. That’s when the market starts moving.

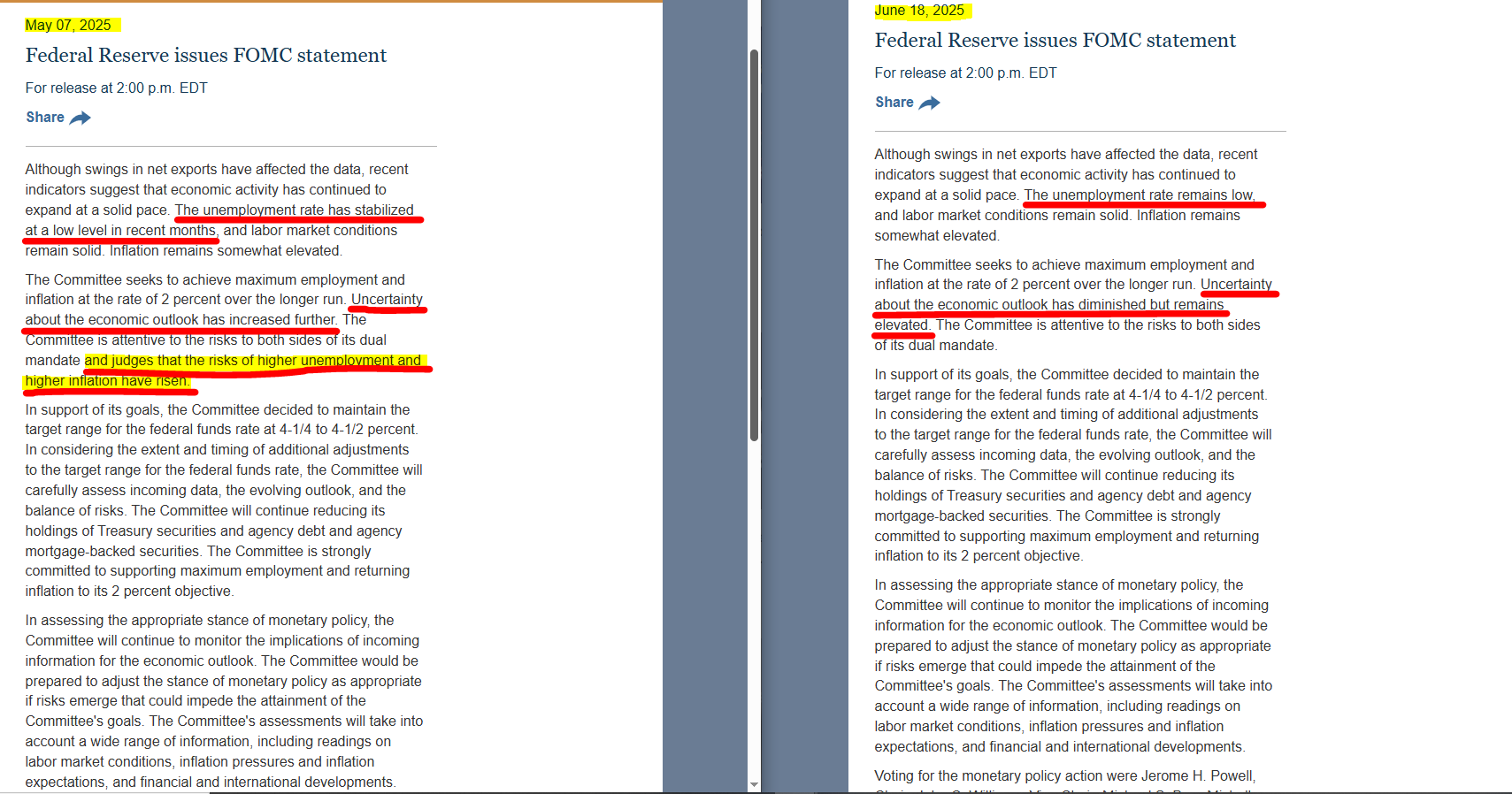

Let me show you an example from the FED/FOMC. We can clearly see that within a short span of one month, many words in the statement have changed, but the majority remain the same.

That’s exactly what makes the statement so important it signals whether the FED (or any other central bank) is indicating a shift in its outlook. If the language changes, it’s a sign that their thinking has changed too.

4. Dovish vs Hawkish: What the Language Tells You

Central banks don’t just raise or cut rates they also communicate their attitude toward the economy through tone and phrasing. This is where the terms dovish and hawkish come in.

A dovish tone suggests the bank is in no rush to raise rates, or may even lower them. This often means they’re more focused on growth and are less worried about inflation.

A hawkish tone suggests the bank is concerned about inflation and is more likely to raise rates or keep them high.

Some examples of dovish language:

“Inflation is coming down.”

“Economic activity has moderated.”

“Further hikes may not be necessary.”

Some examples of hawkish language:

“Inflation remains elevated.”

“We are prepared to tighten policy further.”

“Job market remains too strong.”

Even a single word change from one meeting to the next can signal a shift in tone, and traders watch these shifts closely.

5. The Press Conference: Where the Real Signals Come From

Right after the statement is released, central bank leaders like Jerome Powell (Fed) or Christine Lagarde (ECB) usually hold a press conference.

This is where journalists ask questions, and it’s often the most important part of the entire event.

In the press conference, the central bank may:

Clarify what was meant in the statement

Talk about future risks like recession or global uncertainty

Hint at whether they think rates will go up or down next time

Because these answers are less scripted than the written statement, they often contain more genuine signals about what the bank is really thinking.

A pause, a hesitation, or a choice of words can all trigger reactions from traders.

The press conference is free and public, anyone can watch over the YouTube, simply search: ECB (or the bank you're looking for) live press conference. On the day and the time that they will be hosting it.

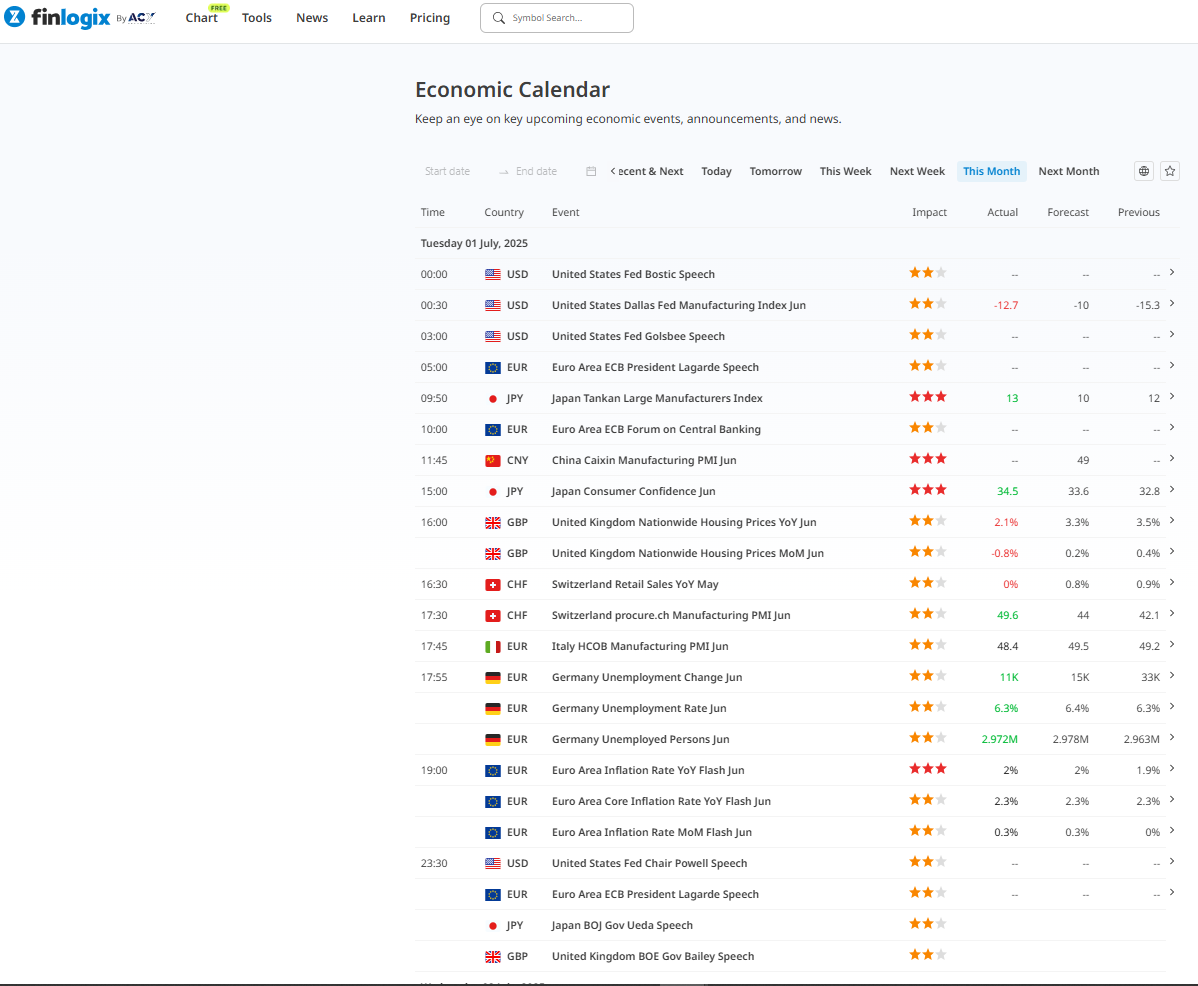

There are two ways that you can find out when a Central Bank will have a meeting, the simplier way is to use an economic calander like finlogix, where you can selcet all the coutries on the small globe (earth emoji) around the world and have “This month” selceted and from there you can search for what will be the central bank meetings for that month.

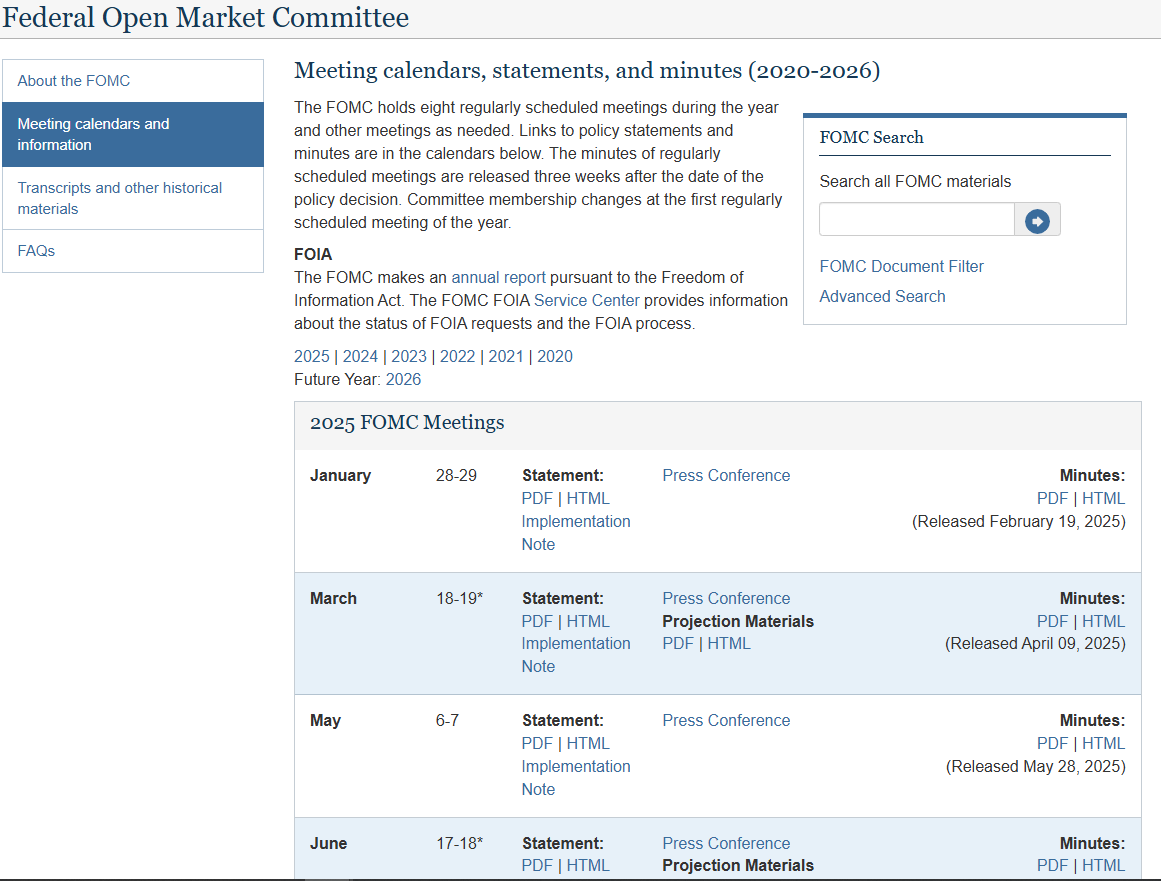

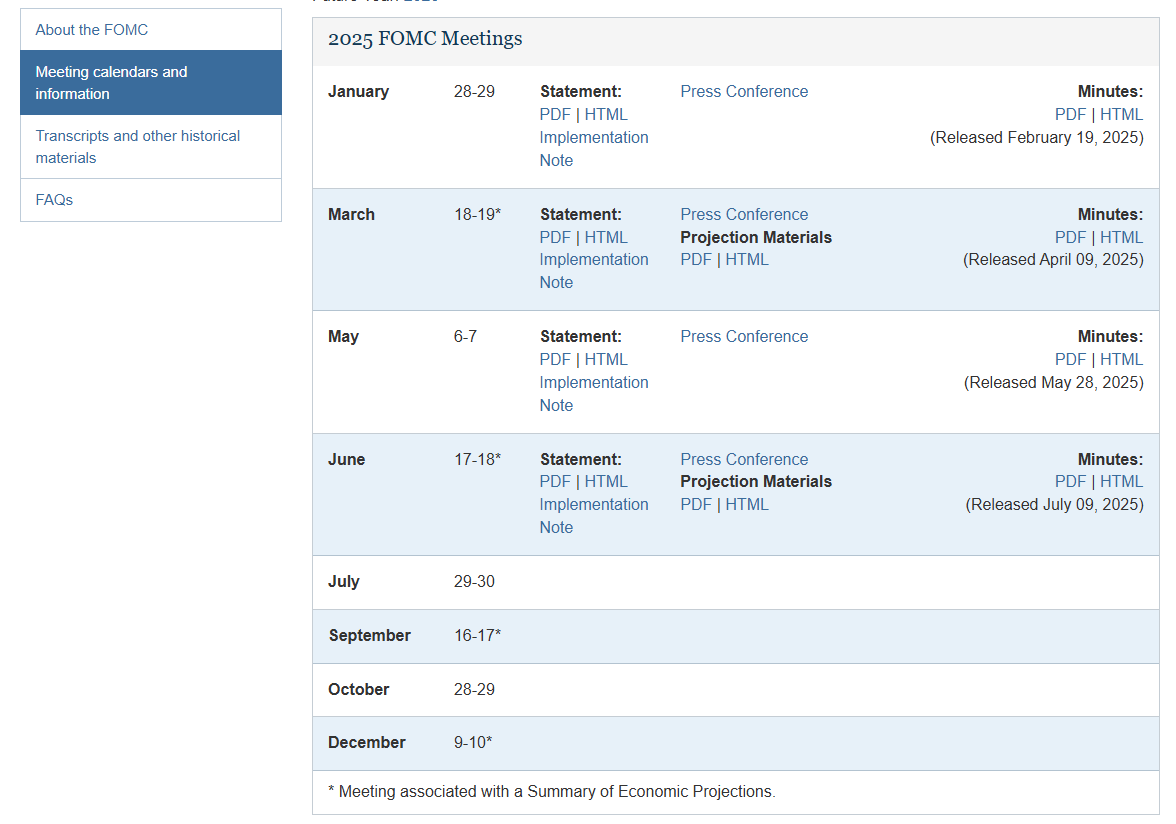

The second way is going trougth Google and searching the central bank you're looking for and entering into their meeting calendar just as on the photo below.

We can see that the next FED meetings will be held on July, Sep, Oct and Dec, and also we can see the days!

Here’s a simple checklist to follow:

Start with the rate decision — Was it expected? If yes, focus more on the language.

Compare with previous statements — Has any wording changed? Words like “strong,” “moderating,” or “uncertain” can signal shifts.

Identify the tone — Dovish or hawkish? Is the bank sounding cautious or confident?

Watch the press conference — Pay attention to how the central bank leader answers questions.

Observe market reactions — See how stocks, bonds, and currencies respond, especially during the press conference.

Over time, you’ll begin to spot patterns. For example, you’ll notice that certain phrases usually precede a market rally or decline.

You don’t need to be a central bank expert to understand their signals. You just need to:

Watch for changes in wording

Understand the general tone

Pay attention during the press conference

Follow the market’s reaction

By learning to read these statements step by step, you’ll start to spot the moments when language not just numbers moves the market.

Whether you’re trading currencies, stocks, or just trying to understand the headlines, this skill will serve you again and again.

Q: What is the FOMC?

The FOMC stands for the Federal Open Market Committee, which is the part of the U.S. Federal Reserve that makes decisions about interest rates and monetary policy. They meet about eight times a year to decide whether to raise, lower, or hold interest rates—and they issue a statement after each meeting.

Q: What’s the difference between the statement and the press conference?

The statement is a short written summary of the central bank’s decision and economic outlook. The press conference, held shortly after, allows the central bank leader (like Jerome Powell) to explain that decision in more detail and answer questions from the media. Many traders find the press conference more revealing than the statement itself.

Q: What do “dovish” and “hawkish” mean?

Dovish means the central bank is likely to support the economy by keeping rates low or slowing down rate hikes. It usually signals concern about growth or jobs.

Hawkish means the central bank is focused on fighting inflation, often by raising interest rates or keeping them high.

Q: Why do markets move even if the rate decision is expected?

Because traders already “price in” the rate decision before the announcement. What really moves the market is any change in tone or unexpected language in the statement or press conference. Even a small shift in wording can lead to big reactions in stocks, bonds, and currencies.

Q: How can a beginner start reading central bank statements?

Start by:

Reading the interest rate decision itself

Comparing the current statement with previous ones to spot wording changes

Learning to recognize dovish vs hawkish phrases

Watching or reading summaries of the press conference

With practice, you’ll start to notice the signals that experienced traders focus on.

Further Reading: Deepen Your Trading Knowledge

Continue sharpening your market analysis and trading strategies with these hand-picked guides across gold, macroeconomics, risk sentiment, and trading psychology that I’ve wrote!

Gold Trading & Strategy

- Gold in War Times – XAUUSD Historical Guide

- Gold & CPI/NFP – Sentiment and Trader Insights

- XAUUSD Forecast: CPI, NFP and Outlook

- When to Trade XAU/USD – Time Zones & Sessions

- Why Fundamentals Matter in Gold Trading

- XAUUSD vs Cryptocurrency – Safe Haven Comparison

- China Reserves, Basel III and the XAUUSD Structure

- Geopolitical Conflicts and Gold in 2025

- XAUUSD in Market Crashes and Surge Conditions

Risk Sentiment & Global Events

- How to Trade Risk-On and Risk-Off Markets

- Global Events Impacting Financial Markets

- Israel-Iran Conflict and Oil Price Impact

- Understanding Market Context – Why It Matters

- Trading News Events – How the Market Reacts

- Sentiment Analysis – A Trader’s Strategy Guide

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.