How to Trade Forex with a Small Account Using EA

ACY Securities - Francis Palo

ACY Securities - Francis PaloThis article is reviewed annually to reflect the latest market regulations and trends

- Brutal Honesty: Growing a small account (100 - 1,000) is a slow, methodical process. The temptation to over-leverage a small account with an Expert Advisor (EA) is the single fastest way to financial ruin. Realistic growth with proper risk management (1-2% per trade) is measured in months and years, not days.

- EAs are Tools, Not Solutions: Free EAs are a dangerous illusion; their true costs include mandatory VPS hosting (300 - 600/year) and a high probability of capital loss from flawed strategies (e.g., Martingale). They do not eliminate fear and greed but transfer these emotions to system-level anxiety.

- Mastery Before Automation: Before touching an EA, a beginner must build a foundation in manual trading, market analysis, and risk management. Use EAs on a demo account first to learn their mechanics, not to blindly chase profits.

- Adopt a Legendary Mindset: Channel Jesse Livermore by trading with the trend, cutting losses swiftly, and waiting patiently for high-probability setups. True success comes from disciplined execution, not a magic robot.

"The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor." - Jesse Livermore

The $100 Forex Account: Can a Robot Turn Your Side-Hustle into a Fortune?

Let's be brutally honest. You have a small account, maybe $100, maybe $1,000. You have a full-time job, a family, a life. You’ve seen the Instagram ads with their glittering promises: a "set-and-forget" trading robot, an Expert Advisor (EA), that can turn your modest starting capital into a river of passive income while you sleep.

This is the siren's call for every aspiring side-hustler in the forex market. And it's a lie.

The central, agonizing question for traders with limited capital is, "Can I actually make meaningful money with such a small account?" This article will answer that question with the brutal honesty you deserve. We will dissect the promise of automated trading, expose the dangerous paradox of "free" EAs, and reveal a modern, far more viable path for the undercapitalized trader.

Forget the fantasy of a magic money-printing robot. It's time to get serious about what it truly takes to succeed.

What is the Path of a Beginner Forex Trader? (And Why Does it Hurt So Much?)

The journey of a retail forex trader is a remarkably predictable funnel of escalating challenges. It’s a path that moves from wide-eyed curiosity to, for an estimated 90% of participants, profound frustration and financial loss. Understanding these stages is the first step to overcoming them.

- Stage 1: Confusion & Overwhelm. This is the "What is a pip?" phase. You're bombarded with intimidating jargon, leverage, margin, spreads, indicators. The primary pain point is a feeling of inadequacy and the fear of the unknown. You crave simple, clear answers.

- Stage 2: Fear & Mistrust. As you prepare to deposit real money, the questions change. "Is my broker a scam?" "Am I going to lose all my money on the first trade?" This phase is defined by a lack of trust in the industry and a deep-seated fear of being taken advantage of.

- Stage 3: Frustration & Despair. You've started trading, and you're losing. This is the most emotionally charged stage. "Why am I still losing?" "What am I doing wrong?" Here, you wage a fierce internal battle against fear (holding losers too long), greed (over-leveraging after a win), and crippling self-doubt. This is the stage where the promise of an "emotionless" EA becomes almost irresistible.

- Stage 4: Realism & Discipline. The few who survive Stage 3 enter the "How do I do this sustainably?" phase. The pain here is the grueling struggle for consistency. For the side-hustler, it’s the acute challenge of balancing trading with a demanding life, knowing that one impulsive mistake can wipe out weeks of patient gains.

It is from the depths of Stage 3 that most traders desperately reach for an automated solution. But are they reaching for a lifeline or an anchor?

Can an Expert Advisor Solve Your Trading Psychology?

The primary sales pitch for any Expert Advisor is that it acts as a circuit breaker for the destructive emotional cycles of fear and greed. An EA is a program that operates on a set of predefined, objective rules. It doesn't feel the sting of a loss or the euphoria of a win. When its conditions are met, it trades. No hesitation, no second-guessing.

This automated execution is designed to enforce discipline and consistency, the two pillars of success that humans find so difficult to maintain. In theory, it removes your greatest liability from the equation: you.

However, this is a dangerous misunderstanding. The software is emotionless, but the human operator is not. An EA does not conquer fear and greed; it simply relocates the battle.

Instead of the micro-anxiety of managing a single trade, you now experience the macro-anxiety of watching your entire account's equity curve.

- When the EA enters an inevitable drawdown, your fear manifests as an overwhelming urge to turn it off, right before it might recover.

- When the EA has a winning streak, your greed tempts you to crank up the risk settings beyond safe limits, exposing your account to catastrophic failure.

The psychological battle hasn't been won; it has been shifted from the tactical (the trade) to the strategic (the system). This is a complex topic, and learning how to navigate it is a critical skill for any trader considering automation. You can learn more about using expert advisors to manage fear and greed and avoid these common psychological traps.

How Do You Realistically Trade with a Small Account Using an EA?

If you insist on using an EA with a small account, you must treat it not as a get-rich-quick scheme, but as a long-term, systematic business. This requires a radical shift in expectations and a non-negotiable commitment to risk management.

The Brutal Mathematics of a Small Account

Let's be clear: with standard professional risk management (risking 1-2% of your account per trade), your growth will be slow and methodical. On a $500 account, a 1% risk is just $5. A winning trade with a 2:1 reward-to-risk ratio will net you $10. You will not be buying a Lamborghini next month. The primary danger is the temptation to abandon this discipline in favor of high-risk settings that almost inevitably lead to ruin.

The "Free" EA Paradox: A Comprehensive Cost Analysis

The most significant trap for a small-account trader is the "free" EA. It is not free. A comprehensive accounting reveals significant, unavoidable costs:

- Mandatory Virtual Private Server (VPS): An EA must run 24/5 without interruption on a trading platform connected to the market. A power outage or internet failure at home can prevent a critical stop-loss from executing, leading to a devastating loss. A reliable VPS is a remote server that ensures 99.9% uptime. This is a non-negotiable recurring expense, realistically costing 30 - 50 per month, or 360 600 per year.

- The High Probability of Capital Loss: The vast majority of free EAs are built on fundamentally flawed, high-risk models like Martingale (doubling your trade size after a loss) or Grid (placing orders without stop-losses). These are not legitimate trading strategies; they are mathematical traps designed to eventually wipe out your entire account balance.

Your "free" tool now has you paying a monthly fee to run a piece of software that is statistically engineered to lose all your money. This is the paradox that destroys countless beginners.

The Prudent Path:

If you are to use an EA, it must be as a tool, not a crutch.

- Foundation First: Spend 3-6 months on a demo account learning to trade manually. Understand market structure, price action, and risk management.

- Demo the EA: Before ever using an EA with live money, run it on a demo account for at least 3 months. Understand its behavior, its drawdown characteristics, and its performance in different market conditions.

- Use Transparent, Low-Risk EAs: Avoid "black box" EAs with secret algorithms. Choose a simple, transparent EA, preferably one where you can understand the logic (e.g., a basic moving average crossover system).

- Start with Micro-Capital: When you do go live, start with a micro-account and the absolute minimum capital you can afford to lose (100 - 500).

Manual Day Trading vs. EA Trading: Which Path is for You?

The choice between manual trading and automated trading involves different skills, costs, and psychological pressures.

| Feature | Manual Day Trading | EA / Automated Trading |

| Time Commitment | High (Requires hours of daily screen time for analysis and execution) | Low (Monitors and trades 24/5, but requires significant setup and monitoring time) |

| Emotional Factor | Very High (Constant battle with fear and greed on every trade) | High (Battle shifts to system-level fear during drawdowns and greed during winning streaks) |

| Core Skill | Market analysis, price action intuition, discretionary decision-making. | Statistical analysis, backtesting interpretation, system management, coding (optional). |

| Feedback Loop | Direct and immediate. A bad trade provides a clear lesson. | Indirect and delayed. It's hard to know if a loss was due to the EA, the market, or settings. |

| Upfront Cost | Cost of educational resources. | Cost of the EA (if paid), and the non-negotiable monthly VPS fee. |

| Hidden Risk | Over-trading, revenge trading, emotional mistakes. | Flawed strategies (Martingale), over-optimization, technical failures, scams. |

What Would a Trading Legend Think? How Jesse Livermore Would Trade a Small Account

Jesse Livermore, the legendary trader of the early 20th century, never saw a trading robot. But his timeless principles offer a clear verdict on how to approach the market, especially with limited capital.

- He Would Wait for the "Pivot Point": Livermore believed in patience. He would not trade every day. He would wait for the market to show its hand and enter only at key "pivot points" where the trend was clear and confirmed. For a small account, this means avoiding low-probability setups and preserving capital for the A+ opportunities. An EA, by contrast, often trades whenever its simplistic conditions are met, regardless of the broader market context.

- He Would Follow the Path of Least Resistance: "Markets are never wrong—opinions often are." Livermore would never fight the trend. He would identify the dominant market direction and trade with it. He would see high-risk Martingale or Grid EAs, which inherently fight trends, as a form of financial suicide.

- He Would Cut Losses Without Hesitation: Livermore's cardinal rule was to never average losses. If a trade went against him, he would exit immediately. The emotional pain of taking a small loss was nothing compared to the financial ruin of holding on. A small account cannot afford to sustain large drawdowns.

- He Would Let His Profits Run: "Money is made by sitting, not trading." Once in a profitable trade that was aligned with the major trend, Livermore had the conviction to hold it. He would tell the small-account trader that one well-managed, big winning trade is infinitely more valuable than dozens of tiny, scalped profits.

Livermore would reject any "black box" that promised to replace his brain. He would embrace tools that enforced his own well-defined, trend-following strategy, but he would never outsource his judgment.

What Can a 1936 Self-Help Book Teach a 2025 Forex Trader?

Dale Carnegie's How to Win Friends & Influence People is not a trading book, but its lessons on human psychology are profoundly relevant to the trader's internal battle. The market, after all, is a reflection of collective human psychology.

10 Lessons from Dale Carnegie for the Modern Trader:

- Don't Criticize, Condemn, or Complain: Don't beat yourself up over a loss. It's a business expense. Complaining clouds your judgment and leads to revenge trading.

- Become Genuinely Interested in Other People (The Market): Don't just look at charts. Develop a genuine curiosity for why the market is moving. Understand the economic forces and sentiment driving price.

- If You Are Wrong, Admit It Quickly and Emphatically: This is Carnegie's version of "cut your losses." The moment the market proves your trade idea wrong, admit it and get out. There is no room for ego.

- The Only Way to Get the Best of an Argument Is to Avoid It: You cannot win an argument with the market. If you are long and the market is plummeting, the market is right. Don't fight it.

- Be a Good Listener. Encourage Others to Talk About Themselves: A trader's "listening" is observing price action. Let the market tell you its story through its highs, lows, and momentum before you jump in with your own opinion.

- Try Honestly to See Things from the Other Person's Point of View: Why are the bulls or bears in control? Understanding the other side's perspective helps you anticipate market movements and avoid being trapped.

- Arouse in the Other Person an Eager Want: Your trading plan should be so logical, so well-tested, and so compelling that you have an "eager want" to follow it, rather than feeling like it's a chore.

- Smile: Trading is stressful. Maintaining a positive, professional attitude, even after a loss, prevents you from spiraling into a negative mindset.

- Remember That a Person's Name Is... the Sweetest Sound: In trading, this translates to knowing your currency pairs. Understand the unique "personality" of EUR/USD versus GBP/JPY. Respect their volatility and behavior.

- Appeal to the Nobler Motives: Your "nobler motive" is to be a disciplined, professional trader, not a gambler. Every decision should serve this higher goal.

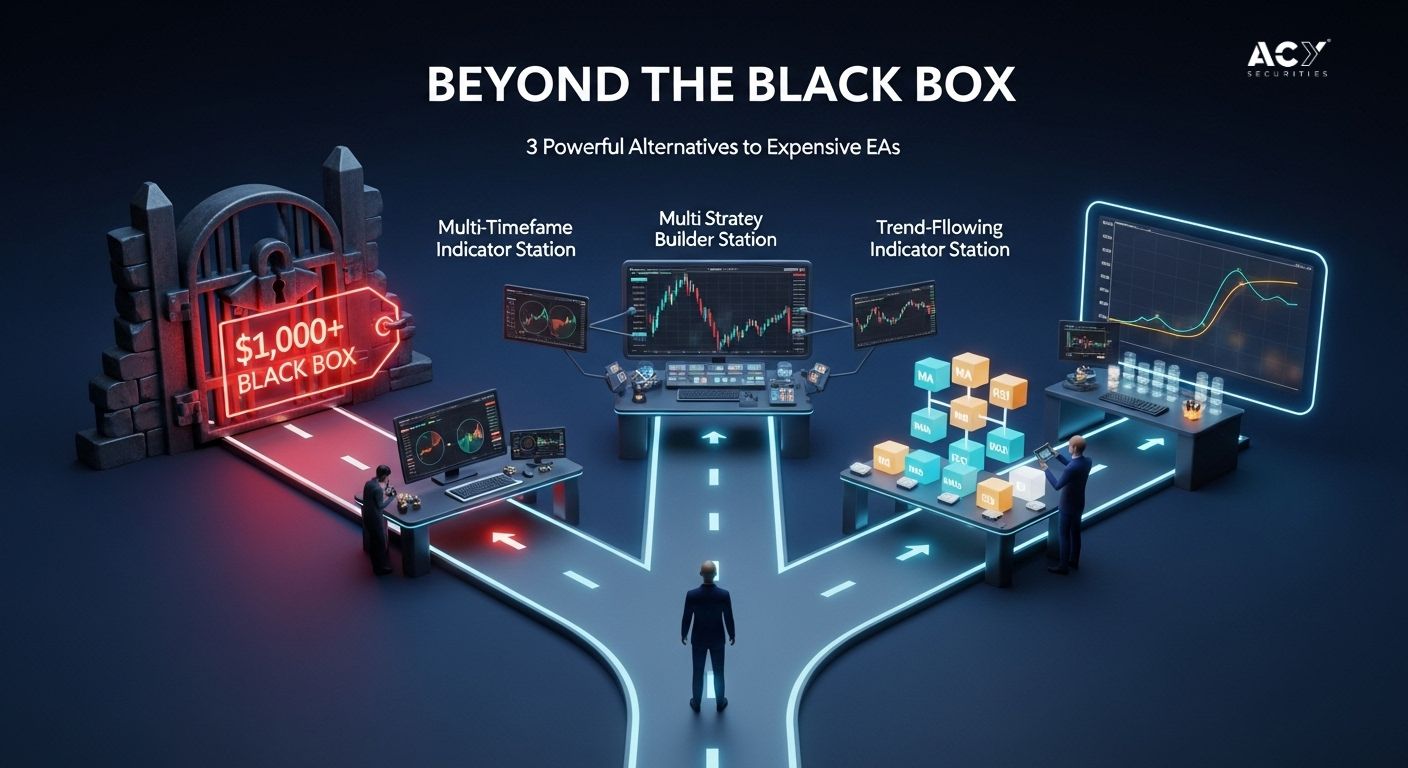

What if You Can't Afford a Premium EA? 3 Powerful Alternatives

If you've graduated from the beginner stages and want to use automation to assist, not replace, your trading, you don't need to spend $1,000 on a black-box robot. Here are three powerful, often free, alternatives that keep you in control.

- The Multi-Timeframe Indicator: A common mistake is analyzing a chart on only one timeframe. This tool displays the readings of an indicator (like the RSI) from multiple timeframes (e.g., M15, H1, H4) on a single chart. This gives you an at-a-glance view of the overall trend, helping you filter out weak signals and focus on high-conviction trades where all timeframes are aligned.

- The Multi-Strategy Trading EA / Builder: Instead of a single, rigid strategy, these tools let you build your own simple EA without coding. You can define entry rules based on a combination of indicators (e.g., "Enter BUY only if the 50 MA crosses above the 200 MA AND the RSI is oversold"). This enhances confirmation and allows you to automate your own nuanced, tested strategy.

- The Simple Trend-Following Indicator: The trend is your friend. This tool is designed to do one job perfectly: identify the dominant market direction with clear, unambiguous visual signals (e.g., a colored line on the chart). It removes guesswork, enforces discipline, and ensures you are always trading with the primary momentum.

These tools represent a smarter way to approach automation. If you'd like to explore this topic further, there are several powerful alternatives for hands-free trading that can enhance your strategy without breaking the bank.

Final Verdict: The Roadmap for the Prudent Beginner

The idea of using a free EA to trade a small account and achieve profitability is not a viable strategy for a beginner in 2025. It is a path littered with hidden costs, a steep learning curve, and an almost certain probability of financial loss.

A smarter journey exists.

- Phase 1: Foundation First (3-6 Months): Forget automation. Focus 100% on education. Use a demo account to learn manual trading, technical analysis, and risk management.

- Phase 2: Controlled Experimentation (3-6 Months): Explore the EA alternatives listed above on a demo account. The goal is not profit, but to learn the mechanics of automation and how these tools can augment your manual strategy.

- Phase 3: Live Trading: Whether it's a funded account or your own small live account, you must trade with the discipline of a professional. Risk no more than 1% per trade and treat it as a business.

Success in forex is a marathon of skill acquisition and emotional resilience. The discipline you need cannot be downloaded; it must be built. Invest in your education, master your psychology, and then, and only then, look to technology as a tool to augment your hard-won skills.

Frequently Asked Questions (FAQ)

Q: Can you really start forex trading with just $100?

A: Yes, you can start with $100, especially with brokers offering micro or cent accounts. However, it's crucial to have realistic expectations. With proper risk management (risking 1- 2 per trade), growth will be very slow. A $100 account is best used for learning to trade with real money and mastering your psychology, not for generating significant income.

Q: Are all forex EAs scams?

A: Not all EAs are scams, but the majority of those marketed to beginners, especially free ones, are dangerous. They often use high-risk strategies like Martingale that are designed to fail. Reputable EAs do exist, but they are sophisticated tools that require significant expertise to manage correctly. A beginner cannot distinguish between a good tool and a dangerous one.

Q: Is passing a prop firm challenge like FTMO difficult?

A: Yes, it is very difficult. The majority of traders who attempt the challenges fail. The combination of a profit target and strict drawdown limits creates intense psychological pressure. Success requires a proven, profitable trading strategy and excellent emotional control.

Q: Can I use an EA to pass a prop firm challenge?

A: While technically allowed by many firms, it is very challenging. You need to find an EA that can generate 8-10% returns in a month without ever having a 5% drawdown in a single day. Furthermore, if the firm detects that multiple traders are using the same EA (i.e., copy trading), they may disqualify all of them. A custom-coded EA is often necessary.

Q: What is the single most important thing for a small-account trader to focus on?

A: Capital preservation. A small account has no room for error. Your primary job is not to make money, but to protect the money you have. This means using strict stop-losses, risking only 1-2% of your capital per trade, and waiting patiently for only the highest-probability setups.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.