.jpg&w=3840&q=75)

How to Trade Reversal Patterns using Price Action

ACY Securities - Jasper Osita

ACY Securities - Jasper OsitaGoal of This Lesson:

To help traders recognize key candlestick reversal patterns, understand where and why they form, and avoid common traps when trying to catch tops and bottoms.

Real-Life Analogy:

Imagine brakes on a speeding car. The brake lights flashing aren’t the full stop — they’re signals the car might slow down. But whether it stops, turns, or just pauses depends on the road ahead.

Reversal patterns are the same: they're not guarantees, but signals. And just like you'd check mirrors, road signs, and traffic before turning, you need to confirm the market’s context before acting.

What Are Reversal Patterns?

Reversal patterns are price action structures that signal a potential change in direction. These patterns can appear at the top of an uptrend (bearish reversal) or at the bottom of a downtrend (bullish reversal).

But candlestick patterns alone are not enough. You need:

- Context: Where they form matters more than the pattern itself.

- Confluence: Other technical or fundamental clues that strengthen the case.

- Confirmation: The follow-through that validates the reversal idea.

Where Do Reversals Usually Happen?

Look for these setups at high-probability reversal zones:

- Previous highs/lows (session, day, week, or quarter)

- Major support/resistance zones

- Supply and demand areas

- Fibonacci levels (61.8%, 78.6%)

- Round numbers or psychological levels

- Trendline breaks or wedge patterns

- Fair Value Gaps or Order Blocks (SMC traders)

These are what you call your Key Levels.

Tip: The best reversals happen after liquidity is swept (price hits stops above/below a key level) and then rejects with momentum.

To learn more about these key levels, check these contents out:

Mastering Price Action at Key Levels – How to Spot, Trade, and Win at the Most Crucial Zones

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

How to Anticipate and Trade Reversals

1. Spot the Trap at Key Levels

- Wait for price to reach liquidity at key levels.

- Observe price for potential weakness.

Note: Don’t expect reversals at these levels, you wait for confirmation.

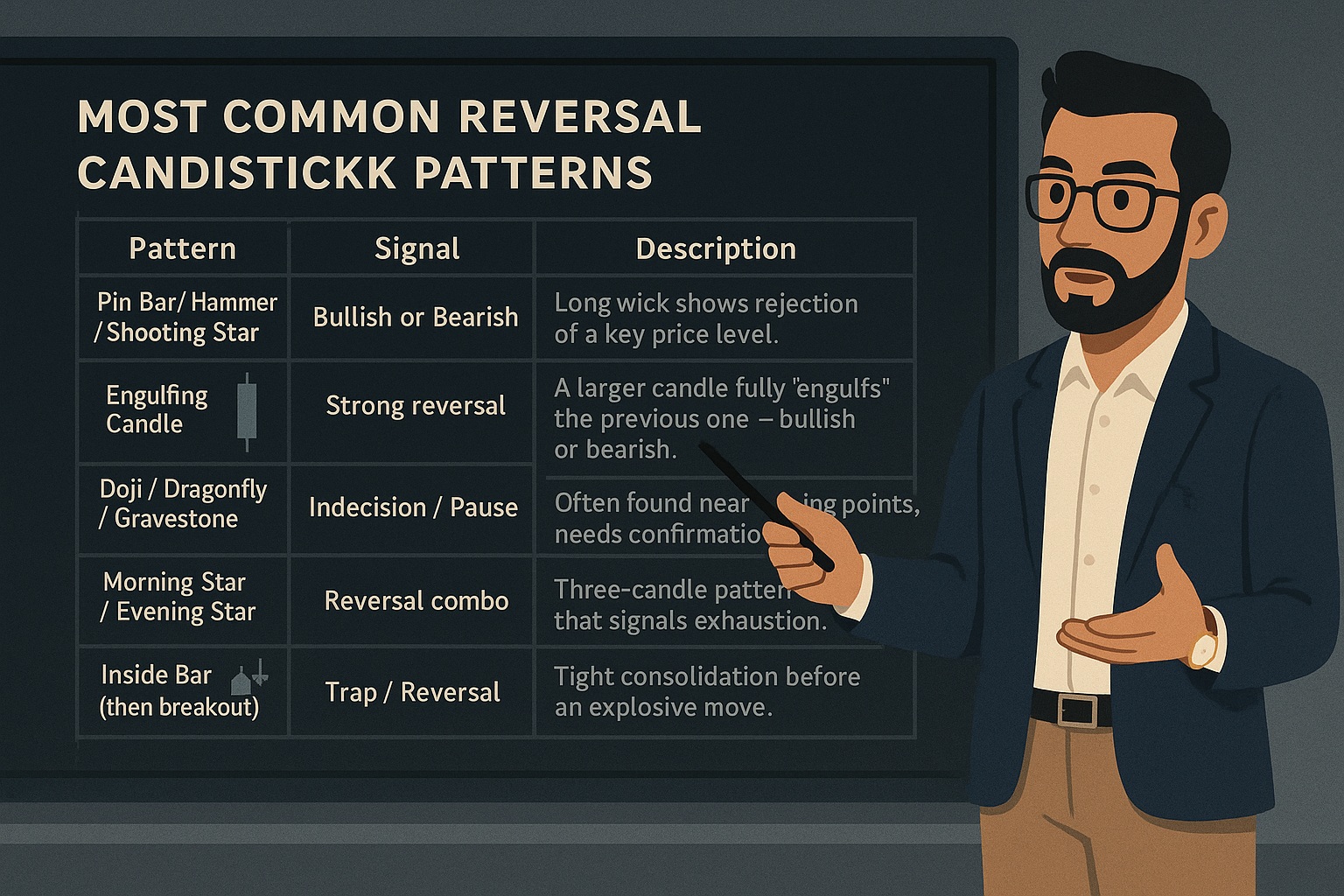

2. Identify the Pattern

- Wait for clear reversal candlestick (pin bar, engulfing, etc.).

- Observe if the pattern forms at the key level (not in the middle of nowhere).

3. Get Confirmation

- Entry only after a break of structure (BoS) or momentum candle.

- Lower timeframes help validate timing.

To learn more about candlestick patterns:

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

4. Define Risk

- Stop-loss beyond the wick of the reversal candle or the structure.

- Target previous structure points or Fibonacci levels.

How Long Should You Hold?

You’ve caught the reversal — now what?

Here’s how to stay in the trade without guessing:

Use Opposing Key Levels as Price Targets

- As price moves in your favor, mark the next key levels or swing high/low in the opposite direction.

- These are your natural exit zones — where other traders might start to take profits or reverse.

Look for Reversal Clues to Exit

- Use the same approach you used to enter:

- Wait for liquidity sweeps, reversal candles, or a break of structure against your trade.

- If you entered on a bullish pin bar, exit on a bearish pin bar + rejection at resistance.

You don't need to guess the top or bottom. Just trail your target using structure and exit when the same signs of reversal appear — but against you.

What to Avoid

- Trading reversals in the middle of a strong trend without context.

- Entering on weak patterns without follow-through.

- Relying only on candlestick names without understanding the story.

- Using reversal patterns as prediction tools instead of reaction tools.

- Ignoring higher timeframe context (reversals on M5 mean little if H1 is trending).

Reversal Checklist Before You Enter

| Check | Explanation |

|---|---|

| Key level? | Is this happening at support/resistance or a fib zone? |

| Liquidity taken? | Was there a sweep of highs/lows before the signal? |

| Reversal candle? | Is there a strong candlestick pattern confirming rejection? |

| Confirmation? | Is there a break of structure or momentum follow-through? |

| Risk defined? | Do you have a logical stop loss and target in mind? |

Actionable Tip:

Go back to your charts and mark the last 5 major reversals. What made them work?

Was there a sweep? A rejection candle? A higher-timeframe level?

Build your playbook from these real-world clues.

Final Thoughts

Most beginner traders lose money trying to predict reversals too early.

Smart traders wait for the signs, stack confluence, and let the market show its hand.

"Reversals aren’t guesses. They’re reactions to exhaustion."

— Price Action Proverb

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.