IG Announces Record Full Year Results

July 21, 2022 - IG Group reported their results for the last financial year ending 31st May 2022.

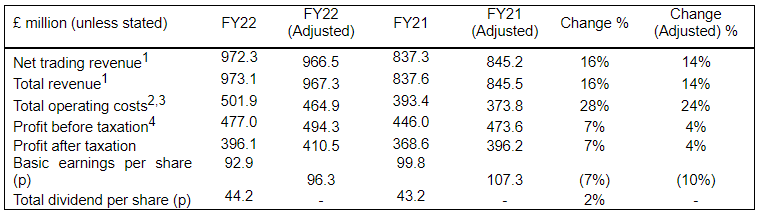

Highlights from the performance included an increase of 16% in net trading revenue to £972.3 million (FY21: £837.3 million) - although excluding the one-time gain associated with the financing of the Tastytrade acquisition, the adjusted net figure was £966.5 million - an increase of 14%.

Total revenue for tastytrade in the same period was £112.0 million, up 16% on a pro forma basis (FY21: £96.1 million).

Adjusted total revenue for IG Group’s Core Markets increased to £827.6 million (FY21: £825.5 million) whilst their High Potential Markets total revenue of £139.7 million was up 20% on a pro forma basis (FY21: £116.1 million). Exchange traded derivatives revenue from Spectrum, increased 90% to £9.3 million and Non-OTC derivative revenue increased to 16% of Group net trading revenue (FY21: 6%)

Financial Summary (continuing operations)

Profit before taxation was up 7% to £477.0 million (FY21: £446.0 million), while adjusted profit before taxation was up 4% to £494.3 million.

Basic earnings per share from continuing operations reduced to 92.9 pence (FY21: 99.8 pence), or 96.3 pence on an adjusted basis (FY21: 107.3 pence). This was down due to the shares issued for the tastytrade acquisition.

IG Group’s final proposed dividend of 31.24 pence per share, represents an increased full-year dividend of 44.2 pence per share (FY21: 43.2 pence per share). They have also announced a share buyback programme of up £150m which they expect to be mostly completed within FY23.

June Felix, Chief Executive Officer, commented: “Our outstanding performance this year is due to several factors: our clients, our people, and our strategy. The quality and loyalty of our clients has generated sustainable revenue, providing positive impact on our financial strength. This strength enables us to invest organically in key areas, expand regionally, create new products, and innovate strategically.”

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.