IMF Downgrade and Fed Drama Weigh on USD, Boost AUD and NZD

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

The U.S. dollar extended its decline this week as political pressure on the Federal Reserve and a downgraded U.S. growth forecast from the IMF rattled investor confidence. Despite President Trump’s reassurance that he won’t remove Fed Chair Jerome Powell, concerns over central bank independence continued to weigh heavily on the greenback.

USD – Pressured by Policy Credibility and Growth Concerns

U.S. dollar remains under broad selling pressure amid political interference fears and economic downgrade.

- President Trump clarified he won’t fire Fed Chair Powell, but markets remain wary of Fed independence.

- IMF downgraded 2025 U.S. growth to 1.8%, highlighting risks from tariffs and policy instability.

AUD – Gains on China Stability and Trade War Relief Signals

Australian dollar strengthened as PBoC policy support and renewed U.S.–China trade talks improved sentiment.

- China held lending rates steady, reinforcing Asia-Pacific economic stability.

- Secretary Bessent called the trade war “unsustainable” and hinted a near-term deal is likely.

NZD – Up on Risk Flows, Capped by Local Weakness

The New Zealand dollar tracked AUD gains but lagged slightly due to weaker domestic data.

- U.S. dollar weakness lifted NZD on global flows and improved risk appetite.

In response, commodity currencies like the Australian dollar and New Zealand dollar rebounded, though gains remain capped by trade risks and domestic data headwinds.

Trump Walks Back Powell Threat, But Dollar Still Suffers Amid Political Heat

The dollar weakened across major pairs this week, with traders discounting President Trump’s statement that he has “no intention” of firing Federal Reserve Chair Jerome Powell. Markets remained focused on the broader issue: increasing political pressure on the central bank just months before the U.S. election.

- The dollar was down nearly 6% in April fueling risk asset rallies and currency repositioning, but managed to rebound after Trump’s comment callback.

Check out my latest forecast and analysis on dollar here:

- Gold soared past $3,400/oz as investors fled dollar exposure in favor of safer stores of value.

Check out my latest forecast and analysis on gold here:

IMF Slashes U.S. Growth Outlook to 1.8%, Highlighting Tariff Fallout

Further compounding dollar weakness, the IMF downgraded its U.S. growth forecast, citing uncertainty from protectionist trade policies. This added to the narrative of long-term erosion in USD demand, especially among institutional players.

U.S.–China Tariff Talks Rekindle Optimism

In a surprise shift, diplomatic backchannels between Washington and Beijing reopened this week, sparking speculation of renewed negotiations over tariff schedules and bilateral trade terms.

- The development added another layer of support for AUD and NZD, both of which are heavily exposed to China’s economic trajectory.

- Markets responded positively, with investors positioning for potential tariff relief and increased commodity flows.

While talks remain early-stage, the prospect of reduced trade friction is enough to lift sentiment across Asia-Pacific FX.

Top U.S. Official Signals Trade War with China Is 'Unsustainable’

Adding to market optimism, U.S. Treasury Secretary Scott Bessent reportedly told a private JPMorgan conference this week that the current trade war with China is “unsustainable.” According to attendees familiar with the remarks, Bessent expressed confidence that:

“Washington and Beijing would reach a deal in the very near future.”

This behind-the-scenes comment added fuel to the AUD and NZD rally, reinforcing expectations that tariff relief may soon be on the table, which would benefit Asia-Pacific currencies tied to global trade.

Australian Dollar Rides the Wave: Buoyed by Dollar Decline and China Stability

AUD Rallies to Four-Month High on Weak USD and PBoC Rate Hold

The Australian dollar surged above 0.6400 this week, lifted by renewed risk appetite, dollar softness, and supportive signals from China.

- The People’s Bank of China left key lending rates unchanged, reinforcing stability in the region’s largest economy.

- Hopes of progress in U.S.-China trade discussions added further support, easing fears over commodity demand disruption.

Daily

After breaking new highs coming from a dip, Aussie is in a sustained upside.

As risk-on sentiment is still “on”, we are looking for a continued upside in favor of the Australian Dollar.

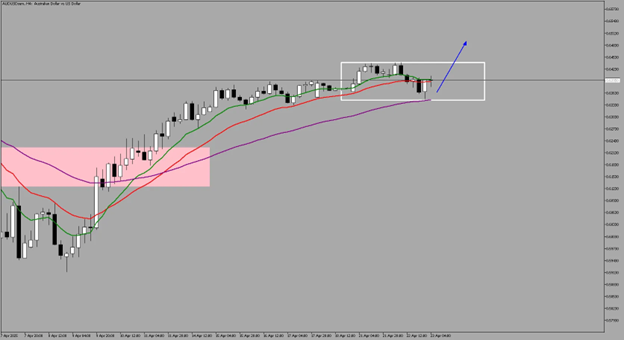

4-Hour

A breakout of 0.645 level could trigger an upside momentum with potential new highs.

As long as we continue to see a weakened US dollar, Aussie will continue to benefit from this trend.

Australia, as a major trading partner of China, stands to benefit from any de-escalation in tariff tensions, enhancing AUD appeal in global portfolios.

New Zealand Dollar: Gains Ground, Follows AUD Higher

NZDUSD posted moderate gains but remained below 0.6000. The move was driven by external factors, particularly USD softness and regional optimism, but constrained by local data.

Daily

Comparing with AUD, NZD gains more traction and higher upside.

We are above all the moving averages, signifying a continued strength with Kiwi.

This trend will continue to “trend” as long as risk-on sentiment is sustained backed by potential positive talks between US and China on tariffs.

4-Hour

Once price breaks the immediate high sitting at 0.603 level, we could see more upside on NZD.

AUDNZD Continued Downside: Kiwi on Strong Bullish Momentum over Aussie

Daily

As AUDNZD continues to trend lower with no signs of reversing, we’d like to participate on NZD for longs over AUD.

For currency profiling, choosing the better trade over correlated pairs, refer to my blog: https://acy.com/en/market-news/education/currency-pair-selection-guide-02272025-083809/

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

Join me in Discord: https://discord.gg/G8f7a5RnaF

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.