Integral Reports Average Daily Volumes of $44 Billion in July 2021

FX aggregator and technology firm, Integral reported its Average Daily Volume (ADV) figures for July 2021 today, with ADV across Integral platforms totalling $44.0 billion. This represents a decrease of -13.73% compared to June 2021, and an increase of +17.6% compared to the same period in 2020.

Integral's reported ADV represents volumes traded across the group’s entire liquidity network, including TrueFXTM and Integral OCXTM, in aggregate.

The sharp decline in ADV from Integral seems out of line with the other platforms that have already reported this month, with FXSPotStream reporting a decline of -2.40%, 360T a decline of -2.25% and Cboe Hotspot down -2.06%. No indication was given by Integral as to the reason behind the steep decline in trading volumes for July.

In June, Straits Financial announced that it had become a TrueFX clearing member, becoming the 5th Institutional Broker to do so.

The list of TrueFX brokers in the TrueFX Clearing Member (TCM) network now includes:

AxiCorp FXCM Pro Straits Financial Sucden Financial Velocity Trade

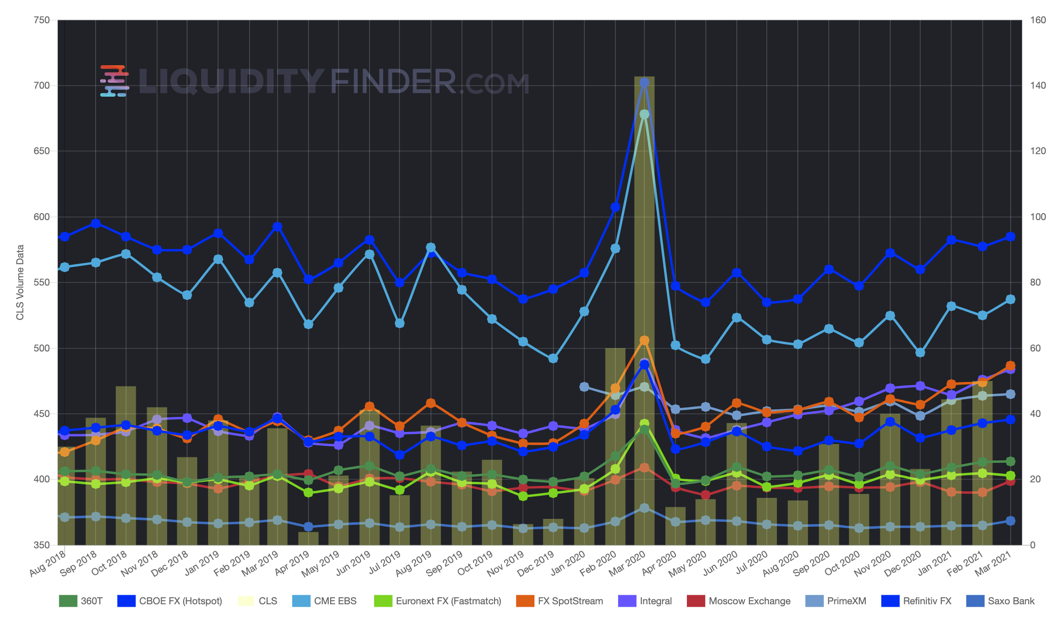

See Integral's Monthly ADV history and their relative performance against other venues by visiting the LiquidityFinder Market Volumes chart for Major FX Trading Venues here:

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.