JPY Struggles Amid Policy Caution, CAD Finds Strength in Oil

ACY Securities - Luca Santos

ACY Securities - Luca Santos

The Japanese yen (JPY) continues to face downward pressure, with market participants increasingly sceptical of any imminent policy shift by the Bank of Japan (BoJ). Despite growing speculation that the BoJ could gradually unwind its ultra-loose monetary stance, the central bank remains cautious. The latest inflation data suggests persistent but controlled price growth, failing to provide a decisive trigger for a change in policy. Additionally, Japan's wage growth figures, a crucial factor in the BoJ’s decision-making, have yet to show the sustained acceleration needed to justify a tighter monetary policy stance. The broader macroeconomic landscape, including global risk sentiment and U.S. Treasury yield movements, remains the dominant force influencing JPY price action.

USDJPY H1 Chart

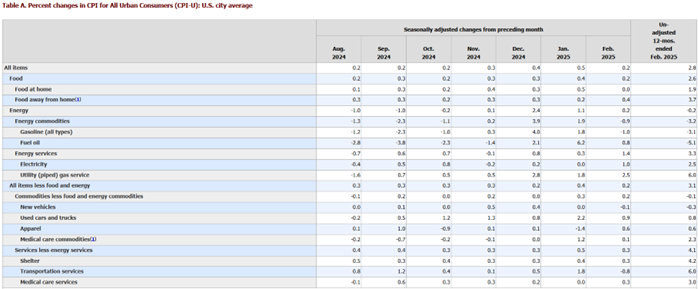

The Federal Reserve's continued restrictive monetary policy has further exacerbated JPY weakness. With U.S. inflation proving stickier than expected market pricing for potential Fed rate cuts has been pushed further into 2024, reinforcing the interest rate differential that favours the U.S. dollar over the yen. This divergence has kept USD/JPY elevated, testing multi-decade highs and prompting renewed speculation about potential currency intervention by Japanese authorities. However, past interventions have only provided temporary relief, and markets remain sceptical about their long-term effectiveness unless accompanied by a meaningful shift in BoJ policy. The risk of further yen depreciation remains high, especially if U.S. bond yields continue to rise, extending the carry trade advantage for the dollar.

USA CPI

The BoJ has signalled that it is closely monitoring FX markets, with officials repeatedly stating that excessive volatility is undesirable. If the yen weakens beyond key psychological levels, the Japanese government may feel compelled to intervene, particularly if depreciation threatens corporate profitability or erodes consumer purchasing power. Nonetheless, without a clear shift in BoJ monetary policy, any intervention efforts may only provide a temporary reprieve.

Meanwhile, the Canadian dollar (CAD) has shown relative resilience, supported by firm crude oil prices and a steady domestic economic outlook. The Bank of Canada (BoC) has maintained a balanced stance, emphasizing data dependence in its future rate decisions. While inflationary pressures in Canada have eased compared to their 2022 peaks, they remain elevated enough to keep the BoC cautious about prematurely loosening monetary policy. The latest employment and GDP figures suggest a slowing but still resilient economy, keeping rate-cut expectations in check.

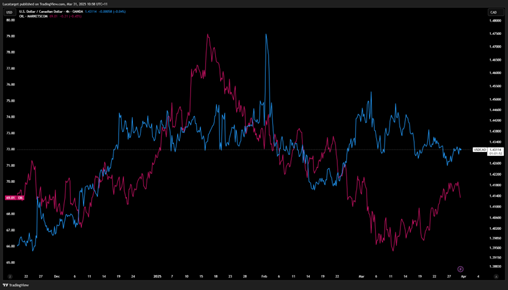

USDCAD x OIL (Pink)

A key driver for CAD’s near-term direction remains the outlook for the Federal Reserve. Any signals of prolonged higher U.S. interest rates could limit CAD’s potential gains, as investors continue to favour the greenback in a high yield environment. Additionally, ongoing strength in oil markets has provided crucial support to the CAD. Global supply constraints, exacerbated by geopolitical tensions in the Middle East and OPEC+ production cuts, have kept crude oil prices elevated. Since oil exports account for a significant portion of Canada’s GDP, sustained strength in energy prices tends to translate into CAD appreciation. However, any slowdown in global demand—particularly from China, which remains a key consumer of commodities could introduce fresh downside risks for the loonie.

Beyond oil prices, the performance of the Canadian housing market and domestic consumer trends will play a crucial role in shaping the BoC’s policy trajectory. Housing market activity has shown signs of cooling, with higher interest rates dampening mortgage demand and slowing price appreciation. If economic growth continues to slow and inflation moderates further, expectations for rate cuts could gain traction, weighing on CAD. Additionally, weaker household spending due to rising debt servicing costs could further justify a shift towards monetary easing in the coming months.

Recent market developments highlight the divergence between the BoJ’s hesitancy to act and the Fed’s continued restrictive stance. With U.S. economic data remaining robust, expectations for rate cuts in 2024 have been dialled back, further weighing on JPY performance. The BoJ’s interventions remain a wildcard, though history suggests authorities will step in only if FX moves become excessively disorderly. Should the yen weaken further, verbal warnings or direct market intervention may resurface, though their effectiveness remains uncertain.

For the CAD, oil price trends are crucial. While crude prices remain elevated, any significant shifts in global supply dynamics, including potential increases in U.S. shale production, could cap further gains. Additionally, domestic factors such as Canada’s housing market and consumer spending trends will play a role in shaping the BoC’s policy outlook. If inflation continues to moderate and economic activity slows, expectations for rate cuts could build, putting downward pressure on the CAD.

Looking ahead, markets will closely watch key economic indicators and central bank signals. JPY traders will scrutinize any BoJ commentary for hints of policy recalibration, while CAD traders will keep an eye on energy markets and BoC rhetoric. Given the complex interplay of global factors, FX volatility is likely to persist, reinforcing the need for strategic positioning in both JPY and CAD markets. The broader risk sentiment, influenced by geopolitical developments and shifting growth expectations, will also remain critical in determining market direction. The coming months may prove decisive for both currencies, as investors weigh the evolving monetary policy landscape against macroeconomic trends and external risks.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.