.jpg&w=3840&q=75)

MAM vs Copytrading vs PAMM: How to Choose Your Managed Forex Account?

This article is reviewed annually to reflect the latest market regulations and trends

TL;DR: How to Choose Your Managed Forex Account

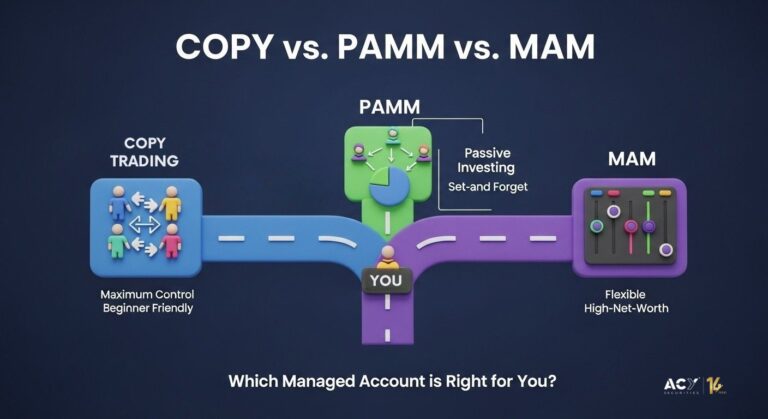

Copy Trading: Best for investors who want maximum control, real-time transparency, and a low barrier to entry. You directly mirror a top trader trades in your personal account, making it ideal for beginners or hands-on learners.

PAMM (Percentage Allocation Management Module): The ideal choice for passive, “set-it-and-forget-it” investors. Your funds are pooled with others in one master account, and profits are distributed proportionally.

MAM (Multi-Account Manager): The most flexible and sophisticated solution. It allows a money manager to customize trade allocations and risk levels for different investors, making it best for high-net-worth clients with specific goals.

The Core Decision: Choosing the best managed account requires you to compare MAM vs. PAMM vs. Copy Trading based on your personal goals for investor control, risk tolerance, and fee structure.

Finding the Right Partner: A trustworthy broker should offer all three systems, giving you the power to select the solution that perfectly aligns with your forex investment strategy.

“The individual investor should act consistently as an investor and not as a speculator.” Benjamin Graham

MAM vs. Copy Trading vs. PAMM: The Best Guide to Choosing Your Fund Manager in Forex 2025

How to Choose Your Managed Forex Account?

You’re ready to enter the forex market, but you want to leverage the skills of seasoned professionals rather than go it alone. That’s a smart decision. But then you encounter the jargon: MAM, PAMM, Copy Trading. It feels like an alphabet soup of acronyms, each promising a path to success, yet leaving you more confused than when you started. Which one is right for you?

This isn’t just another article that defines terms. This is your definitive guide to making a clear and confident choice. We will dissect each model, lay out the pros and cons in plain English, and provide a direct comparison so you can align your personal investment goals with the right solution.

The most important takeaway? There is no single “best” system. There is only the system that is best for you. Your objectives, your desired level of control, your risk appetite, and your fee sensitivity will point you to the right answer. Let’s clear the fog and find your perfect fit.

The Shared Dream: Leveraging Professional Expertise

Before we dive into the differences, let’s appreciate the shared goal of all three systems. MAM, PAMM, and Copy Trading are all designed to solve the same problem: they allow an investor (you) to allocate funds to an experienced trader (a Money Manager) who then trades on your behalf. You benefit from their expertise and market knowledge without having to execute the trades yourself.

Think of it as having a professional pilot fly the plane while you enjoy the journey. But the type of plane, the control you have in the cabin, and the ticket price will differ. Let’s explore your aircraft options.

1. Copy Trading: The Social Network of Investing

What is it? Copy Trading is exactly what it sounds like. It is the most accessible and intuitive of the three models. It allows you to automatically “copy” the trades of another successful trader in real-time. If they buy EUR/USD, your account buys EUR/USD. If they sell, you sell. It’s like a social media feed, but for trading.

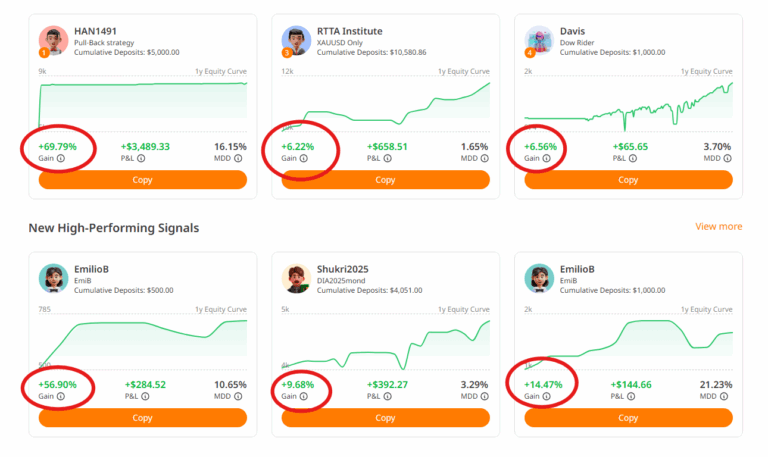

How does it work? You browse through a list of vetted traders (often called Strategy Providers or Signal Providers), view their performance history, risk profile, and trading style. Once you find one you like, you allocate a portion of your funds to copy them. Your account then mirrors their actions proportionally.

The Power of Simplicity and Diversification

One of the most effective ways to begin is with an easy-to-follow copy trading strategy that involves copying multiple traders. By diversifying across 4-5 different traders with varied styles, you spread your risk instead of putting all your faith in a single person.

Pros:

Extreme Accessibility: It’s the easiest to understand and set up, perfect for beginners.

Full Transparency: You see every single trade in your own account in real-time.

Complete Control: You can stop copying, pause, or close individual trades at any moment. The funds are always in your personal account.

Low Barrier to Entry: You can often start with a very small investment.

Cons:

Potential for Slippage: In highly volatile markets, the price at which your trade is executed might differ slightly from the master trader’s price.

Requires Active Monitoring: While automated, it’s wise to monitor performance and decide if you want to continue copying a provider.

Who is Copy Trading best for? The beginner investor who wants to get started quickly, the hands-on learner who wants full transparency, or the busy professional who values simplicity and control.

2. PAMM: The Mutual Fund of Forex

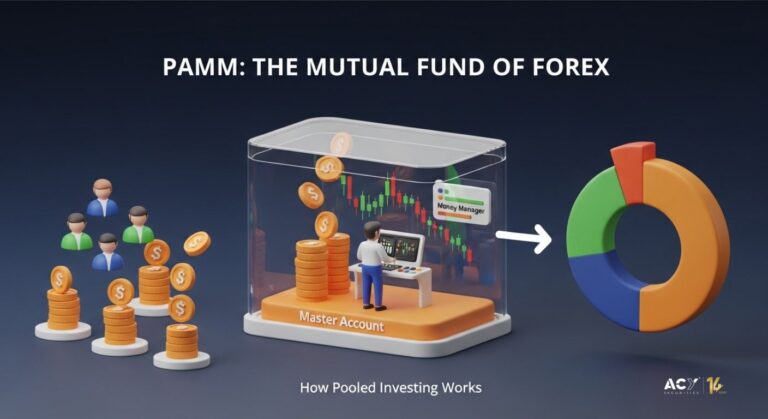

What is it? PAMM stands for Percentage Allocation Management Module. This is a more traditional model where investors’ funds are pooled together into a single master account managed by a professional trader.

How does it work? You invest your capital into the Money Manager’s PAMM account. Your funds join the capital from other investors to form one large pool. The manager then trades this entire pool as a single entity. Profits and losses are distributed among all investors based on their percentage share of the total pool. If you contributed 10% of the capital, you receive 10% of the profits (or absorb 10% of the losses).

The “Set It and Forget It” Appeal

The PAMM model is brilliantly simple from the investor’s perspective. You choose a manager, invest your funds, and they handle the rest. The allocation of profits is done automatically by the broker, ensuring fairness and accuracy. This system is a cornerstone of managed accounts, and understanding the core differences between MAM vs. PAMM is crucial for any serious investor.

Pros:

Simplicity: You invest once, and the rest is handled for you.

Collective Buying Power: The large, pooled fund can sometimes access better trading conditions.

Fair Distribution: The percentage-based system is straightforward and transparent in its calculations.

Cons:

Less Control: You cannot interfere with trades or manage individual positions. Your funds are locked into the pool.

Limited Transparency: You typically receive periodic reports rather than seeing every trade in real-time in your own account.

Uniformity: All investors in the pool receive the same trading results, regardless of their individual risk tolerance.

Who is PAMM best for? The passive investor who prefers a “hands-off” approach, similar to investing in a traditional mutual fund, and is comfortable relinquishing direct control over trading decisions.

3. MAM: The Bespoke Suit of Managed Accounts

What is it? MAM stands for Multi-Account Manager. This is the most sophisticated and flexible of the three systems. While it appears similar to a PAMM on the surface, a MAM account gives the Money Manager far more granular control over how trades are allocated across different investor accounts.

How does it work? The Money Manager trades from a master account, but they can allocate trades to sub-accounts (the investors) using various methods. They aren’t restricted to just a percentage allocation like in a PAMM. They can assign different levels of leverage or risk to different investors based on their specific goals and risk appetite. For a complete breakdown, it helps to understand what a MAM account is at its core.

Customization and Flexibility

Imagine an investor who is aggressive and wants higher leverage, and another who is conservative. With a MAM system, the manager can execute one trade but allocate it differently to satisfy both clients’ risk profiles. This level of customization is the MAM’s superpower.

Pros:

Maximum Flexibility: Allows for tailored trading strategies and risk management for different investors.

Greater Control for the Manager: The manager can reward long-term investors or cater to specific client needs.

More Complex Strategies: Enables sophisticated trade allocation methods beyond simple percentages.

Cons:

Complexity: Can be more difficult to understand for the average investor.

Less Transparency for the Investor: The allocation method can be less straightforward than a simple percentage split.

Typically Higher Investment Minimums: Due to its complexity, it’s often reserved for higher-net-worth individuals.

Who is MAM best for? Sophisticated investors who require a customized solution, or for Money Managers who need the flexibility to manage diverse client portfolios with varying risk tolerances.

What is the difference between MAM and PAMM? And why do we group them?

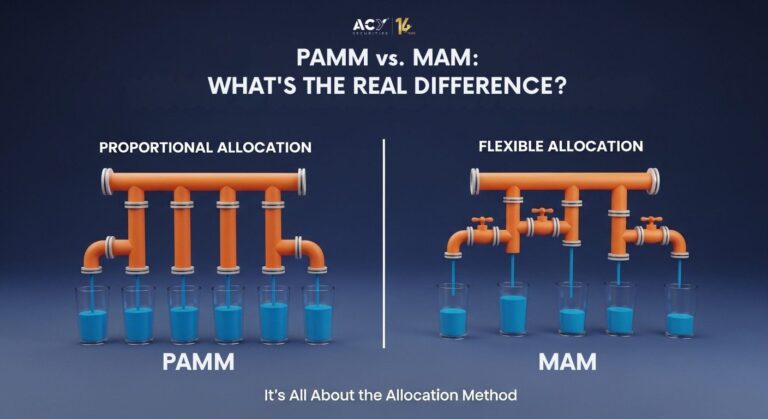

Because they are the same thing, the only differentiation is the allocation methods in use. PAMM system allows the fund manager to proportionally allocate trades to all aggregated sub-accounts according to balance, equity, or margin level.

On the other hand, MAM has various allocation methods which allow investors to choose their risk level on their trading account. In this case, a fund manager can allocate trades to subaccounts based on lots or percent of the equity. For example, an investor with USD$5000 on his account could risk 10% percent of the capital per trade. Another investor with $10,000 chooses only to risk 1% percent per trade.

In addition, the PAMM and MAM systems can hide trades from the investor using P/L methods. These methods are ideal for a fund manager willing to keep their strategy secret to save property rights. In this scenario, the fund manager has access to master orders from the backend while the investor receives the P/L after the position has been closed.

The Ultimate Comparison: MAM vs. PAMM vs. Copy Trading

To make your decision easier, let’s put them side-by-side. Your choice depends entirely on what you value most.

| Feature | Copy Trading | PAMM (Percentage Allocation) | MAM (Multi-Account) |

| Investor Control | Highest: You can stop, pause, or close trades at any time. The funds are in your name. | Lowest: Funds are pooled. You cannot interfere with live trades. You commit capital for a set period. | Low-to-Medium: More control than PAMM as your account is separate, but trades are still managed for you. |

| Transparency | Highest: See every trade executed in your account in real-time. | Medium: View periodic statements and reports. Not real-time trade-by-trade visibility. | Medium: Similar to PAMM, you receive reports, but the allocation logic can be more complex. |

| Best For | Beginners & Hands-on Learners | Passive, “Set-and-Forget” Investors | Sophisticated & High-Net-Worth Investors |

| Risk Management | Self-Directed: You choose who to copy and can diversify easily across multiple traders. | Manager-Directed: Risk is uniform across all investors in the pool. | Manager-Directed & Customizable: Risk can be tailored to individual sub-accounts. |

| Fee Structure | Performance fees, spreads, or subscription fees. | Management fees and performance fees, taken from the pooled funds. | Management fees and performance fees, highly customizable. |

| Minimum Investment | Lowest | Medium | Highest |

How to Make Your Choice: Ask Yourself These 3 Questions

What Level of Control Do I Truly Want?

If you want the final say and the ability to intervene at any moment, Copy Trading is your answer. If you believe in a “set it and forget it” philosophy and trust a manager completely, PAMM is a perfect fit.

How Important is Simplicity vs. Customization?

If you want the easiest, most straightforward path to get started, nothing beats the intuitive nature of Copy Trading. If you are a high-net-worth individual with specific risk parameters that require a bespoke solution, the flexibility of a MAM account is what you need.

What is My Primary Goal? Learning or Passive Income?

If your goal is to learn the markets by observing professionals while participating, Copy Trading offers an unparalleled educational window. If your sole focus is allocating capital for passive returns with minimal involvement, PAMM is designed for precisely that purpose.

Your Partner in Success

For investors and aspiring Money Managers alike, the broker is the critical link. A premier broker doesn’t just offer one solution; they provide a suite of options because they understand that every investor is different. This is also vital for partners and Introducing Brokers, who can better serve their clients by guiding them to the right product. An Introducing Broker who understands these nuances can build immense trust and long-term relationships.

At ACY Partners, we proudly offer multiple systems because we believe in empowering our clients with choices that fit their unique journey.

Conclusion

The “MAM vs. Copy Trading vs. PAMM” debate isn’t about finding a winner. It’s about self-discovery. By understanding the core mechanics of each system, you can move past the confusing acronyms and make a strategic decision that aligns with your personal financial goals.

Whether you’re drawn to the transparent simplicity of Copy Trading, the hands-off nature of a PAMM, or the bespoke power of a MAM account, the right path is waiting. Do your due diligence, assess your goals, and step confidently into the world of managed forex trading.

Frequently Asked Questions

Q1: Is copy trading profitable for beginners?

Copy trading can be profitable for beginners, but it is not guaranteed. Success depends on choosing the right traders to copy, practicing good risk management (like diversifying across several traders), and understanding that past performance is not indicative of future results. It is an excellent tool for learning and participation.

Q2: Can you lose all your money in a PAMM account?

Yes, as with any form of investment, it is possible to lose money in a PAMM account. The value of the account will fluctuate based on the performance of the Money Manager’s trades. It is crucial to review a manager’s history, risk strategy, and maximum drawdown before investing.

Q3: What are the typical fees for a MAM account?

MAM account fees are highly variable but typically consist of a management fee (a small percentage of the total assets under management) and a performance fee (a percentage of the profits generated). These terms are negotiated between the investor and the Money Manager.

Q4: Which system offers the most transparency?

Copy Trading offers the highest level of transparency. Because all trades are mirrored in your personal trading account, you can see every position opened and closed in real-time, 24/7. PAMM and MAM accounts typically provide transparency through periodic reports.

For more detailed insights on developing daily trading routines, risk management, and effective position sizing strategies, explore additional articles on ACYPartners. Our experts at ACY and FinLogix are also great resources to guide your journey towards trading excellence.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.