Market Breather or Trap? U.S. Indices React to Global Trade Turbulence

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

Last week, Wall Street rode a razor’s edge between relief and renewed anxiety. What began as a sharp rebound from early-April selloffs quickly turned into a cautious drift lower as fresh trade headlines and regulatory shifts rekindled investor fears. While some optimism emerged midweek from easing tariff threats on U.S. allies, new restrictions on tech exports to China and fading progress in trade talks with Europe reminded markets just how fragile the current rally is.

- Wall Street Balances Relief and Renewed Uncertainty

Markets rebounded early in the week before drifting lower on renewed trade and regulatory concerns.

- Temporary relief from a 90-day tariff pause boosted short-term sentiment.

- Unresolved trade friction with China and Europe rekindled downside anxiety.

- Trump: “It’s Up to China” to Make the Next Move

Fresh White House comments added pressure on Beijing and shifted risk back into the market.

- U.S. holds firm on China tariffs despite easing restrictions for allies.

- Lack of new offers from China leaves the trade standoff unresolved.

- EU Trade Talks Falter, Tariffs Expected to Stay

Brussels warns that negotiations with Washington are stalled and largely symbolic.

- Most tariffs likely to remain in place with limited progress made.

- Uncertainty weighs on exporters and risk-sensitive sectors.

- Volatility Eases Slightly, But Risk Remains Elevated

Despite a cooler VIX reading, markets remain cautious under the surface.

- VIX retreats from 40 to 33, showing reduced panic but lingering unease.

- U.S. 10-year yields stay near 4.5% as inflation and Fed uncertainty persist.

- DOW Recovers But Outlook Remains Divided

After invalidating a bearish imbalance, DOW enters consolidation with a mixed tone.

- Price holds above the 50% range, favoring a bullish lean.

- A break below may reintroduce downside bias amid fragile sentiment.

- NASDAQ Holds Gains Despite Nvidia Shock

Tech remains a relative outperformer, even as chip restrictions cloud the horizon.

- U.S. blocks Nvidia’s H20 chip exports to China, risking $5.5B in revenue.

- Apple and Microsoft continue to attract capital on strong positioning.

- S&P Clears One Imbalance, Eyes the Next

The S&P 500 shows signs of recovery after clearing a key range, but confirmation is needed.

- Next upside target lies at the 5396–5523 zone if momentum continues.

- Progress in Big Tech and macro relief could drive continuation — if policy risk doesn't intervene.

Trump: "It's Up to China" to End the Trade War

In an unexpected pivot, President Trump told reporters that it’s now China’s move to propose a new tariff deal. This statement — made after markets had begun pricing in easing tensions — injected fresh uncertainty into the global trade outlook. Though the U.S. granted some 90-day exemptions to allies, Trump reaffirmed that China remains squarely in the crosshairs.

“If China wants peace, they know what to do,” Trump said, signaling no further concessions until Beijing offers a new deal.

EU Sees Little Progress in Talks with U.S.

Meanwhile, the European Union confirmed that it expects most U.S. tariffs to remain in place, citing stalled negotiations. Officials in Brussels said the U.S. had shown little intent to roll back import duties, and any progress would likely be “limited and technical.”

This hardened posture sent a clear signal to traders: global trade frictions are far from resolved. For multinational companies and exporters, uncertainty around tariffs remains a major overhang.

Liquidity & Volatility: Calm on the Surface, Risk Beneath

Markets appeared relatively recovering amidst the 90-day tariff pause— but the CBOE Volatility Index (VIX) told a deeper story. After spiking near the 40 level in early April, the VIX moderated to around 33 by April 15, suggesting lower panic but persistent caution.

Meanwhile, institutional flows showed signs of divergence. While U.S. equity ETFs saw fresh inflows, bond yields remained elevated, with the 10-year Treasury Yields hovering near 4.5%, reflecting inflation risk and uncertainty about the Fed’s next move.

For a reference of the market overview, check out my latest video:

DOW

Daily

After the Dow invalidated the bearish imbalance between 39198.07 and 40387.70 by trading through it, the index is now showing signs of a potential recovery.

However, while the 90-day tariff pause has offered some temporary market relief, this may be no more than a brief breather in an otherwise uncertain environment. The broader outlook remains fragile.

4-Hour

Dropping down to the 4-hour chart, price is currently consolidating above the 50% midpoint of the range, which suggests a bullish bias. A breakout above the nearby resistance could act as a trigger for a continued recovery to the upside.

If price breaks below the 50% level and begins consolidating beneath it, a bearish bias will take precedence. With ongoing market turmoil, the broader outlook leans more toward continued downside than a sustained recovery.

NAS

Nvidia Hit with New China Export Curbs

Just as the market began digesting the temporary tariff relief, Nvidia dropped a bombshell: the U.S. government has placed fresh restrictions on its advanced H20 AI chips, blocking shipments to China unless a special license is granted.

Apple, Microsoft, and the Rest of Big Tech Show Resilience

Despite Nvidia’s headline risk, the broader Magnificent 7 — including Apple, Microsoft, Amazon, and Alphabet — showed resilience. Apple extended gains from its earlier rebound following tariff exemptions, and Microsoft continued to attract flows as a defensive AI play. Yet the sector remains in a fragile balance, and policy tailwinds could shift direction quickly.

Daily

Same can be seen with NASDAQ. Price pushed thru the volume imbalance and its currently holding for a bullish potential.

4-Hour

Amidst a choppy price action with the main tech stocks like Apple, Nvidia, we could see an upside potential if price breaks out of the range and gets sustained.

As of now, we are still consolidating above 50% inside the bigger range.

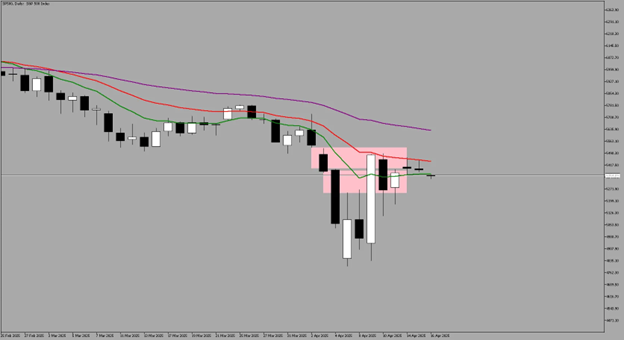

S&P

Daily

S&P has also invalidated the 1st layer of volume imbalance at 5247.21 - 5384.08.

The next layer for upside move is 5396.53 - 5523.69. Once we break these levels and we get a follow-through, we might see S&P, together with NASDAQ to gain traction for a potential recovery.

Final Word

"Markets are built on expectations — not guarantees. And right now, expectations are changing by the headline."

For now, the outlook remains murky — but that’s also where the opportunity lies. The fundamentals are the narrative behind the technicals— but price action remains king, as it ultimately reflects the collective emotions and decisions of market participants.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

Join me in Discord: https://discord.gg/G8f7a5RnaF

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.