MarketAxess Partners With CFETS to Provide Access to China's Bond Market

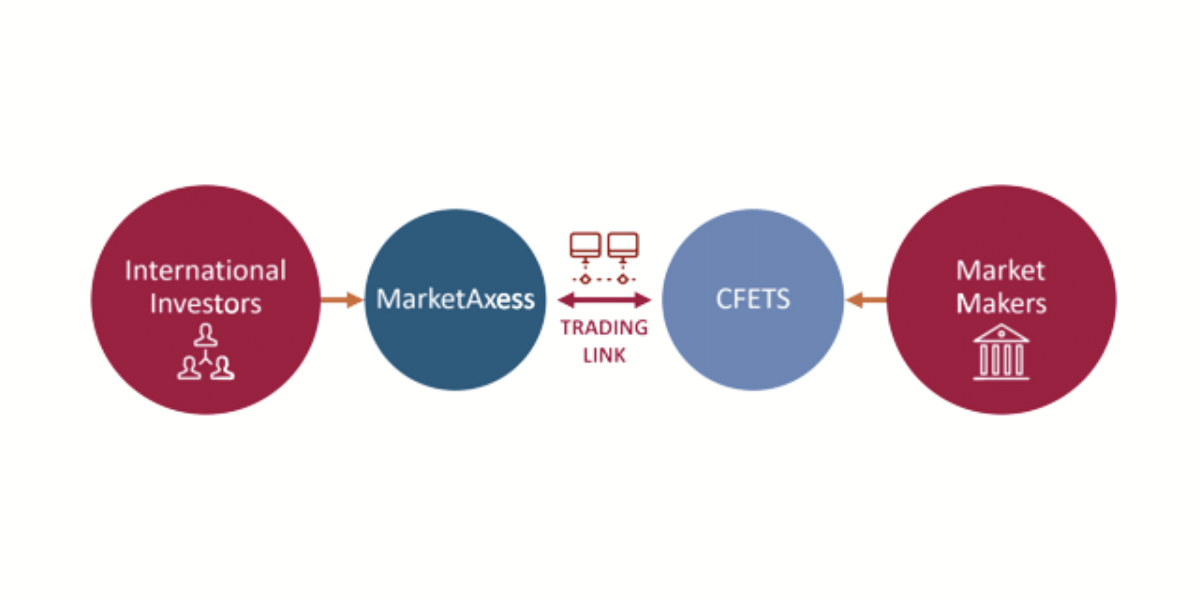

September 28, 2021 - Electronic fixed-income trading platform MarketAxess announced today the launch of a new trading channel for its global investors to access the China Interbank Bond Market (CIBM). Access is via the connection between CFETS and MarketAxess under the Bond Connect and CIBM Direct schemes, in partnership with China Foreign Exchange Trade System (CFETS) and Bond Connect Company Limited (BCCL).

Global investors on MarketAxess are now able to trade onshore Chinese bonds through a single, integrated, easy-to-use trading interface.

To initiate a trade, an investor sends a request-for-quote (RFQ) via the MarketAxess platform, which acts as an interface to transmit the quote information to onshore dealers either via Bond Connect or CIBM Direct.

The response is then communicated back to MarketAxess by the CFETS. The yield and price are then displayed back on the MarketAxess interface, investors accept a price and the trade is then done.

Trading hours are 9:00AM – 12:00PM and 1:30PM – 8:00PM (China Standard Time).

"This launch is the result of a close partnership between MarketAxess and CFETS that aims to enhance investor experience in the China interbank market," said Rick McVey, Chairman and CEO of MarketAxess. "I'm delighted that together we're able to bring greater, more diverse global investor participation to the $15trn onshore bond market, and I'm excited to think of the many opportunities for collaboration that lie ahead."

Christophe Roupie, Head of EMEA & APAC at MarketAxess, added, "We saw a 74% increase in our trading volume across Asia Pacific in 2020. That success is built on the strategic investments we've made to help the region's bond markets to innovate, improve workflow efficiency and attract greater global client participation. This launch is another important milestone for our continued international growth."

Zhang Yi, President of CFETS, said, "As an important financial infrastructure of China's interbank bond market, CFETS has been committed to facilitating global investors to invest in the interbank bond market while continuously providing better services through closer collaboration with global trading platforms. Our partnership with MarketAxess can now provide overseas investors with new access to the mainland bond market. In the future, both parties shall explore more opportunities to further promote the opening-up of China's interbank bond market."

MarketAxess clients will be able to trade directly with onshore market makers via CFETS, using already familiar MarketAxess trading protocols such as Request-for-Quote (RFQ) and list trading functionality. The addition of the China interbank market extends MarketAxess' leading global fixed income trading coverage, which reached $669 billion in total credit trading volume in the second quarter. It also further enhances the firm's leadership in emerging markets debt, which currently covers over 27 local-currency bond markets and more than 1,800 trading participants through the Open Trading all-to-all ecosystem.

"We are delighted with the addition of MarketAxess as a new access platform to Bond Connect's trading link," said Julien Martin, General Manager of Bond Connect Company Limited. "We are optimistic that this will further promote enhanced liquidity alongside increasing international participation in the China interbank bond market. We are witnessing higher demand for credit assets among foreign investors, and we believe MarketAxess will add significant value in the space."

"We are pleased to see that access to the China onshore bond market is being made easier and more efficient. China presents an immense opportunity for foreign investors. This is particularly true for the growing onshore bond market, where continued inclusion in leading global indices is helping to drive investors' interest", said Patrick Leung, Head of APAC Fixed Income and Foreign Exchange Trading at BlackRock.

Stephen Chang, Portfolio Manager, Asia at PIMCO, also commented, "The expansion of China's debt market and its continuing inclusion in the world's leading indices is driving increased investor demand for Chinese corporate and government bonds. We're very pleased to see MarketAxess offering a simple, integrated way to trade those bonds on their platform, and look forward to the efficiency gains that will bring."

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.