Markets Are Repricing Fast And The Dollar’s Losing Its Grip

ACY Securities - Luca Santos

ACY Securities - Luca SantosIt’s not often that one report can shake the whooe market narrative, but that’s exactly what happened after Friday’s U.S. non-farm payrolls data.

I’ve been watching these developments closely, and the shift in sentiment is something traders shouldn’t underestimate.

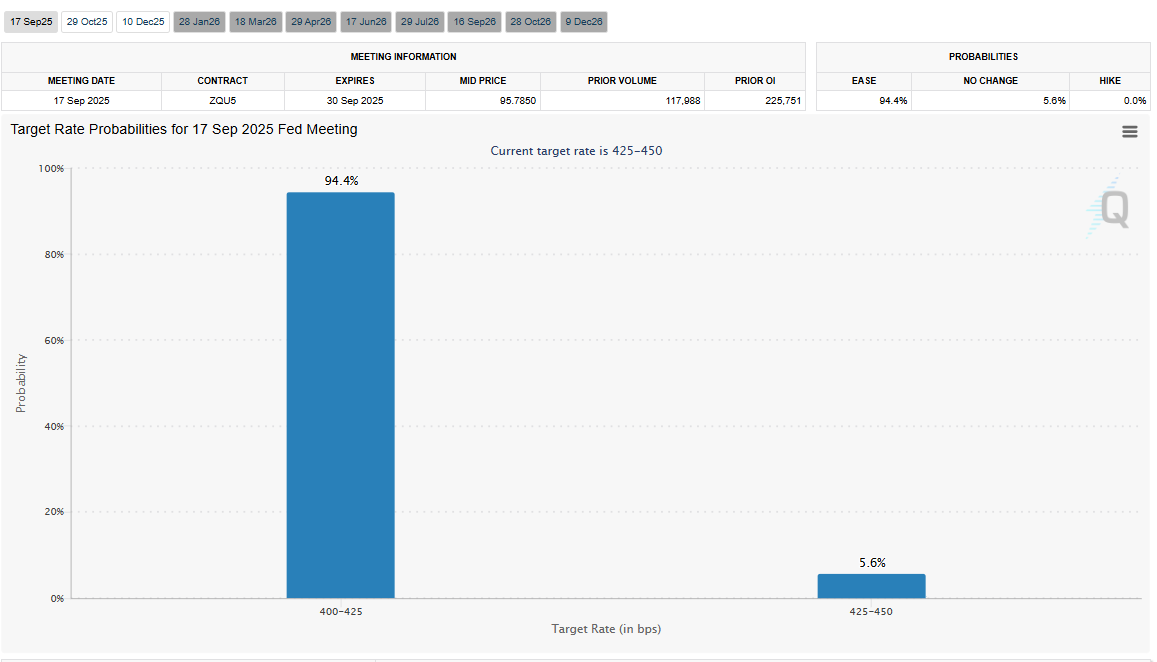

Just days ago, the market was still debating whether the Fed might hold rates into year-end. Fast-forward to now, and we’re staring down the barrel of an 90% probability of a rate cut in September.

The US02-year yield collapsed by almost 30 basis points, and the dollar reacted exactly as you’d expect in this kind of repricing: it tanked.

But there’s more to the story than just rates.

The Jobs Data Wasn’t Just Weak, It Was Alarming!!

We’re not just talking about a soft report here. The revisions to previous data were brutal. Over the last three months, non-cyclical sectors (excluding health and education) lost 49,000 jobs.

This isn’t your typical post-COVID adjustment, that kind of decline is historically associated with full-blown crises.

Add to that a significant drop in the ISM manufacturing employment index, which plunged to levels we haven’t seen since the GFC, and it becomes clear: this wasn’t a blip. It’s systemic.

We’ve now gone from “data-dependent Fed” to “what will stop them from cutting?” The market is no longer waiting for a green light the assumption is that the easing cycle is now the base case, not the tail risk.

Why This Time Feels Different

What makes this moment stand out is that the USD is already weak, it’s fallen over 10% in the first half of the year.

And while that may suggest limited room for further downside, the underlying drivers here are far more concerning than usual.

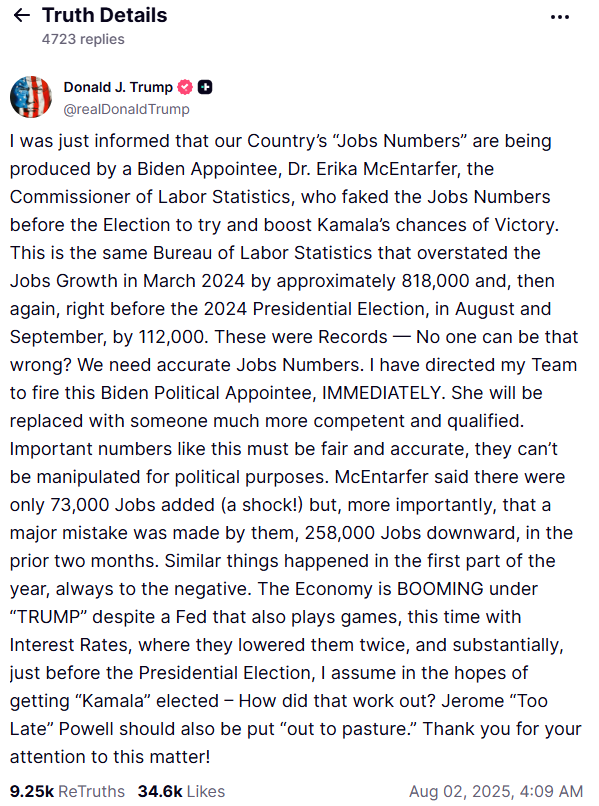

There’s also a growing sense that politics is spilling over into monetary policy. Trump’s comments about Powell and the firing of the BLS head after weak jobs data raise valid concerns around institutional independence something markets are hypersensitive to.

If that confidence erodes further, we could see another leg down in the dollar.

What I’m Watching Next

Right now, the market is digesting all of this and starting to rethink the entire U.S. macro narrative. The Fed's messaging remains cautious, but if inflation doesn’t surprise to the upside, a cut in September looks almost baked in.

Some key things on my radar this week:

Durable goods and factory orders today (both expected to slow sharply)

The next CPI print, which could either fuel or halt this dovish pivot

The Fed’s Loan Officer Survey, giving us insight into credit conditions, which are likely tightening further

Trade Ideas I’m Exploring

With yields plummeting and risk appetite slowly returning (at least for now), here are two setups I find compelling:

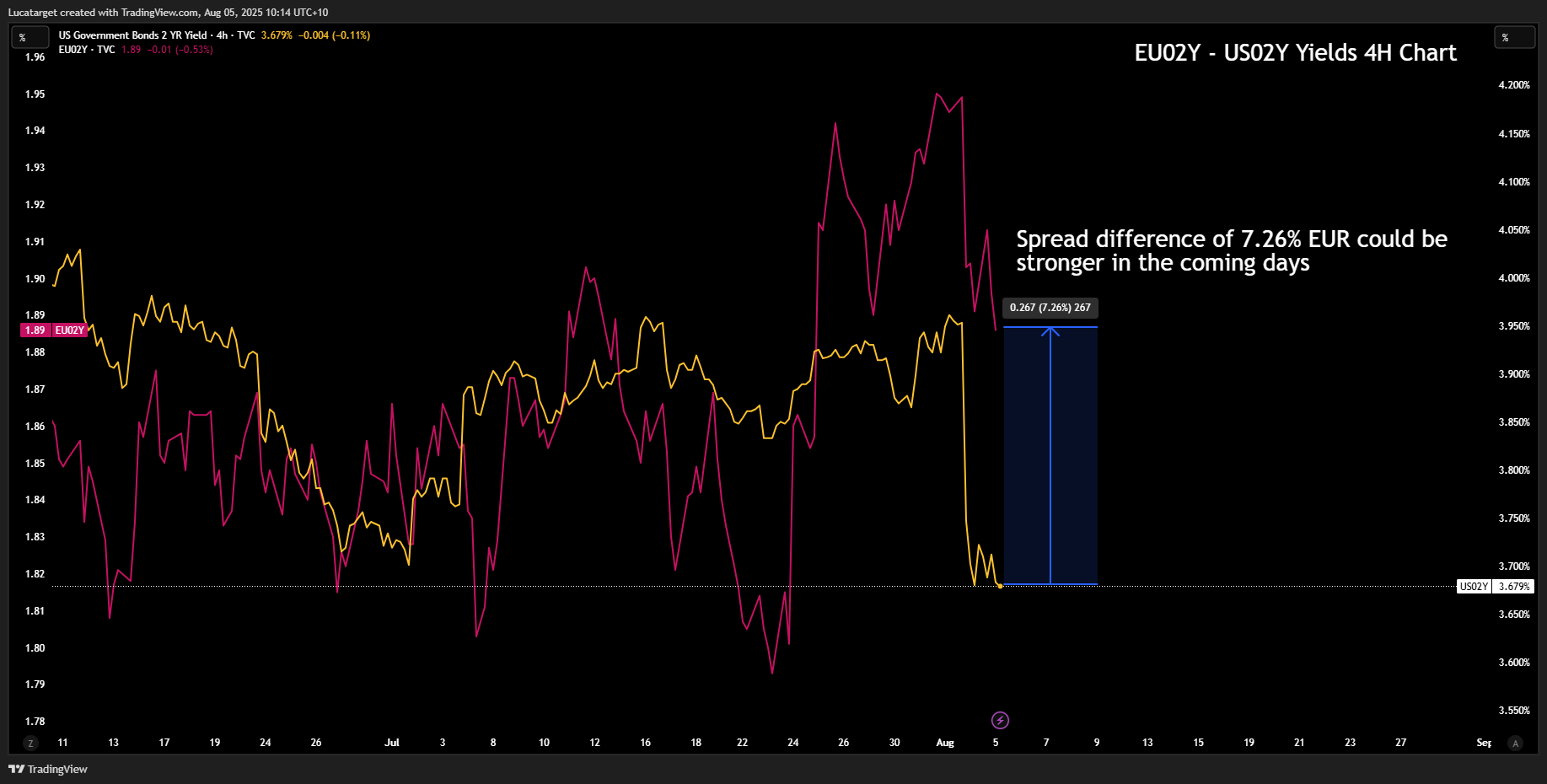

1. Long EUR/USD

With the Fed pivoting dovish and the ECB in “hold” mode, the yield spread is starting to favor the euro again. (Yellow US Pink EU)

We’ve cleared key resistance levels and are now looking at 1.1600 as the next area of interest and possible reisstnce. I'm looking to targets near 1.1800 and 1.20 as last target, 1.1550 could be attractive for long entries.

Catalyst: Further confirmation of weak U.S. data or even neutral Eurozone numbers could be enough to drive this higher.

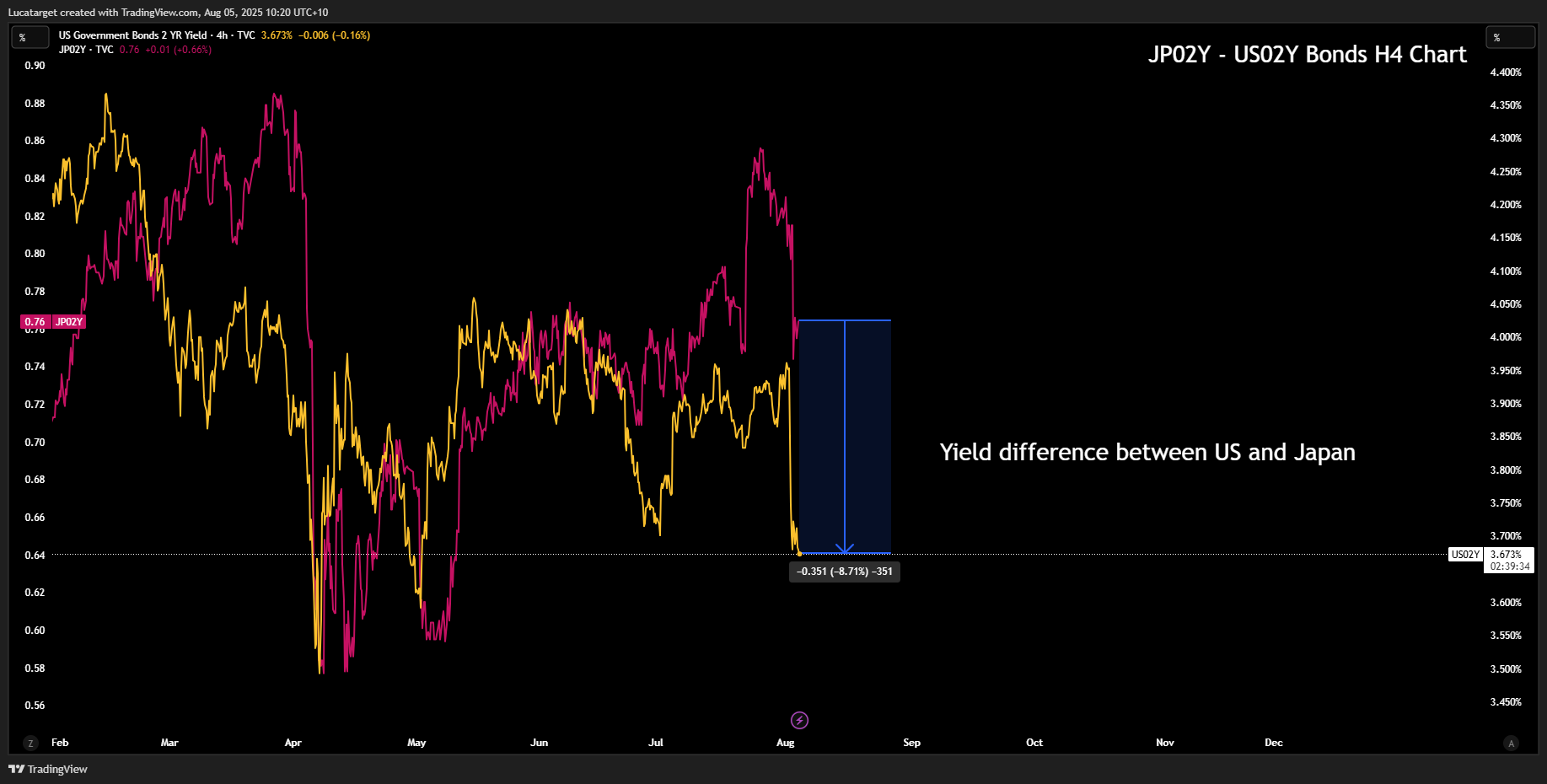

2. Short USD/JPY

While Japanese yields remain subdued, the sharp drop in U.S. yields has made the rate differential far less compelling.

Add to that growing concerns around Fed credibility, and there’s a case to be made for downside.

Targeting a return to 144.00, with stops above 148.00. Not a swing-for-the-fences type of trade, but the risk/reward is starting to stack up, specially looking for the final target at 140.000

I’ll be keeping a close eye on incoming data, especially with Trump signaling another Fed appointment is imminent.

If the next pick is perceived as politically motivated, we could see more pressure on the dollar.

Markets are clearly in a transition phase, from inflation fears to growth fears, and when that happens, the FX market becomes reactive, not predictive. That’s where opportunity lives.

Let’s see what the rest of the week brings. Stay sharp, stay flexible and as always, trade what’s in front of you, not what you hope for.

1. Why did the U.S. dollar drop after the latest NFP release?

The dollar fell sharply because the non-farm payrolls data showed significant weakness, especially after major downward revisions. This has increased the market’s expectation of a Fed rate cut in September, reducing demand for USD-denominated assets.

2. What’s the probability of a Fed rate cut in September 2025?

Market pricing currently reflects an 90% chance of a rate cut at the September FOMC meeting, driven by weaker jobs data, deteriorating economic indicators, and political pressure on the Fed.

3. How do weaker U.S. job numbers impact forex trading?

Weaker employment data usually signals slower economic growth, prompting expectations of monetary easing. This tends to lower bond yields and push the U.S. dollar down, especially against currencies where rate expectations remain stable or hawkish.

4. What are the best forex pairs to trade during a dovish Fed pivot?

When the Fed signals a pivot, EUR/USD and USD/JPY often present opportunities. EUR/USD tends to rise as the yield spread narrows in favor of the euro, while USD/JPY can fall due to shrinking rate differentials with Japan.

5. Could political interference in the Fed impact forex markets?

Yes. Any perceived erosion of the Fed's independence, such as politically motivated personnel changes, can trigger a loss of investor confidence, adding downward pressure on the U.S. dollar and increasing volatility across major pairs.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.