Markets on Edge Again: Trump’s Tariff Whiplash Returns to Centre Stage

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidTrade Tensions Are Back — With a Vengeance

Just when markets had started to settle after the temporary reprieve on China tariffs, Trump’s trade war is not just back—it’s back with bite. From 1 June, the US could slap a 50% tariff on EU imports, raising fears across markets that the relatively stable patch we've seen might be short-lived.

Tech and pharma stocks, both on the receiving end of the president’s ire, are especially vulnerable. Expect volatility. The potential for sweeping price hikes looms large, and markets are now factoring in the knock-on effects for broader economic activity.

Consumer Confidence Might Rebound — But It’s Yesterday’s News

Yes, we’re likely to see a pop in consumer confidence this week. The temporary US-China deal—where tariffs were cut from 145% to 30%—and recent equity gains should’ve helped sentiment. But Friday’s social media tirade from Trump changes the outlook.

The rebound, if it comes, will be met with a shrug. Consumers, like markets, are more concerned about what’s next. With no guarantee that tariffs on Chinese goods stop at 30%, fear over future spending power will cap any positive momentum from this data.

Core PCE Deflator: Soft Print, But the Wrong Focus Now

We’re looking at a benign inflation read this week—core PCE deflator likely up just 0.1% MoM based on recent CPI and PPI data. Normally, that would cool rate hike fears. But with tariff hikes looming, the Fed’s preferred inflation gauge might already be obsolete.

If companies are forced to eat higher import costs now, they’ll be passing those on to consumers before long. Inflation expectations might look calm today, but the re-escalation in tariffs puts that picture at risk.

Boeing’s Order Book Plunges — And So Will Durable Goods Data

April was brutal for Boeing. Just 8 aircraft orders, down from 192 in March. That collapse alone will take a chunk out of durable goods orders data, and it's a clear warning that corporate confidence is taking a hit.

It’s not just a Boeing story—it’s emblematic of broader demand uncertainty as companies freeze big-ticket investment decisions amid trade chaos.

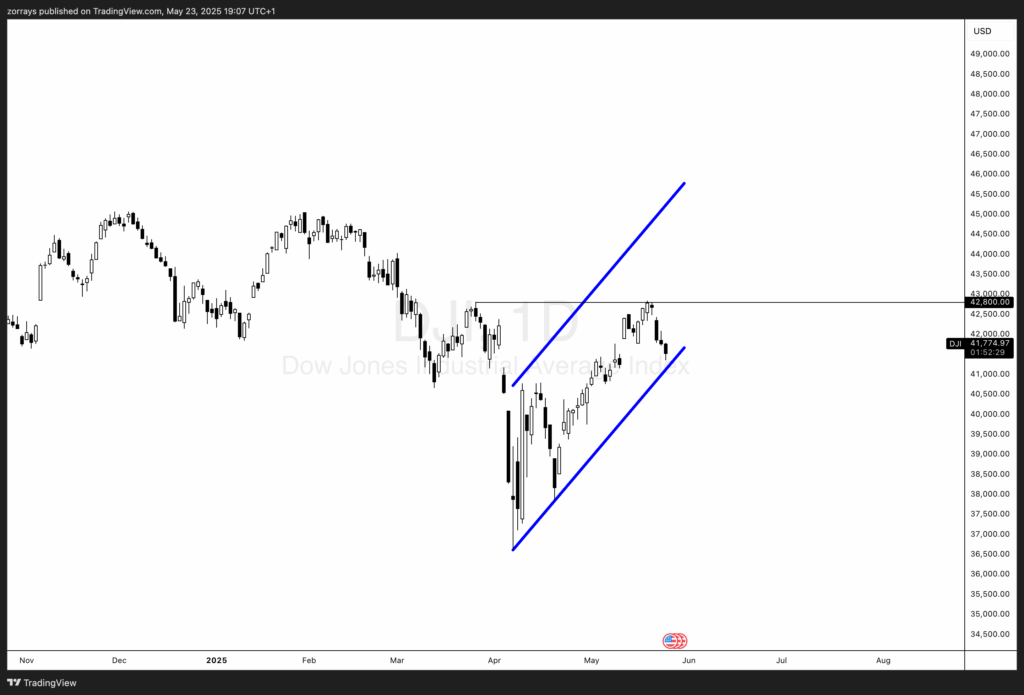

Chart to Watch: Dow Jones Industrial Average

Dow Jones is in a very interesting position at the moment. It’s just rejected a major horizontal resistance around 42,800—a level that’s previously acted as both a ceiling and a floor—supporting bearish momentum and adding weight to the idea that a short-term top could be in.

More crucially, it’s flirting with the lower boundary of an ascending channel that’s defined price action since the April lows. A clean break below that support line could be the signal for a deeper retracement. Given the macro backdrop—rising tariff risks, fragile sentiment, and patchy data—I reckon we’re in a complex correction of some sort. This market clearly isn’t ready to trend with conviction.

Technically, it looks like price is rolling over and momentum has shifted. We might see a deeper move towards 40,000 if this channel gives way decisively. Keep an eye on that structure—it’s shaping up to be the battleground for the next leg.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.