Nasdaq 100 Forecast: Riding High on Rate Cut Bets, But Can Tech Sustain the Lift? Key Levels To Watch

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita- Nasdaq 100 rallies to all-time highs, fueled by AI optimism and rising Fed rate cut bets.

- Markets now price in 2–3 cuts starting September, boosting liquidity and tech valuations.

- 22,600 is the key breakout zone, while downside risks grow ahead of NFP and Fed surprises.

Nasdaq Pumps to New Highs

The Nasdaq 100 is powering to fresh all-time highs, driven by AI-fueled optimism and a macro environment increasingly priced for Federal Reserve rate cuts. With dovish sentiment surging and liquidity expectations rising, tech is thriving—but the rally could be tested if economic surprises or Fed pushback arise.

Macro & Fundamental Drivers: All Eyes on the Fed

Rate Policy Decision Forecast

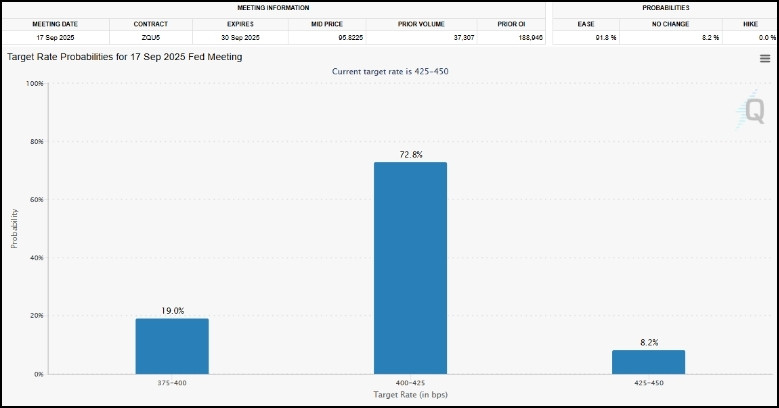

September

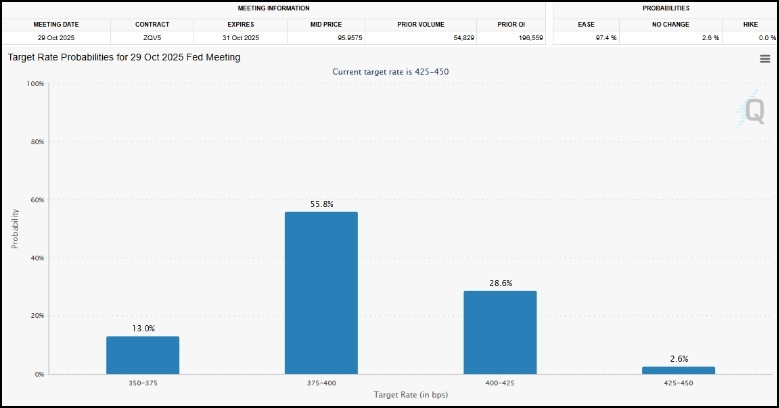

October

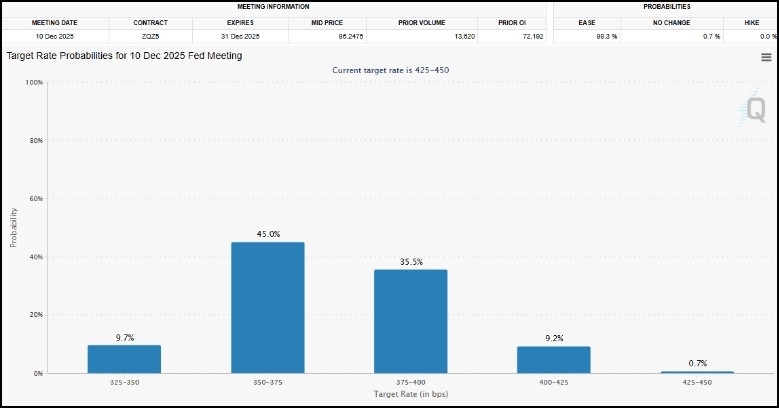

December

- Rate cut bets drive the rally: Markets are now pricing in two to three Fed rate cuts starting September(72.8%), October(55.8%), and, potentially, December(44.5%), with Fed Funds futures showing a 72%+(continues to develop) chance of easing this quarter. For rate-sensitive tech stocks, this is fuel—lower rates reduce discount rates, boosting the present value of future earnings and making high-growth Nasdaq names more attractive.

- Liquidity boost supports tech valuations: The Nasdaq thrives in low-rate environments. As yields fall and real rates soften, big tech stocks—especially those with long-duration growth profiles—are seeing renewed institutional inflows.

- AI momentum still in play: With Nvidia, Microsoft, and AMD continuing to surprise to the upside, the AI theme remains the core narrative keeping investor appetite strong.

- Geopolitical calm adds to tailwinds: A quieter macro backdrop, fewer escalations in the Middle East and easing U.S.–China tensions, has helped stabilize risk appetite, benefiting Nasdaq and broader equities.

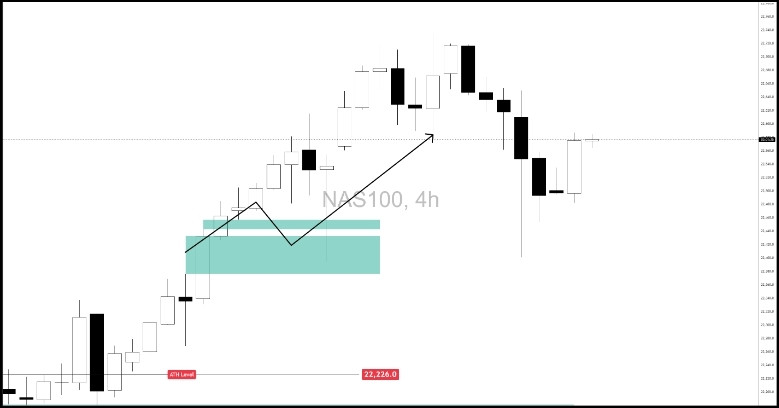

Technical Outlook: Bulls in Control but Watch the Breadth

Bullish Scenario

Previously, on market wraps - Weekly Market Wrap: What Moved Forex, Gold & Indices - as outlined, Nasdaq 100 is leaning more towards to the upside following the impending Fed rate cuts and easing. Nasdaq bounced off nicely at the 4-Hour FVG resting between 22,457.1-22,376.5 levels.

Since yesterday, Nasdaq has experienced a big blow to the downside. Though on a downside move, reversal is yet to show as long as:

- Nasdaq stays above the equilibrium level of the range

- It breaks and gets sustained above the 22,600 level

- Nasdaq does not close below 22,500 level

Bearish Scenario

Downside risk is still on the table, especially with the incoming non-farm payroll data to be released this Thursday.

A strong jobs data could cause a renewed pullback on Nasdaq. Risks for downside could increase if:

- Nasdaq does not get any bullish follow-through above 22,600 level

- 22,500 level gets visited again

- Hawkish surprise

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.