Nexo Pro Launches Retail Aggregated Liquidity and Tools to retail clients

September 7, 2022 - Nexo, the regulated institution for digital assets, launched Nexo Pro, the first global trading platform to offer retail clients access to institutional-grade aggregated liquidity, with no minimum funding requirements and at near zero cost.

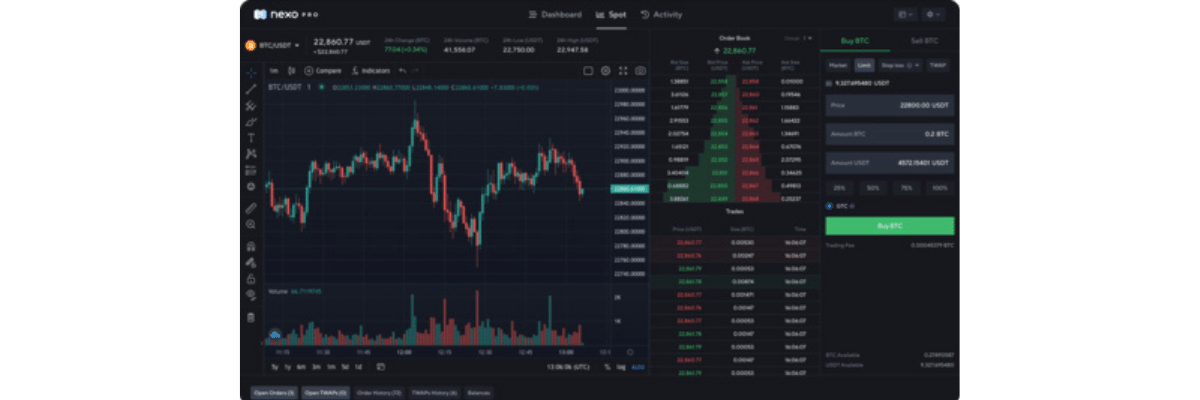

Nexo Pro provides its customers with spot, margin, and futures trading functionalities with near-zero slippage. The product has been rolled out to all five million Nexo clients. Nexo Pro offers advanced TWAP (Time-Weighted Average Price) orders used by large institutions – into the everyday trading stack of the non-technical user.

It also combines its own order book with those of other trading venues and market makers, to give users access to the broad market, both in a single user interface and via API.

A summary of features provided by Nexo Pro:

• Access to aggregated spot and futures liquidity • Integration with all existing Nexo services • Limit and market orders • Short and long margin trading • Perpetual futures contracts • API gateways • Reserves audited in real time

Nexo Pro is available directly and through the REST & WebSocket APIs. Initially accessible on desktop, Nexo Pro will soon launch on mobile with a private beta of the Nexo Pro app.

“Nexo Pro is the result of a long exploration in the world of retail and institutional trading. We’ve tried and tested its underlying features – the best prices across 420 liquidity pools, the tightest bid/ask spread, near-zero slippage, automated TWAP and basis trading – as part of our institututional prime brokerage platform Nexo Prime. We are now passing this most advanced trading performance to our 5M+ customers at near zero cost and are set to revolutionize retail trading globally,” said Yasen Yankov, Nexo’s VP of Product Development.

“Nexo Pro is a gateway to professional-like trading for retail customers. We are the first platform to offer institutional-grade liquidity aggregation with this many venues as pure-play exchanges usually prefer to settle exclusively within their own order books. As a crypto lender, Nexo is able to source liquidity from 3,000 order books and guarantee our customers the best possible quote for their spot, margin, or futures trades, so they don’t have to go looking for it themselves. We expect Nexo Pro to quickly become the first choice for those striving to outperform the average trader, and do so in the most secure way,” said Kosta Kantchev, Co-Founder and Executive Chairman of Nexo.

In the coming weeks, Nexo will introduce additional token utilities giving NEXO Token holders the ability to reduce trading fees and pay those using $NEXO. The NEXO Token will combine the utilities of both exchange and lending tokens into a single asset.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.